Trending Assets

Top investors this month

Trending Assets

Top investors this month

Overall Pet Spend Increasing and $ZTS

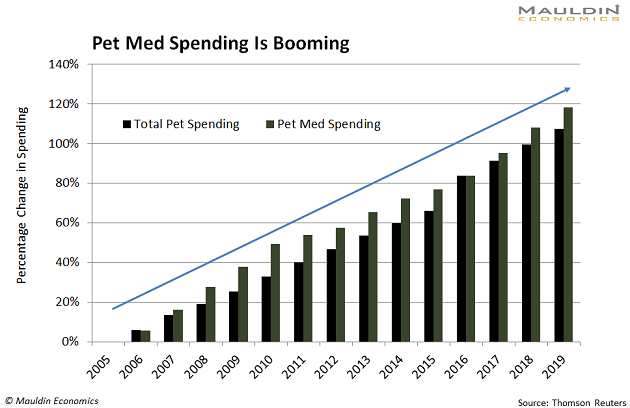

An idea that has interested me over the last year or so is the general increase in overall pet spending. This applies to both food and more importantly medicine.

This chart shows that increase and while I was unable to find more current data the growth has been exponential after 2020.

The company that I have been looking at most closely is Zoetis $ZTS.

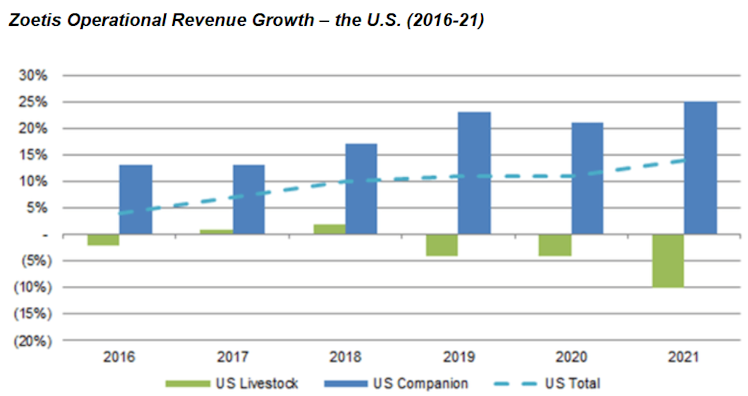

Zoetis has been on a roll these past few years - with rapid revenue growth in both US...

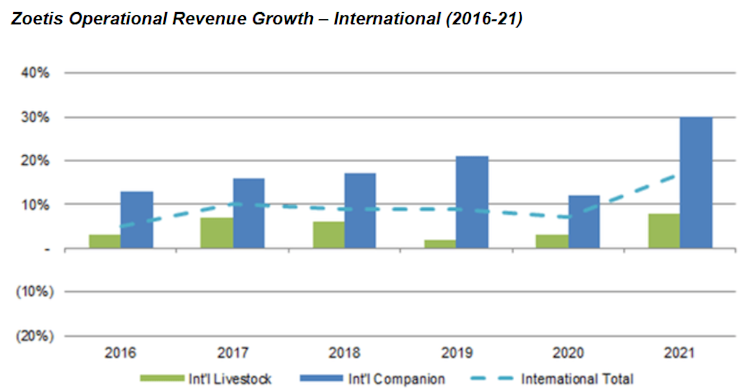

And International revenues the slight decline in US livestock revenue is more than made up for by the boom in international revenues.

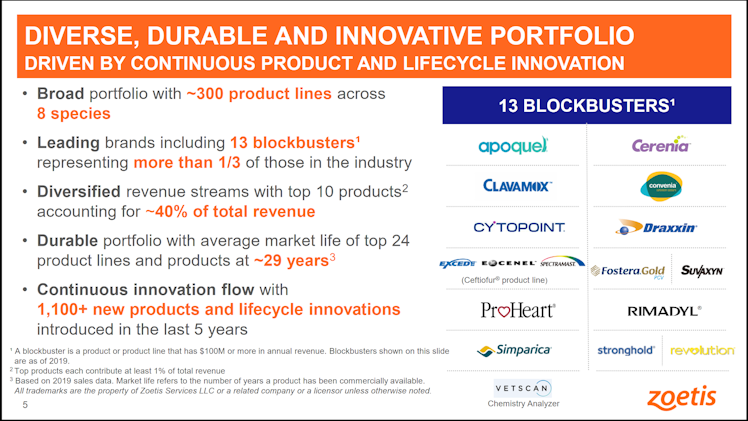

$ZTS is a spinoff of Pfizer $PFE and just like its former parent company works incredibly hard to develop and patent new drugs for animal care.

When these new drugs are developed, much like the ones given in human medicine, the drug maker receives a patent and what's called "Marketing Exclusivity."

The big difference is that this exclusivity on animal drugs only lasts 5 years instead of 20 in human medicine.

That means animal drug makers have to work extra hard in order to stay ahead.

The above is the list of what Zoetis refers to as "Blockbusters" - these are developed drugs that have brought in $100 million or more in annual revenue.

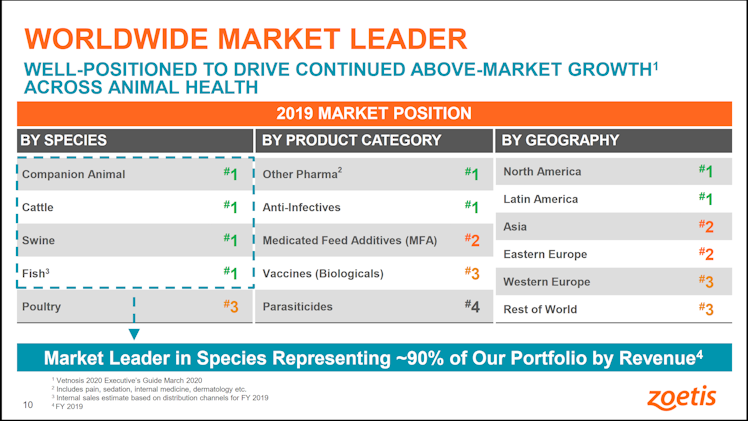

This plethora of products has allowed $ZTS to become and sustain market leadership across the world.

And I believe it is likely that Zoetis will be able to sustain this market leadership well into the future given how entrenched they are across the world

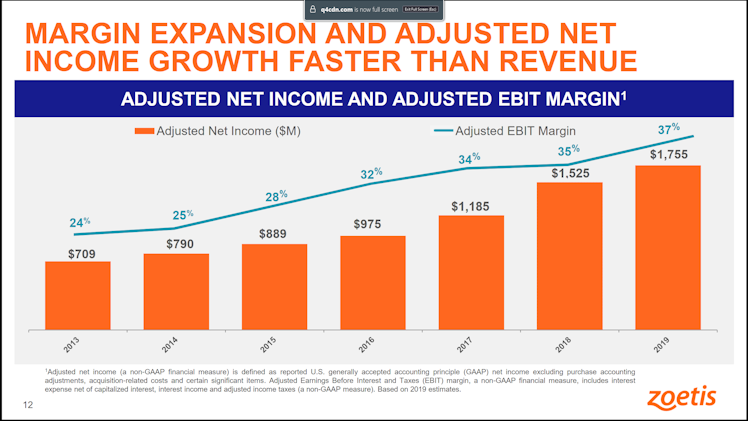

The company is also making great strides in improving margins and increasing net income. Going from 24% to 37% in just 7 years is pretty impressive in my book.

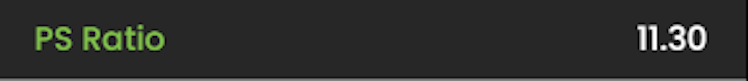

While I do think the future is bright for $ZTS I also believe the stock to be fundamentally overvalued.

With an over 11 Price-to-Sales...

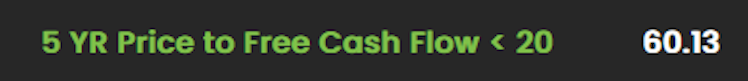

And a 5YR price to Free-Cash-Flow (I like to see under 20) I think I will wait on the sidelines for the price to fall quite a bit before considering buying.

I do want to point out the solid profit margin...

And the reduction in shares outstanding recently though. Both are great to see I think.

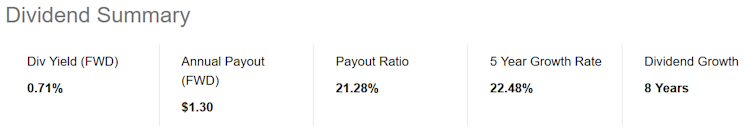

Also, the dividends are easily afforded and growing rapidly. $ZTS easily has enough free cash flow to continuously increase its dividends every year and plenty of room to do so as well.

Overall I think $ZTS is a tremendous company and a critically needed one at that. I just think it is worth waiting for the price to reconnect to the underlying fundamentals before investing in this possible future world-class company.

Already have an account?