Trending Assets

Top investors this month

Trending Assets

Top investors this month

Acquisition Pricing

Yesterday in a group channel I moderate, the following question was posed:

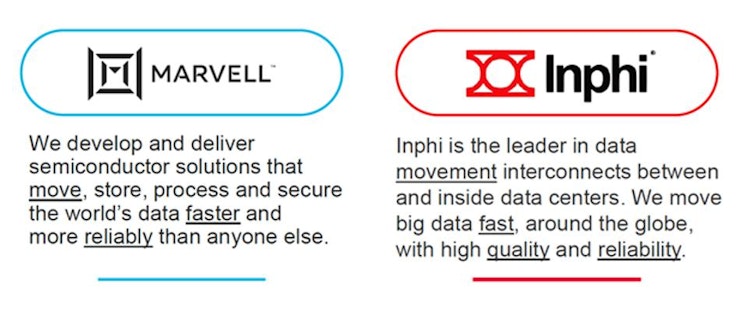

"I'm curious on the Inphi acquisition by Marvell. Marvell is acquiring Inphi for $10B in cash & stock. But the market cap of Inphi is only at $7.7B, does anyone know if I'm missing something? Thanks!"

My thoughts:

The $2.3 billion difference is the premium Marvell is paying Inphi to take over their business.

Why is the premium that high?

An acquisition premium is often a matter of negotiation and simply reflects how badly the CEO of the acquiring company wants to do the deal, and how much leverage the CEO of the acquired company has.

The semiconductor industry is in the midst of a merger frenzy, with AMD buying Xilinx for $35 billion and Nvidia buying ARM for $40 billion. Marvell sees acquiring Inphi as a way to cement their leadership in the cloud and extend their 5G position over the next decade.

So I think it’s safe to say the CEO of Inphi had the upper hand in the negotiations on this one.

After the acquisition, the difference between the market cap and and what was paid for the business will show up as “Goodwill” on the balance sheet of the acquiring company. This is simply a “plug” number that accountants have to use to ‘plug’ the hole that the CEO created by offering more than the company was worth. In this case, $2.3 billion.

Acquisitions are kind of wild when you think about it.

Already have an account?