Trending Assets

Top investors this month

Trending Assets

Top investors this month

Scandinavia: Sleeping Giant?

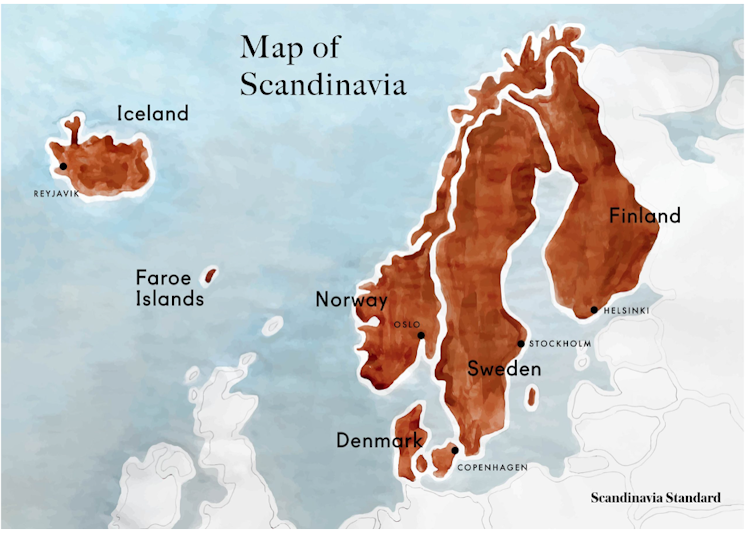

Where is Scandinavia? It’s a question we hear often and it’s harder to answer that one might think.

What constitutes a Scandinavian country changes depending on the context, and on who you ask. If you’re talking about geography, culture, or language, the answer may be different.

When you throw the word “Nordic” into the mix, things get even less clear as you tackle Nordic vs Scandinavian in different contexts; when do you use “Nordic,” and when do you use “Scandinavian?”

I thought it might be best to clarify at the beginning of this post, as there is some disagreement over which countries should be labelled as Scandinavian. There doesn’t seem to be a definitive answer – but when simply discussing investing in the region, I think we can agree on the following:

When referencing the geographic region of Scandinavia, there are three countries: Denmark, Sweden, and Norway. Greenland, which is a Danish territory, and the Faroe Islands, which is a self-governing part of Denmark, are also included in the list.

Finland and Iceland are not considered part of Scandinavia geographically.

Finland and Sweden are ranked as having among the lowest effective taxes on mining internationally.

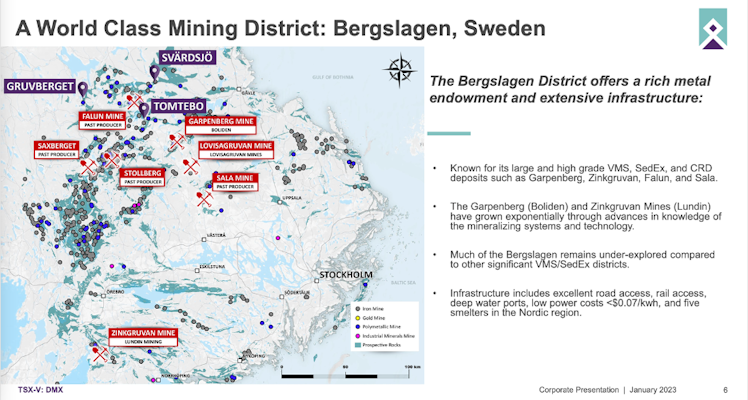

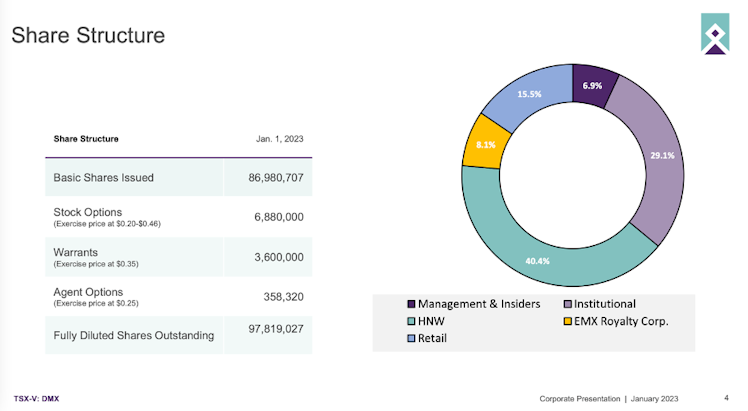

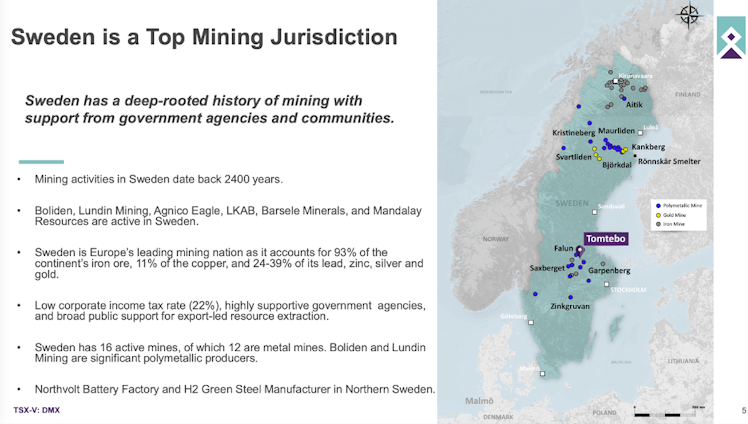

Some time ago, I invested in a small Sweden-based junior mining company named District Metals ($DMX.V). At the time, I was rather convinced the company had a bright future. I appreciated the share structure and experienced management team and felt the Tomtebo project looked very promising. I considered Sweden to be a favourable mining jurisdiction and believed DMX had great potential.

I have often stated how much value contrarians can bring if you’re willing to listen. In this case, @edark94 of Twitter, a London-based “Swede with an interest in commodities & shipping” questioned my take on how favourable Sweden was as a mining jurisdiction. If anyone would know better than I, it would certainly be a Swede himself. Upon further investigation, I did have doubts and sold my DMX position for a small loss. I was grateful for Emil’s input as I watched the share price continue its decline to a 52wL of $0.05. We may not enjoy listening to contradictory opinions, but I can’t stress enough the importance of taking them into consideration when investing. They will either serve to strengthen your thesis or cause you to have reasonable doubts that warrant further investigation – neither of which should be considered negative.

Times have changed since my initial investment in DMX, however, and like most governments these days, Sweden seems eager to forge ahead with the energy transition. In 2018, Sweden put in place a moratorium on the exploration and mining of uranium. A newly elected government will be voting on the ban in March, and it’s expected to be lifted which could be very favourable to the outlook for District Metals.

If you’re interested in investing in District Metals, Mining Charts recently wrote an excellent piece on the company regarding the “Huge Re-rate Potential Ahead”. He mentions the Viken Property – the largest undeveloped Alum Shale vanadium-uranium-molybdenum-nickel-copper-zinc deposit in Sweden. In early January, DMX announced they would be applying for a mineral license to cover about 70% of the property. (https://miningcharts.substack.com/p/district-metals-opportunity-huge)

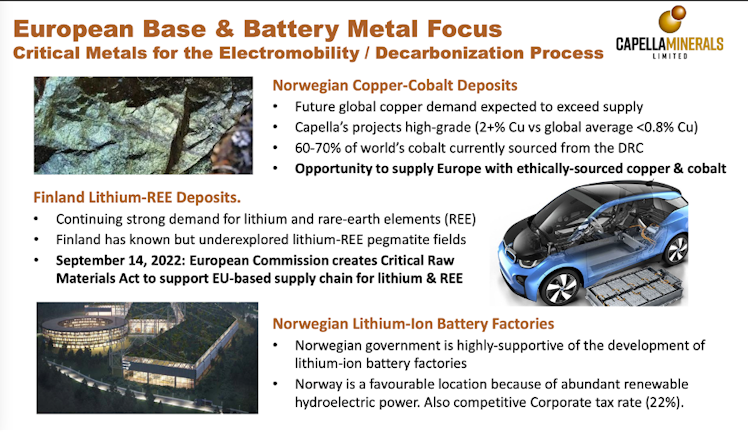

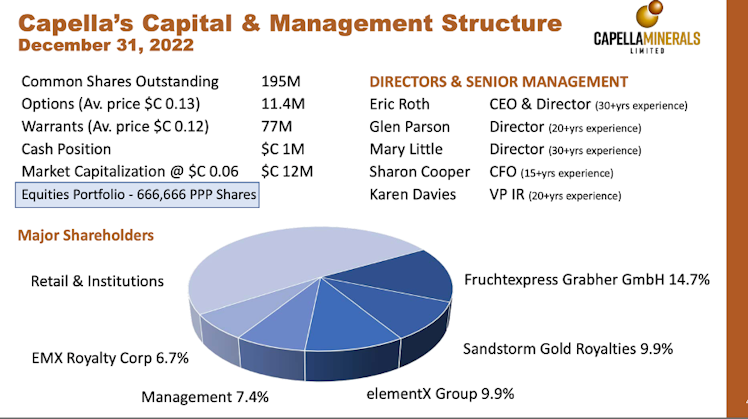

I have recently started a new position in District Metals, as well as one in Capella Minerals which has promising battery metal projects in Norway and Finland.

A recent research report from Stifel covering metals and mining in Europe points out that Finland remains supportive of their mining industry. Sanni Grahn-Laasonen, the legistlature’s head of the commerce committee, noted the mining industry is "vital for the security of supply of raw materials".

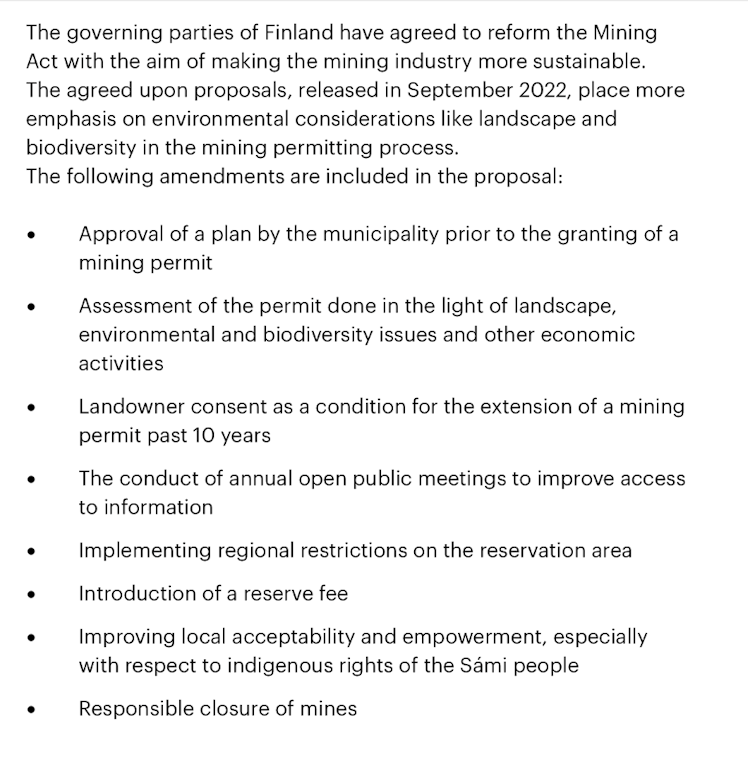

Finland recently reformed their Mining Act, and though there is a risk it could extend permitting timeframes, the stricter regulations and higher fees should increase the quality of mining operators, mechanically by making it harder to get permitted.

Stifel’s report covers several other important points worth noting regarding mining in Finland:

Finland is located on the ancient Fennoscandian shield, which has strong geological similarities to parts of Ontario, Quebec and Western Australia, some of the most prolific mining regions of the world. Despite this, much of the area is still much unexplored. This is partly because during the Cold War years, Finland had a very state-dominated economy and the government did not want to competition to then state owned miner OUTOKUMPU. This changed upon privatization before 1997 and since then, the country has greatly opened up its economy.

Finland is host to over 40 mines, and ten smelters and steel mills, including:

- Kittila, Europe’s biggest gold mine, producing ~250kozpa

- Kevitsa nickel and copper mine, producing ~13ktpa and ~29ktpa respectively

- State run Terrafame, producing 28kt nickel and 54kt zinc in a bio heap leach

In recent years, the whole of the country has been geological mapped, surveyed and digitized, providing explorers with excellent information.

Finland ranked 13th, just behind Ontario and the top European Jurisdiction in the Fraser Institute’s 2021 Investment Attractiveness Index. It ranked 9th on Policy Perception. A strong rule of law and a favourable legislative environment, Finland is host to many high-quality service providers and research institutions as well as impressive infrastructure. There are ten mining-related universities and research organizations and more than 200 mining technology and service providers in the country.

Finland has advanced transport infrastructure and logistics. Miners are served by an extensive network of roads and railways and by a vast network of waterways, canals, and sea lanes. Energy prices are competitive and power grid covers the whole country.

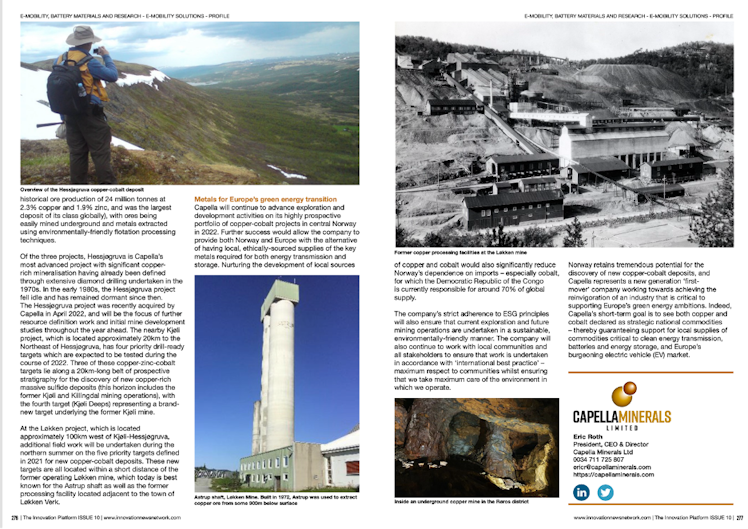

Norway is a country with a rich but oft-forgotten history of copper mining, with the key mining districts of Lokken and Roros having supplied local and European markets since the 1650’s. These mining districts remained in production until the mid-1980’s, when a combination of low metals prices together with a surge in the importance of North Sea oil to the Norwegian economy, effectively left the once-flourishing copper mining districts in a state of hibernation.

Four decades later, copper prices are now fast approaching $10,000/tonne on the back of global supply shortages with increased demand, with the former Norwegian mining districts retaining the potential to provide future supplies of ethically sourced copper to Europe.

The country's reputation for producing copper may have faded from minds across the globe, but it remains close to the hearts of many in Norway.

Capella Minerals is breathing new life into Norway's oft-forgotten, yet historically important, copper mining sector—which has supplied the metal to Europe since the Age of Enlightenment.

The Toronto Stock Exchange-listed company acquired the Central Norwegian Løkken and Kjøli copper-zinc(-silvergold) projects in August last year from EMX Royalty Corp and is undertaking drill target generation activities to position itself to help supply Europe's shift to widespread electrification and Norway's transition from oil to commodities required for green energies.

"These were extensive mining districts—both of them. They're high-grade copper deposits, they're massive sulfide type deposits. These districts lie along the extensions to some very important copper producing regions in north-eastern Canada, such as Bathurst and Buchans. Geologically they're part of the same trend," Capella's chief executive officer and director Eric Roth said.

"Most people think of Norway as an oil producing country— and something that is forgotten is that Norway had a long history of copper mining. A lot of these districts started mining in the mid-1600s and they continued until the mid-1980s," Roth said.

Little systematic exploration in Norway has occurred in the last 40 years, meaning that plenty of upside for new discoveries remains.

Link to Crux’s interview with Capella CEO Eric Roth, “Scandinavian Copper Sparks Interest”:

Please DYODD - I'm always happy to answer any questions that you may have.

YouTube

Capella Minerals (CMIL) - Scandinavian Copper Sparks Interest

Interview with Eric Roth, President & CEO of Capella Minerals (TSX-V:CMIL)Our previous interview: https://youtu.be/X0QcXNpJPI0Capella Minerals Ltd is a Canad...

Already have an account?