Trending Assets

Top investors this month

Trending Assets

Top investors this month

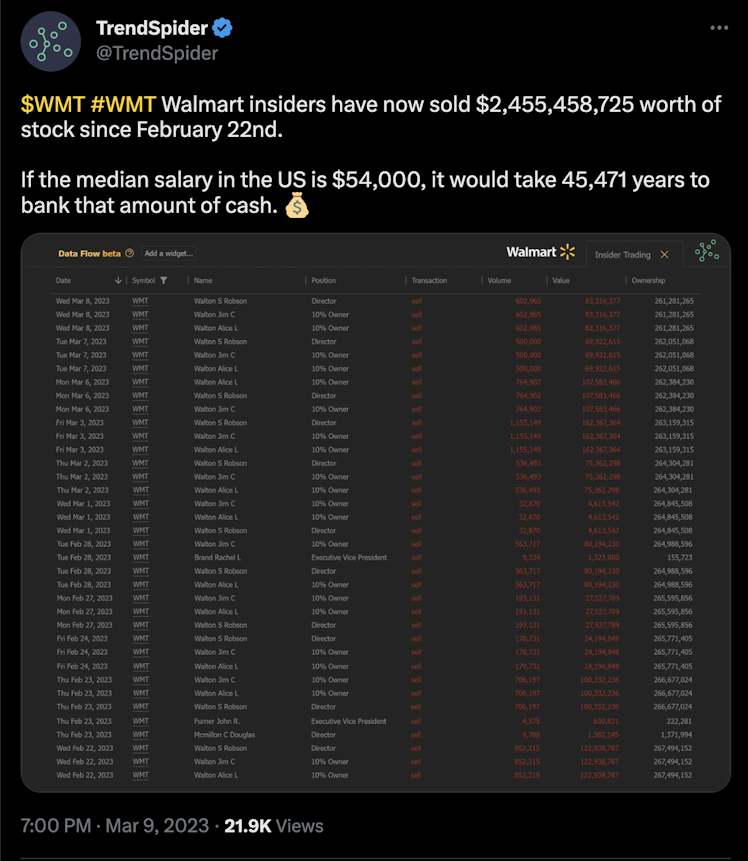

Rising tensions between the West and China are probably why $WMT insiders are cashing out

Last month, I wrote a memo conveying a theory I had for why Walmart $WMT insiders are rushing for the exits. In that theory, I noted that the low margin aspect of the business continuously leaves stores on the edge of unprofitability. With a labor shortage prompting the firm to raise wages and lesser demand for higher margin products, the average Walmart store is close to becoming unprofitable.

One thing that I didn't think would become a bear case for Walmart would be a possible war between China and Taiwan. With a war that's anticipated to happen during this decade, we would think that TSMC $TSM would become the biggest loser of the war. Interestingly, we forget that it's not just those in the warzone that will be negatively affected...it will also be everyone around the world that's addicted to cheap Chinese-made goods.

Walmart's business has grown alongside the growing American addiction of cheap Chinese-made goods. Without cheap goods from China, how can Walmart provide us with cheap goods? The entire brand is dependent upon giving us goods at a cheap price. Without Sam Walton catching the China bug, Walmart would've had a harder time attracting customers and becoming the department store giant that it is today.

With rising tensions at the Taiwan Strait, it's understandable why insiders would want to hold onto cash and not Walmart shares, especially as their employer sources 70% to 80% of its merchandise from China.

The whole China issue with Walmart is more deterimental when it comes to merchandising. Other than that, the growing attacks by the CCP on Walmart seem to be hurting the prospect of Walmart's 425 stores and its $11.4 billion in revenue that it generates from China.

Some will point to Walmart's grocery business as a possible savior of its business. In their 2022 annual report, grocery sales made up 56% of its revenues in the US. Groceries are lower margin in nature and help with sourcing recurring sales for the business. Without higher margin product sales from both general merchandise and health & wellness categories, for all the labor and rent costs Walmart has, it will be difficult to ensure that the stores are profitable from grocery sales alone. Most of these higher-margin products come from China.

Though the supply chain crisis of 2020-early 2022 have inspired Walmart to diversify its supply chains, it's difficult to undertake this endeavor. Not only is China the place where finished goods are made, but it's also where the components of those goods are made in the first place. By increasing the physical distance between the components manufacturer and the finished goods manufacturer, supply chains become more complicated and more expensive to operate. Some think that Vietnam or Mexico are great alternative places to set up factories. Interestingly, Vietnam has a 2.3% unemployment rate and Mexico has a 3% unemployment rate. Indonesia has a 3.8% unemployment rate, according to the World Bank. America has a 3.6% unemployment rate and firms continue to compete for workers. Overall, emerging markets that look to be suitable places to diversify one's supply chains already have tight labor markets and firms have to choose between paying premium wages for workers or stay in China.

The likelihood of China invading Taiwan continues to grow each day. As soon as this month ends, we will be entering one of the two most dangerous months in Taiwan. Walmart is prepared to handle a banking crisis, but it isn't prepared to see its most vital supply chains get hit by Russian-style sanctions from the rest of the world.

World Bank Open Data

World Bank Open Data

Free and open access to global development data

Already have an account?