Trending Assets

Top investors this month

Trending Assets

Top investors this month

Tyson drops 16%: Who are the winners in America's frugal eating trend?

Tyson Foods' performance has taken a turn for the worse, becoming the first industry to be hit by the aftermath of inflation. Which other companies may be affected in the same way?

Conversely, which companies may benefit from the market outflows?

As a leading player in the food industry, Tyson Foods' situation may not be an isolated incident and could offer insight into the industry as a whole. Following the release of Q1 (Q2 FY23) earnings on May 8th, the stock plummeted 16 points, making it the "unexpected" giant to report disappointing earnings during this year's Q1 earnings season.

What went wrong in the earnings report?

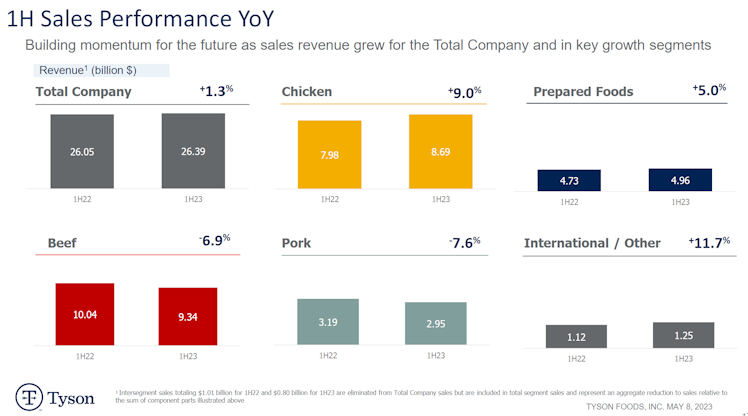

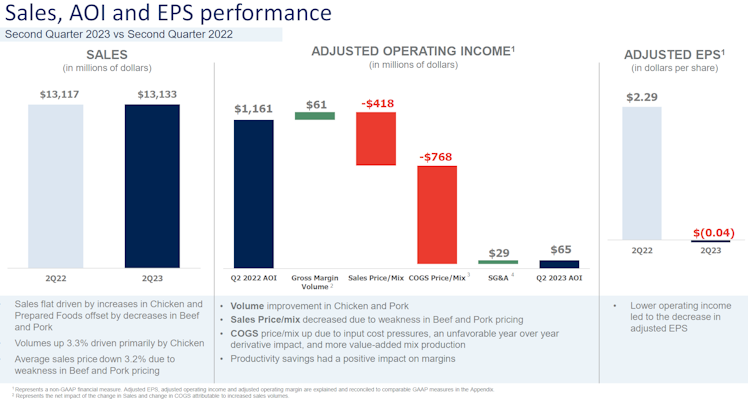

Firstly, from a revenue standpoint, Q1 generated $13.133 billion in revenue, a 3% YoY increase but lower than the average analyst estimate of $13.62 billion. However, actual sales remained largely unchanged due to a 3.2% drop in average pricing. The beef business, the largest of the protein giants, generated $4.617 billion in Q1 sales, down from $5.034 billion in the same period last year. Pork sales generated $1.421 billion, down from $1.565 billion last year, while chicken sales generated $4.43 billion, up from $4.086 billion in the same period last year.

Out of the three major categories, only chicken prices increased by 2%, while beef prices dropped 3% and pork prices fell 10%. This trend continued throughout H1 FY23.

Secondly, shifting from profit to loss is a major mistake for consumer goods companies. In Q1, the company lost 28 cents per share, far below the market's expected earnings of 80 cents per share. Adjusted losses amounted to 4 cents per share, compared to earnings of $2.29 per share in the same period last year.

The increase in operating costs is related to the supply chain. On the one hand, due to a shortage of beef, the cost of live cattle increased the company's expenses by $305 million. Some inefficient factories also incurred costs of $92 million, while inventory management-related expenses increased by $71 million. Raw material and other input costs for the prepared foods business also rose by $55 million.

Furthermore, the company has once again lowered its full-year outlook, indicating that this period of impact in Q1 is just the beginning. The company expects sales for FY23 to be between $53 billion and $54 billion, which is lower than its previous forecast of $55 billion to $57 billion and below the market's average estimate of $55.05 billion. The company has also lowered its adjusted operating profit expectations for all major segments of its beef, pork, and chicken markets for the full year of 2023, citing the uncertain macroeconomic environment this year.

Why is "inflation is a double-edged sword"?

Tyson Foods' performance has taken a hit as all three of its core products—beef, chicken, and pork—face market challenges. Beef, in particular, has been hit the hardest because of its relatively high price per unit. On the one hand, costs have risen, but on the other hand, prices have fallen because fewer people are buying it.

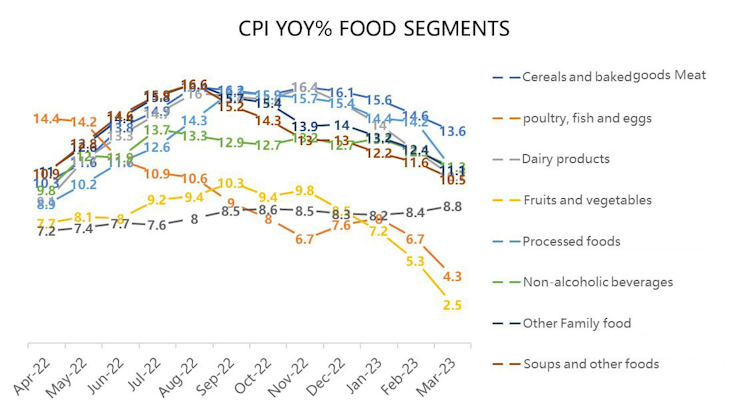

This may be one of the after-effects of inflation. As the CPI for food items has remained high, people are becoming increasingly concerned about the worsening economic situation, leading more consumers to choose more affordable and cheaper high-protein meat substitutes rather than more expensive meat. This trend is reflected in the positive growth of the company's pre-packaged food products, while the slightly lower-priced chicken is expected to see a 3% increase in sales year-on-year.

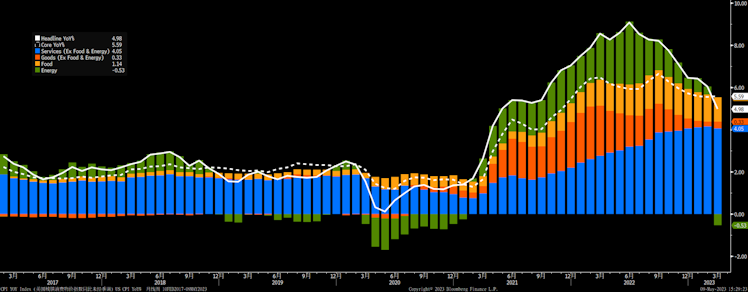

In addition, looking at the CPI sub-items from the past few months, overall food inflation has remained stable (with high stickiness) because food has low substitutability. The rising prices of eating out have not even kept up with the rising costs of cooking at home, which may make more families choose to eat out.

Yellow section: Food inflation

We believe that Tyson Foods' problem is a systemic issue in the food raw materials supply industry and is similar to the difficulties faced by large supermarkets like Walmart and Costco in mid-2022:

Due to supply chain issues, costs have increased while sales have not kept up, and companies have had to "discount" during a period of rising prices, greatly affecting profits.

Which companies are affected by this problem and which ones benefit?

Companies in the meat industry, including $PPC, $HRL, $NATH, and Canada's Maple Leaf Foods (FUMCF), are listed companies in the meat industry, just like Tyson Foods.

However, is it possible that all packaged food industries may encounter problems?

If we look for answers from CPI sub-items, we can see that the prices of subdivided foods such as bread, beverages, candies, soups, and canned foods have remained stable, and these basic consumer goods are not easily replaceable, with most of them being low-priced products. Additionally, these subdivided products have had a same-store sales growth rate exceeding that of eating out in recent months.

The only product similar to meat products whose prices have remained stagnant or even declined is fruits and vegetables. Large fruit producers and wholesalers may also be affected, such as Dole $DOLE and Fresh Del Monte Produce $FDP.

In addition, since more people choose to eat out, restaurant companies may gain a larger market share. For example, established chain stores such as McDonald's $MCD, Yum Brands $YUM, Chipotle $CMG, and Domino's Pizza $DPZ .

At the same time, beverage companies such as Monster Beverage $MNST, Coca-Cola $KO, PepsiCo $PEP, and Celsius Holdings $CELH may benefit from pricing.

As for coffee shops like Starbucks $SBUX, their sales at individual stores need to be observed. From the CPI's coffee-related data, the outlook is optimistic.

Already have an account?