Trending Assets

Top investors this month

Trending Assets

Top investors this month

Sept Idea comp - Mercado Libra $MELI

1 - Introduction - Mercado Libra

Marcos Galperin, a Stanford graduate, began imagining

the vision of an e-commerce company in his home country, while still in the

United States and closely watching the beginning of the growth of a company

called Ebey.

And with big dreams, he returned to his country Argentina, To found the "Ebey of Latin America.

but very quickly he realized that it was going to be difficult. He needed to

build everything from zero, the customer and supplier relationships, and the

platform, and then he discovered that even this was not enough, and decided to

found Mercado Pago, the financial arm of the company To meet all the customer's needs.

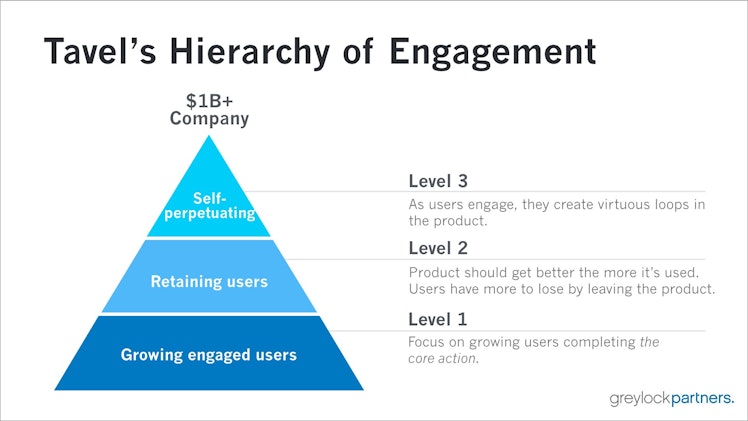

Galperin understood from the very beginning as in the

model of "Sarah Mourning " that to succeed, he must first take care

of a good experience for the users of the platform, and this will bring growth.

The Hierarchy of Engagement - Sarah Tavel (Benchmark).

When the growth continues, decided to add another service to the value chain and

move to level 2 of the model and found Mercado Envíos in 2013, which is the

logistics arm of the company, and by adding a value chain to buyers and

sellers, the users return to the marketplace, the sellers cannot leave it

without experiencing logistical difficulties in sale the product and a lack of

Exposure to a large clientele and thereby losing important revenue. Therefore,

the suppliers do not leave which in turn motivates more customers to join along

with increasing the product offering.

2 - Growth

Meli in the best situation to take benefit from the growth in Latin America.

According to estimates, the fintech sector attributed

to Meli is expected to grow by about 21% per year until 2027, when over 50% of

the citizens do not have a bank account.

While e-commerce is also expected to grow by about 24% per year until 2025.

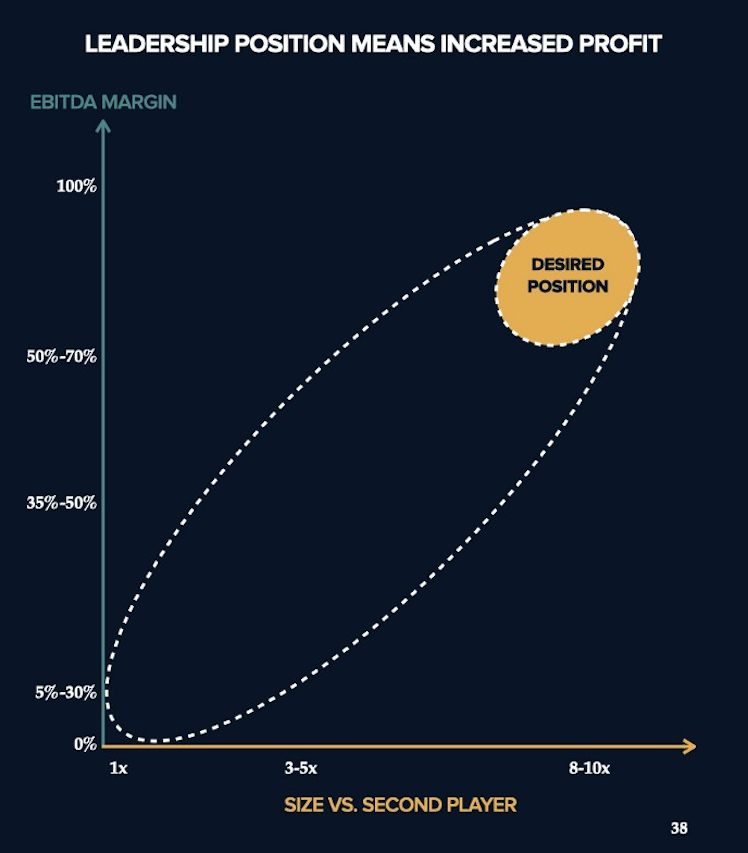

In addition, Meli growth can be expressed by increasing the market share,

as the company grows, it helps it to grow further

in a market where the winner takes all.

According to Sarah Tabel's model, the more the company

grows, the more it can reach a much larger margin as it grows.

After Meli grows enough and moves to level three of

the model, it will be able to provide more services and additional products on

the platform that will add a lot of extra value to the customer, which will add

to revenue growth.

winner takes all - Sarah Tavel (Benchmark).

3 - MOAT

The more Mercado Libra succeeds in

providing significant value to suppliers, the more difficult it will be for

them to switch to competitors without losing revenue, which will maintain a

wide product offering and add more customers that will prevent them from

leaving. Expanding the logistical advantage, adding financial products, and

continuing to improve the platform.

It will be very difficult for other

companies to take market share from Meli, the more Meli grows, the more

difficult it will be.

In addition with a large logistics system built in 2013,

It will be almost impossible to compete on delivery times and logistics for other companies.

4 - Valuation and summary

Meli is expected to revenue $10B in 2022, which is a

price-to-sales ratio of 4.6, which is the lowest the company has received since

the IPO.

However, with the growing concern of raising the Fed's

interest rate, currently looking at the sales multiplier does not tell us much.

But making a DCF for such a complex company with

several business sectors in parallel and high growth, will also not provide us with

the full picture, and will also harm the quality of the thesis, for better or

for worse.

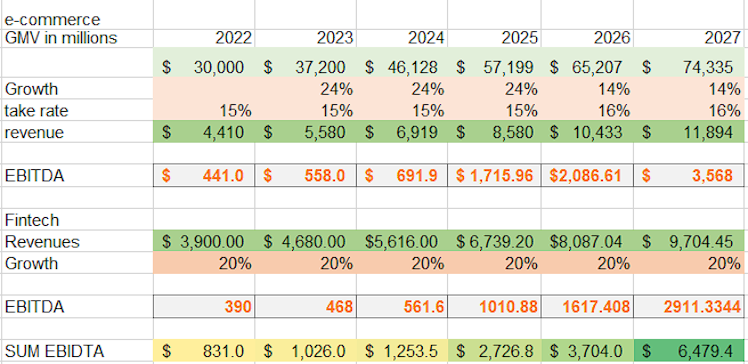

And thus, I think it is appropriate to look at the

Gross merchandise value (GMV), the total sales monetary value for merchandise.

In 2022 the GMV will be $34B which is a market value

multiplier of about 1.4, which is the lowest GMV multiplier the company has had

since the IPO.

I took the forecasts about the growth of GMV in Latin

America for e-commerce, with the calculation of the take rate.

Growth in fintech revenues in line with market growth. considering that once the company

is large enough it will be able to reach a 30% margin EBITDA.

And I got these numbers below.

This is an optimistic forecast, Still I didn't include many scenarios that could surprise for good and could significantly increase the market value.

Already have an account?