Trending Assets

Top investors this month

Trending Assets

Top investors this month

Games Workshop (LSE: GAW) - Big profits from miniature figures - September Ideas Competition

Bull Thesis

- Increased revenue despite the world reopening. Have increased revenue by a CAGR of 14% over the past 5 years. Consistent new product launches have grown sales to existing and new customers.

- Licensing revenue (essentially cost free) increased by 71% in 2022

- Despite increasing costs, gross margin still remains a very healthy 67%

- Generous dividend yield of 4%

- Leveraging sales over a large, fixed manufacturing and selling overhead which gives it significant operational gearing and rapidly growing profits.

- Loyal customer base - They are conquering the globe through customer engagement, IP and product quality

- It’s on sale - Currently trading at a 5 year low 13.6 EV/EBIT

Metrics

- Market Cap = £2.1 billion

- EV = £2.07 bil

- FCF = £89 mil

- FCF Yield = 4.4%

- EBIT = £152 mil

- EV/EBIT = 13.6

Introduction

Games Workshop (LSE: GAW) manufactures Warhammer, Warhammer 40,000 and licences Lord of the Rings / Hobbit miniature figurines. Customers paint the figurines which are then used in wargames.

Despite growing revenues by 162% since the start of the pandemic, the share price currently trades at a discount of 50% from recent highs!

The Business

Games Workshop has built a community around devoted hobbyists. The unique worlds and stories that they have created has ensured they have created an almost impenetrable moat.

Although headquartered in the UK, 70% of sales come from abroad. With over 500 global retail shops and a further 4,000 stockists, Games Workshop is a truly global business. Games Workshop retains control over every aspect of design, manufacture and distribution of models and rulebooks.

Highly Profitable Products

The building block which underpins Games Workshop as a very good business is that it sells quality products that people want to keep on buying. Their miniatures are works of art and of very high quality. It does this better than anyone else and charges a premium price for it.

The company exhibits a continued high proportion of new products as a percentage of sales. The pricing strategy in recent years has been to increase the selling price of new product, which in turn increases the total pricing of the rest of the range. New products remained at 38 per cent of total sales compared with 30% 5 years ago. Continued strong demand for new products will continue to support high gross margins.

There has been a shift of sales away from the company’s own retail stores to trade sellers and direct sales to consumers over the internet.

History

Founded in 1975 by John Peake, Ian Livingstone, and Steve Jackson, Games Workshop originally started out as a manufacturer of wooden board games and importer of

They went on to develop a chain of games shops. In 1981 Games Workshop helped to found Citadel Miniatures Limited, a manufacturer of metal miniatures based at Newark-on-Trent, in Nottinghamshire.

A few years later the company moved closer to Nottingham and began to develop and expand, producing a wealth of miniatures, kits and books under the Games Workshop name.

In 1991 Tom Kirby undertook a management buyout and floated the company on the LSE in 1994.

A dedicated management team

The management ethos at Games Workshop appears to be under promise and over deliver.

The CEO, Kevin Rountree, became the company’s CFO in 2008 and the CEO in 2015. With a company turnaround materialising in 2017, Mr Rountree would appear to be the driving force behind the last several years of growth. Under Kevin’s watch the share price has grown from £5 to over £120. Aged only 52, it’s likely he will be around for many years to come.

Despite their small ownership the board looks after their staff. Last year the board rewarded 2,600 ordinary workers with a £10.6m special bonus on top of a £2.6m profit share for their hard work during the pandemic. This £5,000 pandemic bonus per employee was more than Microsoft, Facebook or Walmart.

Not All Revenue Is Created Equal

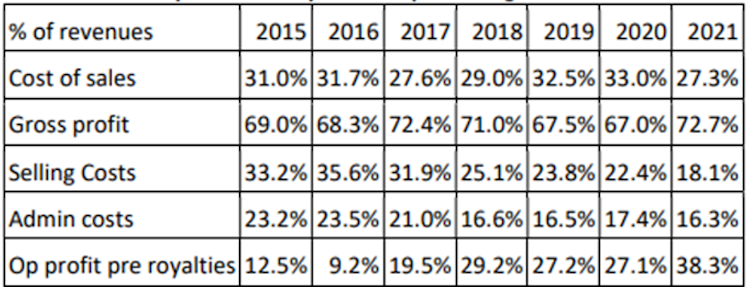

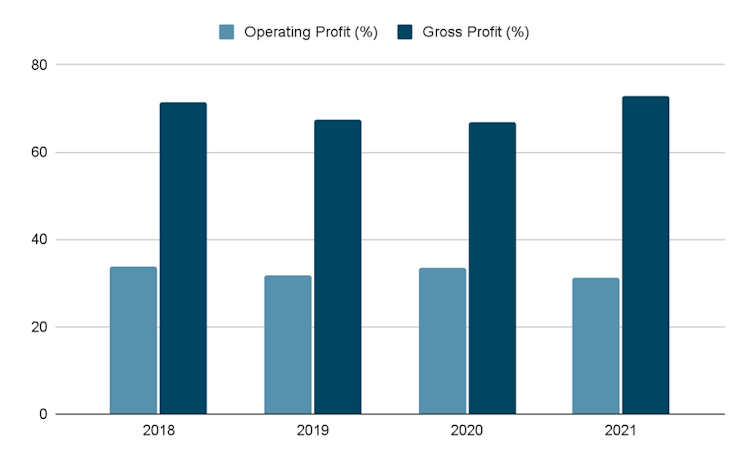

Games Workshop gross margins have averaged 70%, whilst operating profits have averaged 30%, in the past 5 years. The mark-up comes from the fact they are selling resin and moulds that dedicated customers are willing to pay a premium.

Look at those margins! They are ridiculous for a bricks and mortar business that sells physical goods. Games Workshop is not a software business, but the profit margins almost appear so.

The core business of selling Warhammer miniatures continues to grow and remains extremely profitable.

Recent success has been driven by a big improvement in its engagement with its customers. This started with the launch of Age of Sigmar in 2016 which saw a simplification of the Warhammer game rules and changes to the product ranges. Sales momentum has then been built with regular new releases of Warhammer 40,000 and Age of Sigmar.

Licensing and World Class IP

Licensing continues to grow at an extraordinary percentage, up by 74% in 2022 (from £16 million to £28 million). Licensing now has its own dedicated management team

Licensing is almost pure cash profits! As long as the Warhammer brand remains popular, the licensing will continue to grow and go straight to the bottom line

The business owns a wealth of IP. In a world where NFT’s and the Metaverse appear to be two of the most popular phrases on fintwit, there’s no doubt Warhammer can leverage these developments.

On the 25th of August, Games Workshop launched Warhammer+ at a cost of £4.99 per month. Warhammer+ taps into low cost, recurring revenue whilst continuing to grow and engage their fanbase. Warhammer+ will offer some of the following :-

- Warhammer animations and hobby shows

- Weekly in-house Warhammer hobby shows

- Access to digital vault of Warhammer publications and White Dwarf issues

- A free exclusive Citadel miniature worth at least £25* every year

- Access to a second exclusive subscriber miniature

At £4.99 per month Warhammer+ is a low monthly cost for diehard fans, tying together the physical and digital aspects to the Games Workshop model. Warhammer+ has introduced two initial animated series, Hammer and Bolter and Angels of Death along with game commentary plus Citadel Color Painting Masterclass

Warhammer+ is in its infancy. It’s one revenue stream to watch that could take Games Workshop’s revenue and fanbase to new levels, if done right.

2022 also brings with it one big reason to be optimistic, the release of Amazon Prime’s Lord of the Rings series. Amazon Prime has spent a whopping $495 million (the highest ever) to produce a new LotR TV series. With such an exorbitant budget, it’s possible this series could introduce a new generation to the world of Tolkein, and in turn the Games Workshop tie in.

Rounding it all off -The Strategy

- High quality miniatures. GAW miniatures are the best in the world. GAW products are differentiated by the craftsmanship, skill and cutting-edge technology used in the design and manufacturing process and this is reflected in pricing. The company offers a broad range of price points depending on the materials, size and intricacy of the item.

- Own the IP. The miniatures are derived from Games Workshop’s “endless, imaginary worlds”. Games Workshop owns the intellectual property and has full control over the imagery and styles used, and can grow its licensing income.

- Customer focus. They communicate in an open, fun way with customers, and support them wherever they are. Games Workshop uses its online news and content site warhammercommunity and social media extensively to communicate with existing and new customers. Offline, Games Workshop has worked closely with, and provided support to, community groups and event organisers to provide more opportunities for enthusiasts to participate in Warhammer activities (collect, build, paint, play) more often.

- Global nature of the business. Can achieve customers anywhere, using three channels (retail stores, independent distributors, and online). Online sales were 22% of core revenues in FY 2022.

- Cash-focused. Seek a high return on investment in the long-term, and seek growing sales in the short-term (without any reduction in the operating margin). Growth in revenue through recurring, high margin streams, particularly from Warhammer+.

Conclusion

Games Workshop (LSE: GAW) has been one of the LSE market’s big winners of the last few years, with massive profit growth driven by a combination of strong customer engagement, high margin products, unique intellectual property (IP) and significant operational gearing

Games Workshop demonstrates incredulous margins, a devoted fanbase and plenty of IP opportunities. And best of all, the shares are currently on sale at 5 year low EV/EBIT of 13.6, Games Workshop is one the best opportunities in the UK.

Already have an account?