Trending Assets

Top investors this month

Trending Assets

Top investors this month

Expectations Investing - Calculating Market Expectations

Michael Mauboussin is one of the thought leaders that has most influenced my investing framework. His "Expectations Investing" was a seminal work in my development. He wrote a paper nearly a decade ago about understanding PE multiples, from which I gained a deep understanding of the analysis below. I will elaborate more on this in a future newsletter.

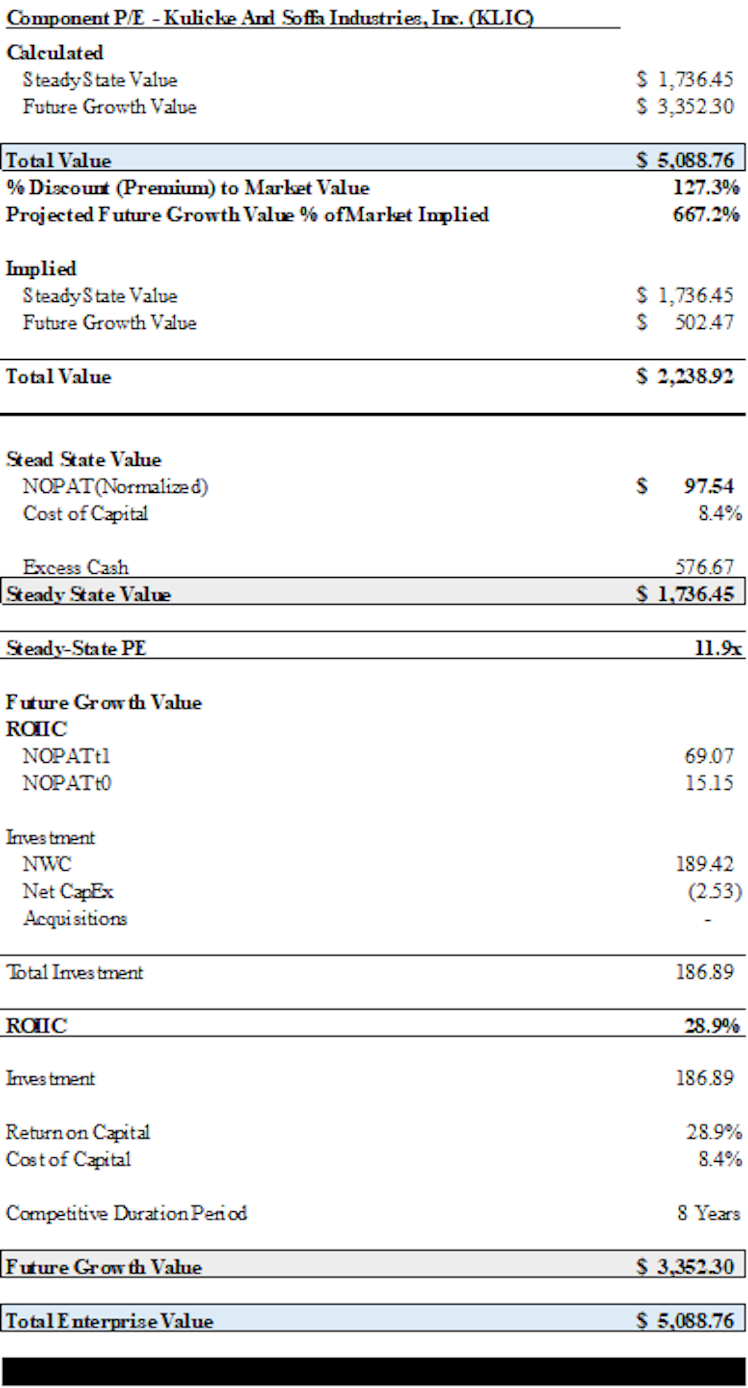

A critical component of my process, adopted from Mauboussin, is truly understanding market multiples and breaking them down into their component parts. Through this, I am able to understand the two components of a company's value: 1) steady-state value and 2) future growth value. This is important so that you can determine how much you are paying for future growth and more importantly if you have a materially different view from the market.

Why is expectations investing the optimal method for valuation IMO? Because instead of trying to make assumptions to arrive at an estimate of value, you are really reverse-engineering the process/company value. Simply, since we know the price (thus, value) of a stock, we only need to ask ourselves "what needs to happen for this price to make sense."

This process illuminates what I believe are the most important factors of company value - discussed further below:

- Return on Incremental Invested Capital (ROIIC) is the most important component of understanding value creation. If ROIIC equals the cost of capital, then investments don't create any value.

- Illustrates the impact of growth/investments, which can be seen via the spread between ROIIC and cost of capital. So, if there is a wide spread in these figures, more rapid growth adds more value.

- Thus, investors should focus on growth LAST. Rather, the importance lies in the company's ability to generate ROIIC > Cost of Capital, sustain this spread over time, and create future investment opportunities. The time during which ROIIC is greater than cost of capital is the period of a company's sustainable competitive advantage.

Alright, so let's start with thinking about firm value as I discussed above - steady-state vs. future growth values.

Steady-State Value

We have to make a really important assumption, that the current steady-state value can be sustained indefinitely and future investments don't add or subtract value (this is captured in the growth value). Based on a steady performed from 1961-2013, the steady-state accounted for ~67% of total company value on average. Before providing the calculation, I recommend understanding the implied steady-state P/E multiple or cost of capital. If you have a calculated cost of capital, the P/E = 1 / Cost of Capital. You can calculate cost of capital using the same formula with a known P/E.

Stead-State Value = Normalized NOPAT / Cost of Capital + Excess Cash

Normalized NOPAT utilizes a sustainable tax rate (I will look at mature comps or assume a 26-30% effective rate). For those of you unaware, NOPAT is "Net Operating Profit After Taxes" which is the operating profit assuming no leverage. It is calculated simply as EBIT * (1 - Tax Rate).

Future Value Creation

There are three main drivers to future value creation:

- Spread between ROIIC and cost of capital

- Magnitude of investment

- How long a company can find investment opportunities at this positive spread

*The first two points dictate the company's growth rate

The one difficult aspect to assume is #3, duration of competitive advantage periods. What I do is combine the company's narrative and competitive positioning with base rates. Historical calculations show the market implies roughly 6 years or more of this period. Brett Olson estimated the average from 1976 - 2007 was about 8 years, with a minimum of 5 years in competitive industries and 15 in stable industries.

Step 1: Calculate ROIIC = (NOPAT @ t1 - NOPAT @ t0)/Investment @ t0

- NOPAT is calculated the same as above

- Investment = Net Working Capital + Net Capital Expenditures (net of Depreciation) + Acquisitions

- This formula makes a VERY important assumption that all NOPAT growth is from the previous period's investments, which we know isn't necessarily true.

Step 2: Calculate Future Value Creation = [Investment (return on capital - cost of capital) competitive advantage period] / [Cost of Capital (1+Cost of Capital)]

So, what I do is calculate the company's values for each state of value. Then I can subtract the steady-state value from the company's current enterprise value to calculate what the market is pricing in for future value creation. Comparing the implied value in the market to the future value I calculated can give insights into if the market is under or overestimating firm value. This is the first step to generating alpha. I pasted an image of my simple analysis below, more than happy to provide more info:

Already have an account?