Trending Assets

Top investors this month

Trending Assets

Top investors this month

FTX: Another One Down

So the thing about crypto is that it has no real utility. That lack of utility gets disguised by financialization schemes, and it usually goes a little something like this:

- Person A lends to person B

- Person B lends to person C

- Person C lends to person D

- Person D lends to person E

- Everyone pats themselves on the back and eagerly points to the thriving ecosystem they’ve built.

- No one questions what person E is up to because they’re all earning a ton of interest on their loans.

- Person E loses all the money by putting on a 14-leg parlay, a leveraged crapcoin position, or whatever. Or maybe they get hacked or just run away with all the money.

- Everyone is sad and wonders how this could have happened.

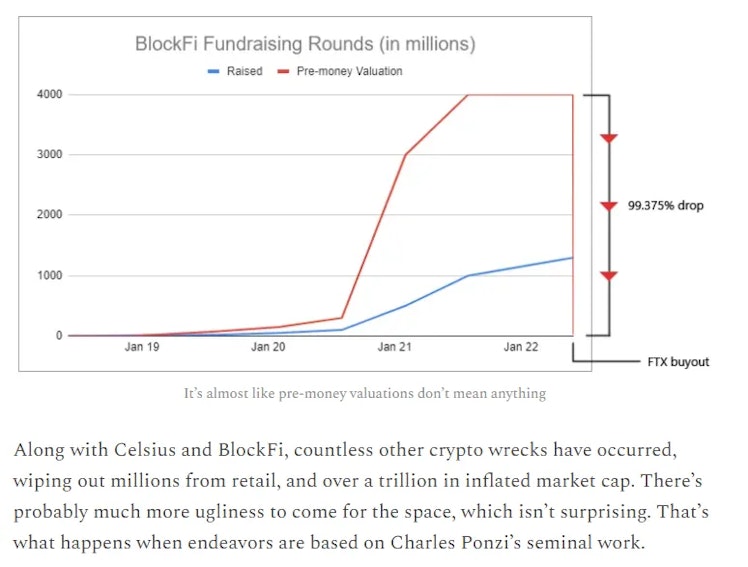

Of course, none of this is new. This kind of devious stuff has happened for centuries, albeit with less flashy buzzwords and tech. Still, it should never feel weird when things blow up. Yet people are surprised every single time it happens.

Last week, FTX, one of the largest crypto firms in the world, blew up. Again, not weird, especially since earlier this year FTX’s CEO effectively described its operations as a Ponzi scheme in an interview. Here’s a sequence of events:

2014 - Sam Bankman-Fried (SBF), the son of two Stanford law professors, graduates from MIT with a degree in physics and a minor in mathematics.

2017 - SBF founded Alameda Research, a Hong Kong-based private equity firm that looked to arb trade cryptocurrency between exchanges.

2019 - SBF founded the crypto exchange FTX, which quickly grew to be one of the world’s largest.

2021 - FTX Raised $900 million at an $18 billion dollar valuation. Investors included Softbank, Sequoia, Thoma Bravo, Third Point, Coinbase Ventures, and other powerhouses. Later in the year, FTX headquarters moved from HK to The Bahamas.

Jan 2022 - FTX announced a venture arm called FTX ventures, which would deploy $2 billion+. FTX then raised an additional $400 million in a series C round at a $32 billion valuation.

Feb 2022 - FTX ran this dumb ad during the Super Bowl, promoting itself as a ‘safe and easy way to get into crypto.’

July 2022 - FTX bailed out the flailing crypto company BlockFi, which I wrote about:

And then November came about...

There’s a token that FTX issued on its exchange called FTT, which stands for FTX Token but more appropriately should be called Funny Transaction Token. The token’s value is very clearly tied to...

Keep reading at the link below:

open.substack.com

FTX: Another One Down

A simple look at crypto's latest implossion.

Already have an account?