Trending Assets

Top investors this month

Trending Assets

Top investors this month

Three Potential Buyouts

With the news of $ZEN finding a new home I figured I would run through three of my favorite companies that are worthy of getting acquired.

1.) $PINS

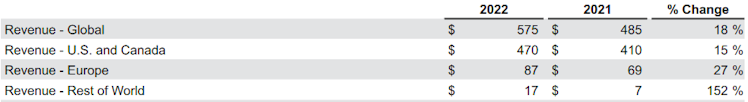

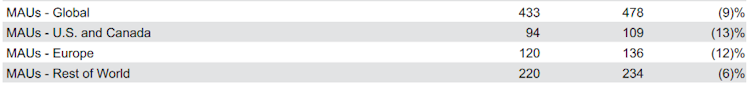

The company has continued to grow favorably against tough 2021 comps.

Revenue has grown a solid 18% overall with International accounting for most of the growth.

This is despite lower Monthly Active Users overall.

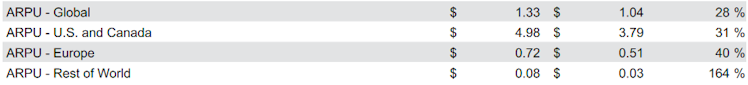

This is thanks to the push for better monetization of the platform.

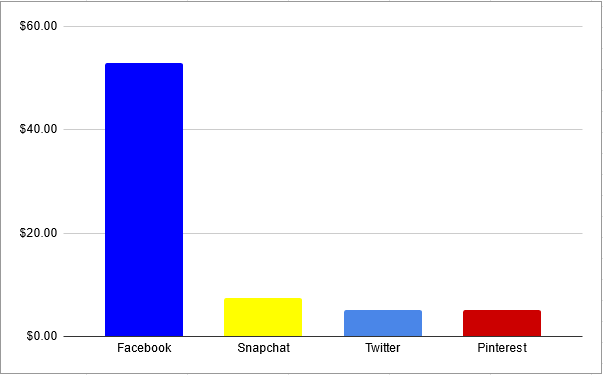

Competition still has higher ARPU overall but $PINS is rapidly catching up. (data from Q3 2021).

$PINS also has $2.68b in cash and less than $500m in TOTAL debt.

On top of all this, they already had an interested party in $PYPL. Unfortunately, the deal did not work out in the end.

2.) $HOOD

Not too much to explain here I just think the idea of a larger financial institution scooping up Robinhood would be a win for everyone around. Robinhood gets its legal trouble cleaned up and the buyer would get a brokerage with a nice UI and decent User Experience.

In addition, it would grant the buyer immediate access to a built-out crypto ecosystem if that is still a desirable goal.

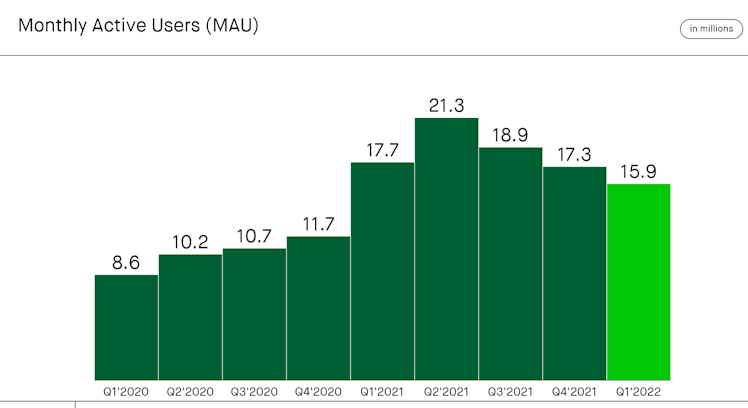

Unfortunately much like $PINS Monthly Active Users is in decline and quite drastic I might add.

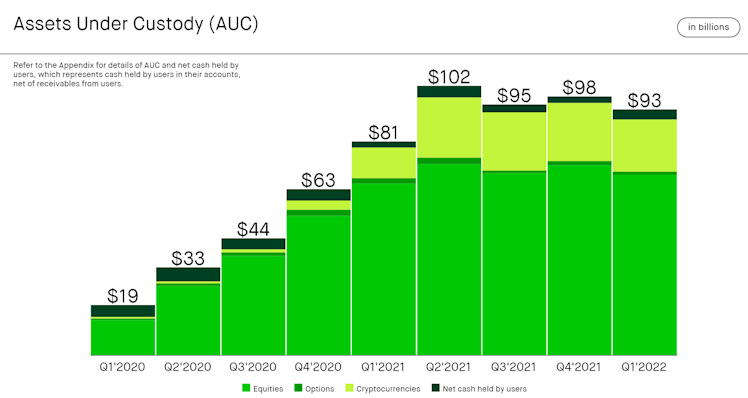

Although AUC hasn't fallen nearly as much.

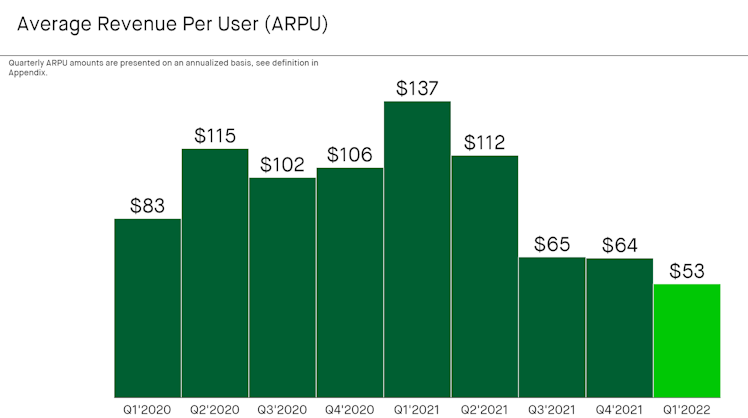

The real gut punch is ARPU where Robinhood has gotten crushed. With the recent crypto rout, the company has lost a significant part of the fees that it can collect.

But again much like Pinterest, the company valuation has gotten crushed. With $6.2b in cash, $HOOD trades at just under a $7b valuation.

3.) $GPRO

I believe GoPro would make a nice addition to any company seeking to build out a social media/health and wellness application.

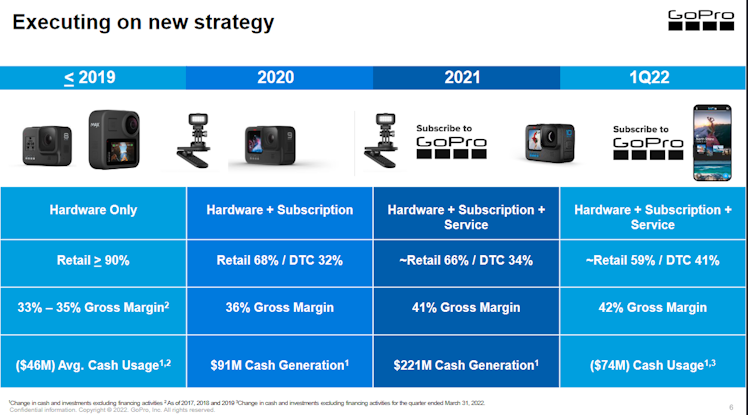

Over the last few years, the company has struggled to grow revenue and profit. That is why over the last few years GoPro has attempted to pivot its business model to a more subscription-based model.

The primary driver of these subscriptions is an add-on to camera sales.

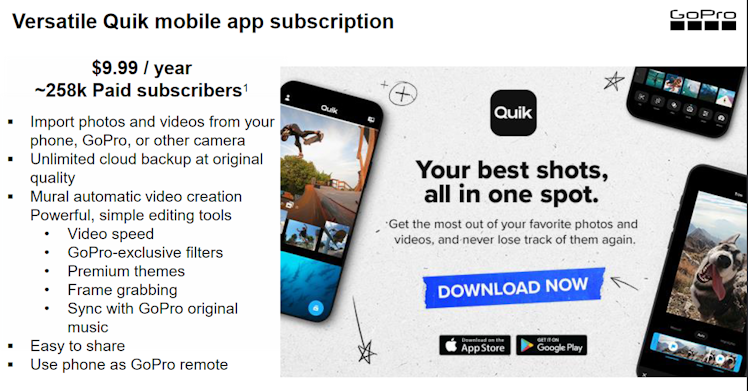

With the GoPro subscription, user get access to Quik which is quickly becoming an integral part of $GPRO's ecosystem. Quik offers a social media experience along with cloud storage and video editing tools.

I think this whole package would fit nicely into an already existing Social Media ecosystem.

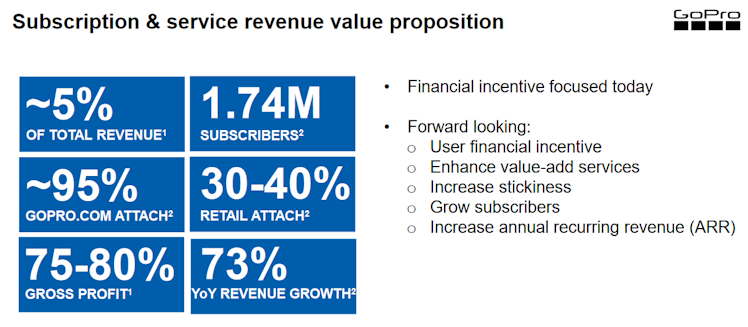

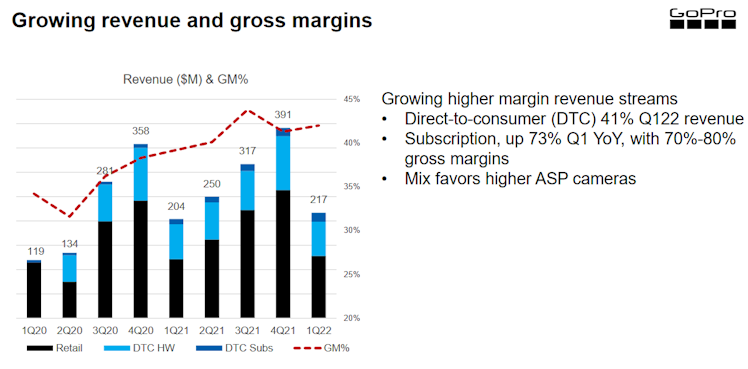

This push toward subscriptions has led to growing revenue led by ARR and higher overall margins.

GoPro also has $450m in cash with only $550m in total debts.

Now with the company trading at less than 3 P/E and under a $1b market cap it's looking like a pretty nice acquisition target.

If you enjoyed this post I would appreciate a follow and you can also check out my Youtube where I have videos covering both Pinterest and GoPro:

Linktree

Dollars and Sense | Twitter | Linktree

Learning and sharing my knowledge of investing with like-minded folks.

Already have an account?