Trending Assets

Top investors this month

Trending Assets

Top investors this month

$HIMS - Healthcare access on your fingertips!

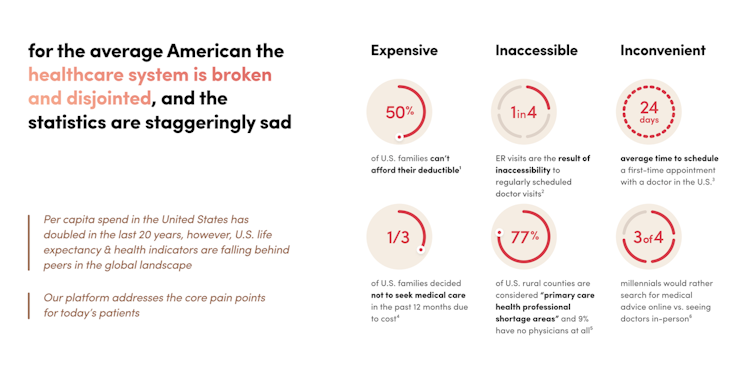

$HIMS is a mission-driven company that is on a mission to make healthcare accessible, affordable, and convenient for everyone.

As we all know, the healthcare system in its current form is broken and needs to be disrupted so that we can increase access to healthcare for everyone and reduce the incredible in-efficiencies rampant in our current healthcare system.

$HIMS brands have stood for de-stigmatization and access. They have been designed to encourage customers to engage with and seek treatment for conditions that are often embarrassing or stigmatized.

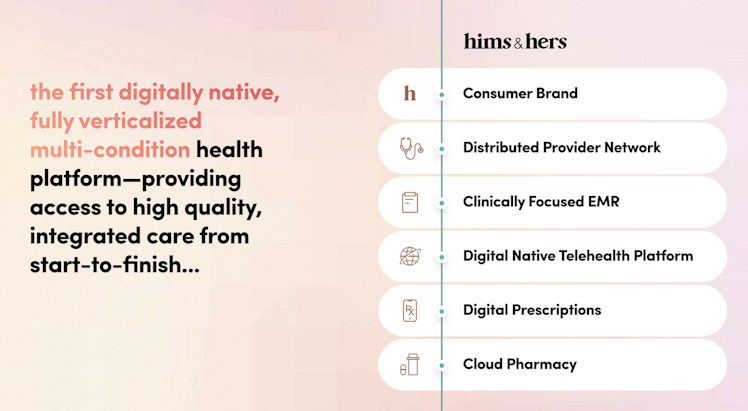

$HIMS designed and built their digitally native, cloud-based technology centered around the consumer, and design everything with the consumer in mind. $HIMS platform has websites, apps, telehealth platform, electronic medical records system, pharmacy integration, and mobile accessibility combine to provide consumers with a seamless, easy-to-use, mobile-first experience.

$HIMS has built a comprehensive and vertically integrated solution that empowers people across the country with direct access to qualified healthcare providers and reliable treatments.

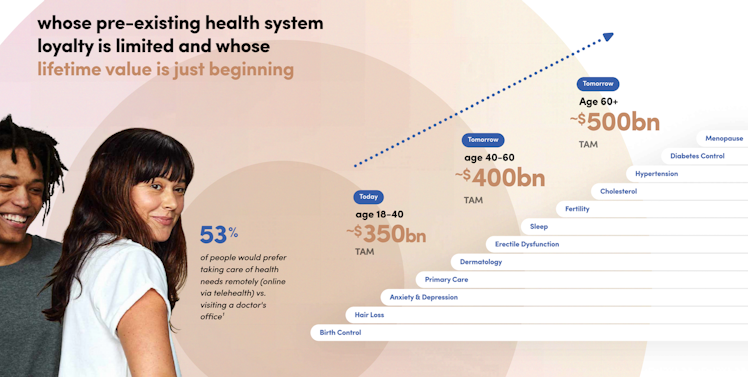

$HIMS TAM in their core categories is ~$350B, they plan to expand in adjacent categories and nearly double their TAM over the long term.

Now let's look at their Competitive Advantage:

- Brand - Consumer-first healthcare brand that has very high Customer and Provider satisfaction(NPS 65+), that is highly trusted.

- Switching Costs/Customer Relationships - Hims has built a trusted relationship with Gen-X and millennials who will spend a majority of future healthcare spend with Hims.

- Technology - Full-service vertically-integrated telehealth offering

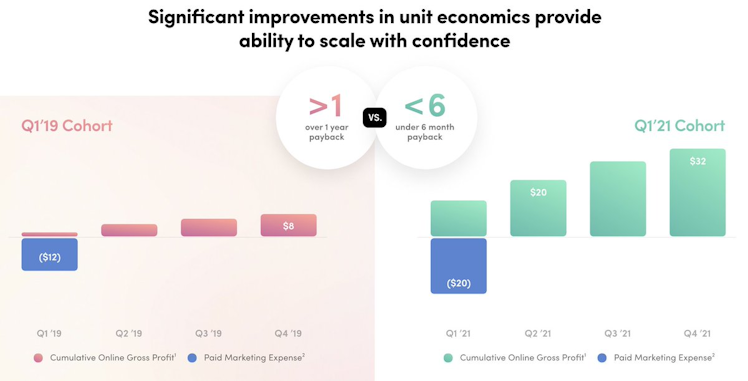

- Scalability - Highly extensible business model with expanding unit economics

- Network Effects - Hims connects consumers to healthcare providers in a very cost-efficient way and will benefit from more scale on both the consumer and provider sides.

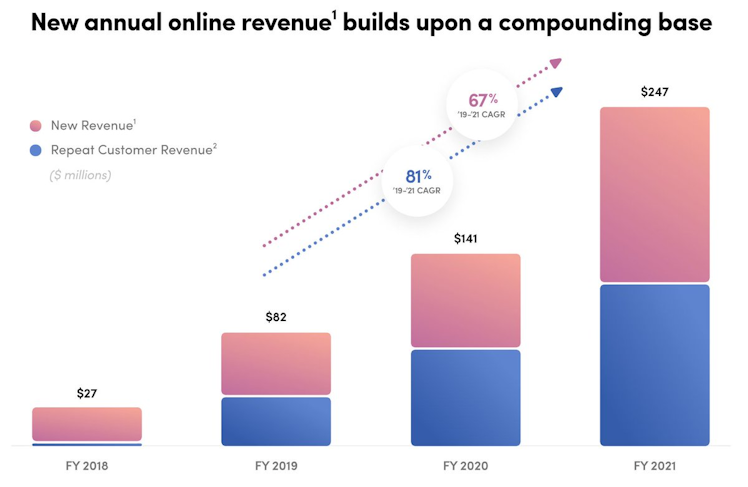

As for their financials, they are rapidly growing their revenues and customer lifetime values.

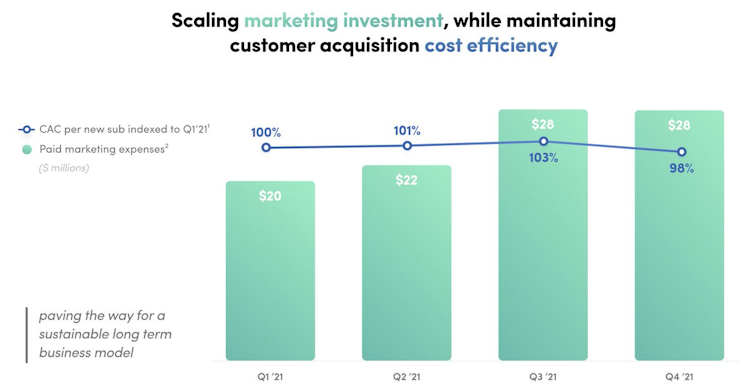

They are at a significant economy of scale leading to improved marketing performance and decreased customer acquisition costs.

What sort of a return/IRR do I expect from $HIMS?

If you use an incredibly conservative 10% 5-year CAGR, I see $HIMS giving us a 25% IRR.

If we assume a 20% 5-year CAGR(still conservative IMHO), we see $HIMS giving us a 45% IRR.

I think $HIMS will significantly exceed all these conservative estimates.

If you liked this post, be sure to Subscribe at: https://www.moderngrowthinvesting.com/

Already have an account?