Trending Assets

Top investors this month

Trending Assets

Top investors this month

What moves this stock? - $LKQ

There is 101 reasons what could move this stock (or any stock) but the THREE that I think are worth keeping an eye on are:

- Share repurchasing

- Dividends

- Return Metrics

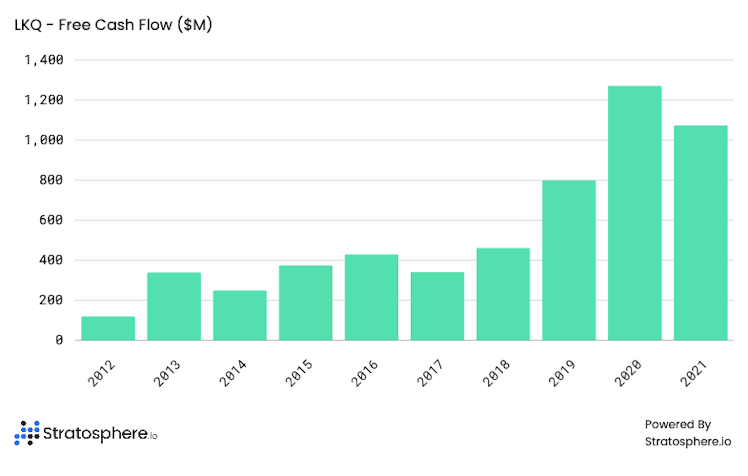

$LKQ went from aggressive acquisitions to being "mature" ish business (in 2020) that is now focusing on cleaning things up and being strategic with all of the Free Cash Flow ($1Billion+ FCF on 14B Market Cap.).

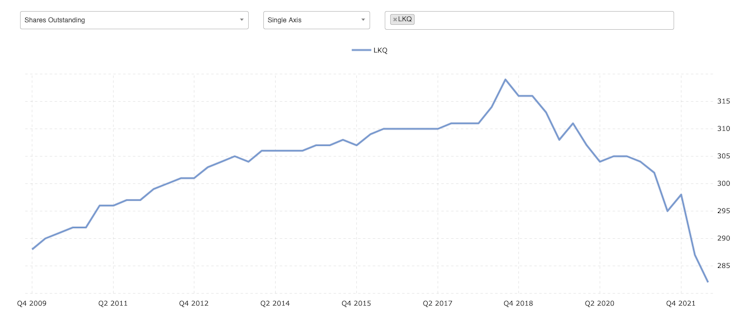

Share repurchasing

2018 was the peak on the amount of outstanding shares...

Now with over one billion of FCF, company is committed to keep buying back shares at these levels or lower.

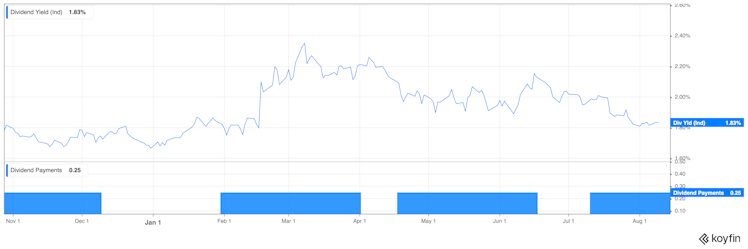

Dividends

Again now that the company is feeling comfortable with the amount of money they will be making, $LKQ started paying dividends for the first time.

Slow and steady, Forward NTM Yield - 1.91%

... its just a beginning...

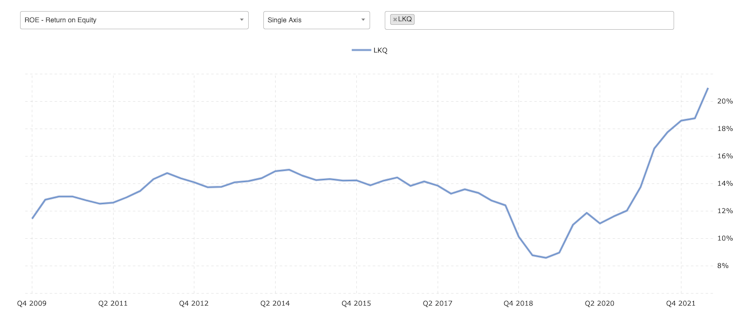

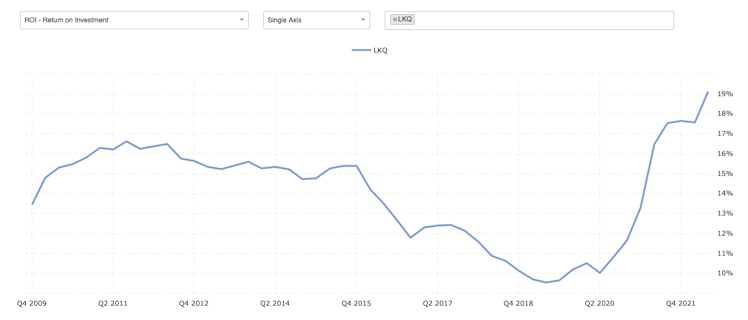

Return Metrics

Return on Equity: 20%

Return on Invested Capital: 10%

Both I'm anticipating to keep on improving (little by little)

As a bonus their ESG report was an excellent "cherry on top" for ESG sensitive institutional investors to put their money in.

In conclusion, all these are potential positives that can move $LKQ as they keep executing but because they are large player and expending into Europe, the macro environment is not the brightest and I'm cautiously optimistic but as long as there is war between Russia and Ukraine there are other macro plays that can also move this stock.

Already have an account?