Trending Assets

Top investors this month

Trending Assets

Top investors this month

Howard Marks: Dare to be Great

When seeing Buffet’s track record beside market performance, I noticed what really put him ahead was avoiding catastrophic losses. Many years he beats the market, but the real outperformance comes from only losing 5% while the market loses 20%. Howard Marks touched on that in this memo and it’s gold.

“I like caution in my money managers. I believe, in many cases, the avoidance of losses and terrible years is more easily achieved than repeated greatness. And thus, risk control is more likely to create a solid foundation for a superior long-term. Investing scared, requiring good value and a substantial margin for error and being conscious of what you don’t know and can’t control are the hallmarks of the best investor’s I know”

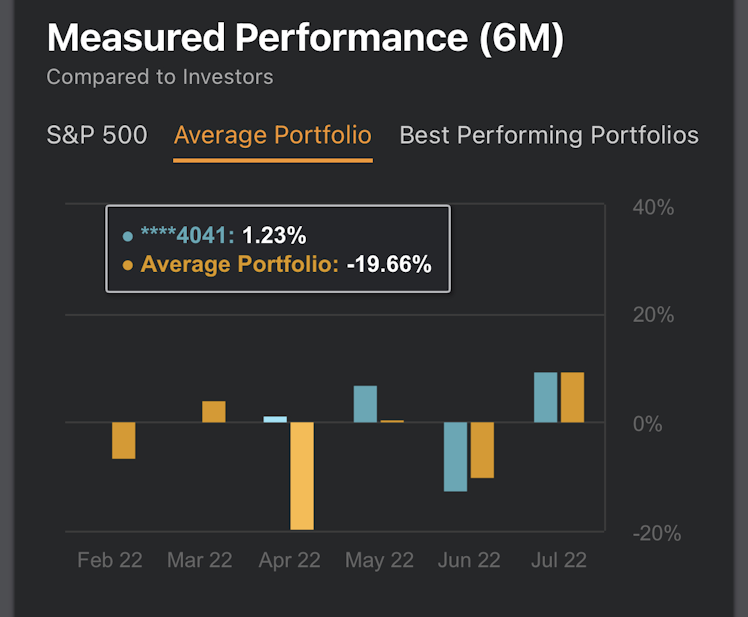

It’s the reason for my individual success. I buy value stocks with a margin of safety. Avoiding massive losses keeps me from having to make up too much ground. Here’s a screenshot from TipRanks to demonstrate the idea:

4041 is the same portfolio I have linked here; you can see while the average TipRanks portfolio lost ~19% in April, I went sideways. Usually not a good thing, but I’ll take sideways over a 20 drawdown all day.

Avoiding losing makes winning so much easier. So overpriced growth stocks with lofty valuations and companies without earnings go straight to the “no thank you” pile.

Already have an account?