Trending Assets

Top investors this month

Trending Assets

Top investors this month

UiPath ($PATH) Q4 and FY Earnings Recap

UiPath, the market leader (1) (2) (3) in Robotic Process Automation (RPA), has been undergoing a transition from a licensing model to a SaaS model since late 2019. While it hasn't been smooth sailing for UiPath, I'm still seeing plenty to keep me long-term bullish.

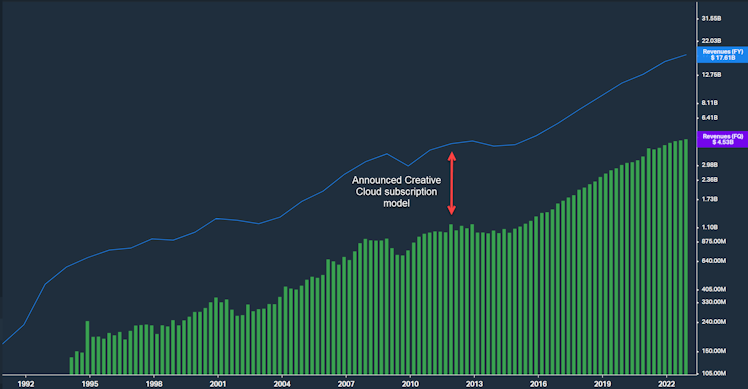

Anyone who has seen a company undergo a switch from license to SaaS knows it can be bumpy in the near-term but, if executed well, creates long-term value. A great example is Adobe ($ADBE). You can see below how lumpy their revenue was by quarter and by year prior to moving to a SaaS offering. In 2011, they announced Creative Cloud as a subscription model and in 2013, they announced that CS6 would be the last version released of Creative Suite and all future releases would be part of Creative Cloud. Not only did that lumpiness continue through the middle of 2014, more than 3 years after launching Creative Cloud, they saw a decline in revenue as well.

The revenue decline is common for larger, established companies who make the change to cloud. That's because the company is no longer recognizing revenue upfront when a license is purchased but instead the same amount of money is smoothed out over several quarters or, more likely, years. Microsoft saw similar declines when they moved to SaaS 10-ish years ago.

Back to UiPath. They only came public in April 2021 so we won't have any charts showing a big chunk of time before their SaaS migration but we can definitely monitor the after to see if their lumpiness smooths out over time. In the mean time, here's what's encouraging me and discouraging me along with a couple other things I'm watching.

Encouraging!

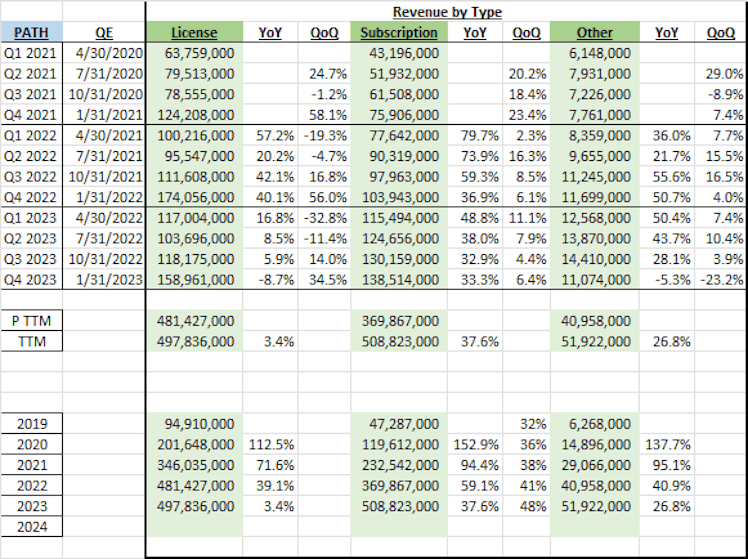

- UiPath is seeing the same slowing growth as other tech growth companies but their subscription revenue growth remains strong. Subscription revenue in Q4 was up 33.3% YoY, a very slight acceleration over Q3's increase of 32.9%. For FY23 (their fiscal years end on January 31), subscription revenue is up 37.6%. Meanwhile, as should be expected from a company changing to a SaaS model, licensing revenue has begun to fall off a cliff, decreasing 8.7% YoY in Q4 and increasing just 3.4% for FY23. This is what we want.

- As a percent of total revenue, subscription revenue has increased from 32% in 2019 to 48% in 2023.

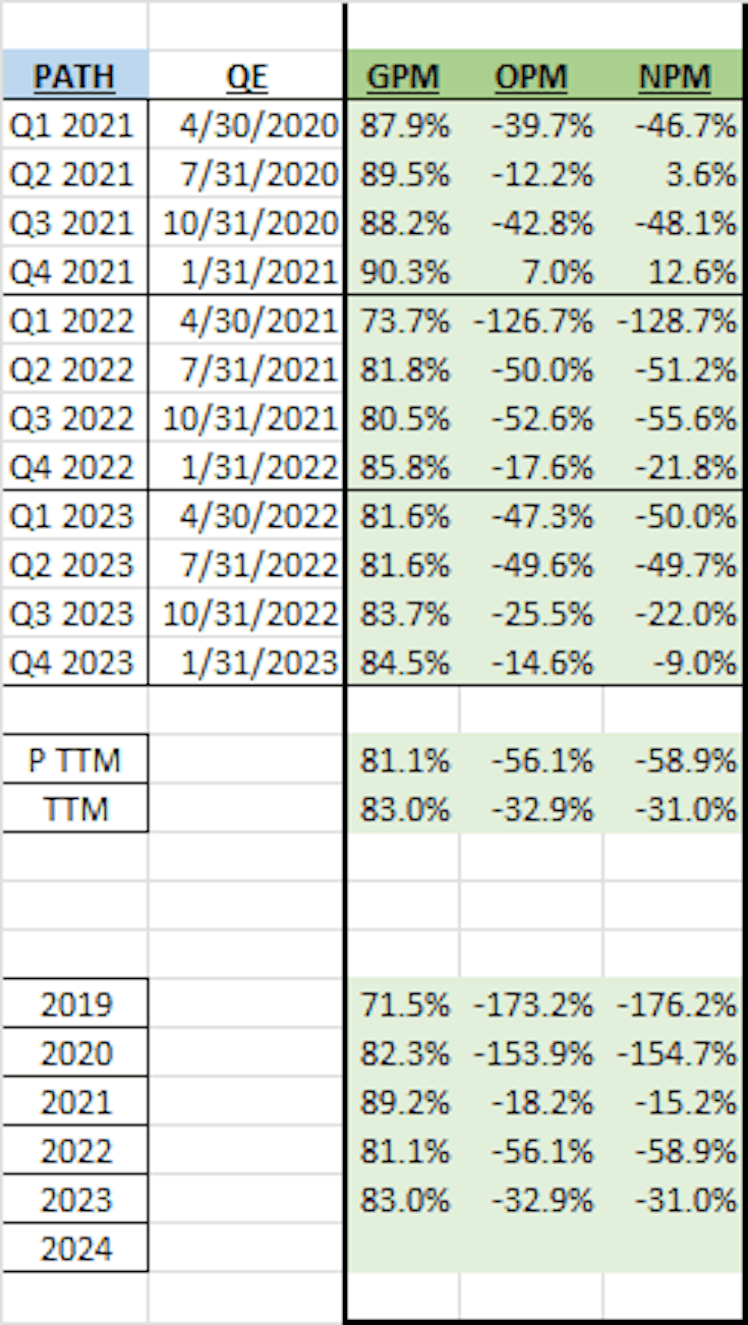

- Gross margins increased in FY23 to 83%, a 190bps improvement over FY22. Management commentary put non-GAAP software gross margins at 93%. I'm not a fan of non-GAAP but that's great to hear regardless when factoring in that non-GAAP gross margins were 87%. It doesn't take a rocket scientist to realize that GAAP gross margins should continue to improve as more revenue comes via subscription and less from licenses.

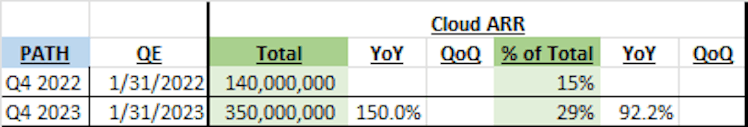

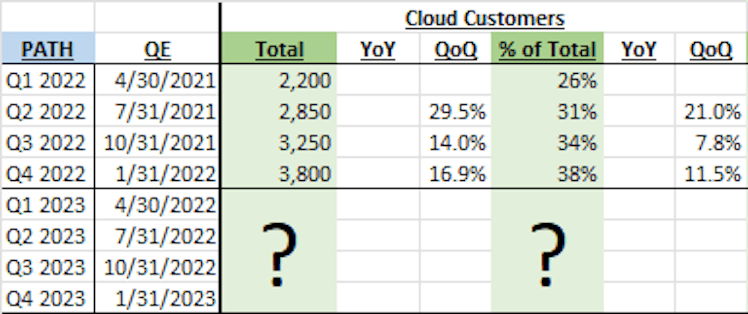

- At the end of their FY22, management said their cloud offering, UiPath Automation Cloud, had exceeded $140M in ARR, which was approximately 15% of the company's total ARR ($925M). Yesterday, management announced that UiPath Automation Cloud ended FY23 exceeding $350M in ARR, a 150% rise YoY and 29% of total ARR ($1.2B).

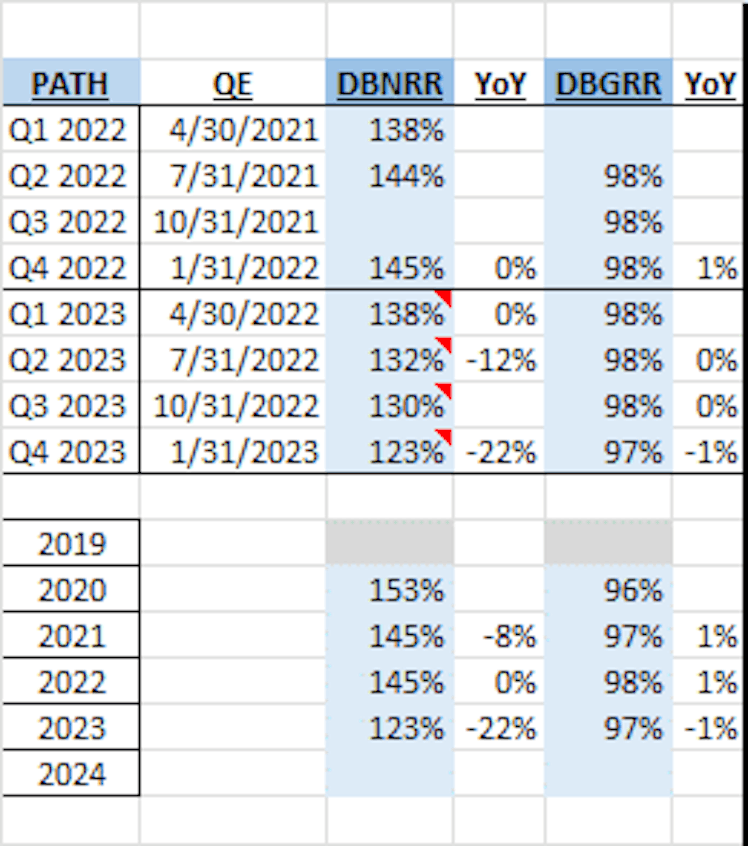

- DBNRR came in at 123% (129% ex. Russia and FX impacts). This is down from COVID peaks but remains above my preference of 120%. DBGRR came in at 97%, simply a great number.

Discouraging!

- Management provided how many customers had begun using cloud products each quarter in FY22. In FY23, we received no updates. I hate hate hate when management provides certain KPIs and then just stops, especially one that is important in showing adoption of their cloud products. I'm going to send a message to their IR team asking for the data but I don't imagine I'll get it.

- Overall slowdown in revenue as part of the broader macro environment we're in. This isn't UiPath specific though so I don't really give it much thought. Short-term macro noise is opportunity for long-term investors.

- Still trading at a premium by certain metrics (P/S of 9, P/GP of 11). It's almost a certainty that I will pick up more shares in 2023. I'd just love to get them at a cheaper valuation.

Other things I'm watching

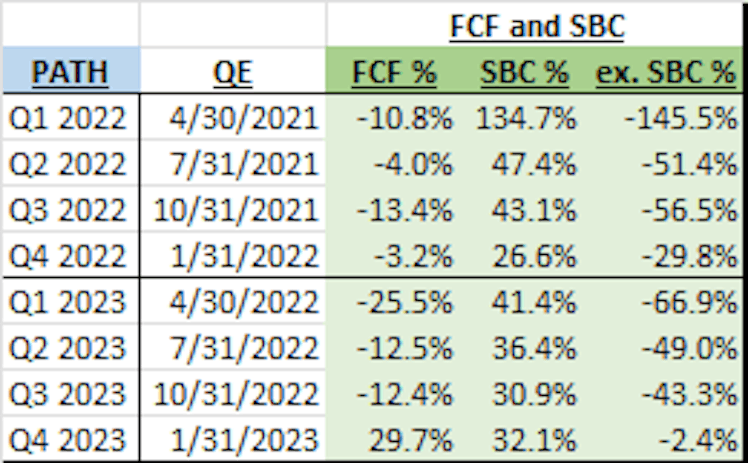

- SBC. Excluding Q1 in FY22 when they IPOed, SBC was 37.5% of revenue. In FY23, that number declined to 35%. I'd like to see it keep falling, preferably below 20% of revenue by the end of FY26. In Q4, they reported a 30% FCF margin and a (2.4%) FCF ex-SBC margin. 4th quarters are historically their strongest quarter for FCF and their public life is young but that's by far their best result to date.

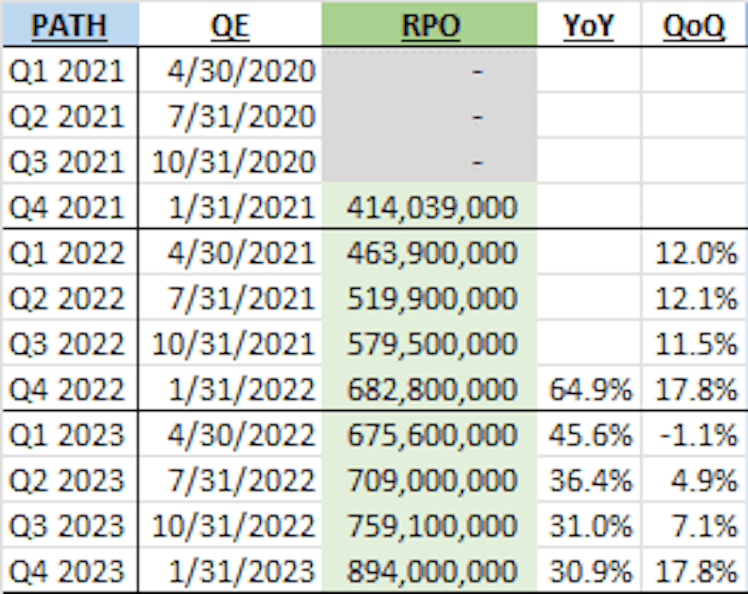

- I like to compare RPO YoY growth vs. revenue YoY growth. I want to see the future pipeline remains robust, and ideally stronger than revenue growth. For UiPath, it's not really a useful comparison since they're migrating to a SaaS model and their revenue growth is hindered by the smoothing out of future revenue. Therefore, I just want to make sure RPO reflects continued demand for RPA. In Q4, RPO was up 31% YoY, matching the Q3 increase.

Conclusion & My Position

I think RPA remains a huge future market and as the industry leader and with their early (if not first) move advantage, I remain very bullish on UiPath. That doesn't mean I'm not watching each earnings closely though.

UiPath, Inc.

UiPath Named a Leader for Sixth Consecutive Year and a Star Performer in Everest Group’s Robotic Process Automation Products PEAK Matrix® 2022

Solidifies market-leading position in the delivery of an end-to-end business automation platform, from discovering to building to…...

Already have an account?