Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Goods and Mortgage Data

Stocks are moving higher due to late day corporate earnings releases yesterday and ahead of the Feds rate decision this afternoon.

In economic news, durable goods orders posted a 1.9% increase in June, beating the expected 0.5% decrease. The increase was largely due to orders for new vehicles and military aircraft. When looking at core orders (excludes transportation and government spending) growth was a more moderate 0.3%.

The advance goods trade balance in June lessened by $5.9 billion to $98.2 billion. Exports increased $4.4 billion and imports were lower by $1.5 billion. The advance wholesale and retail inventories also increased, up 1.9% and 2.0%, respectively.

In housing, mortgage applications fell for the 4th consecutive week posting a decline of 1.8% for the week ending July 22. The Refinance and Purchase indexes decreased 4% and 1%, respectively, and the average rate for a 30-year fixed-rate conforming loan dropped 8 basis points to 5.74%. Pending home sales tanked 8.6% in June, down from 0.4% the prior month and much lower than expectations. All 4 major regions fell with the West leading the decline. Economic uncertainty, higher mortgage rates and affordability continue to sideline would-be buyers.

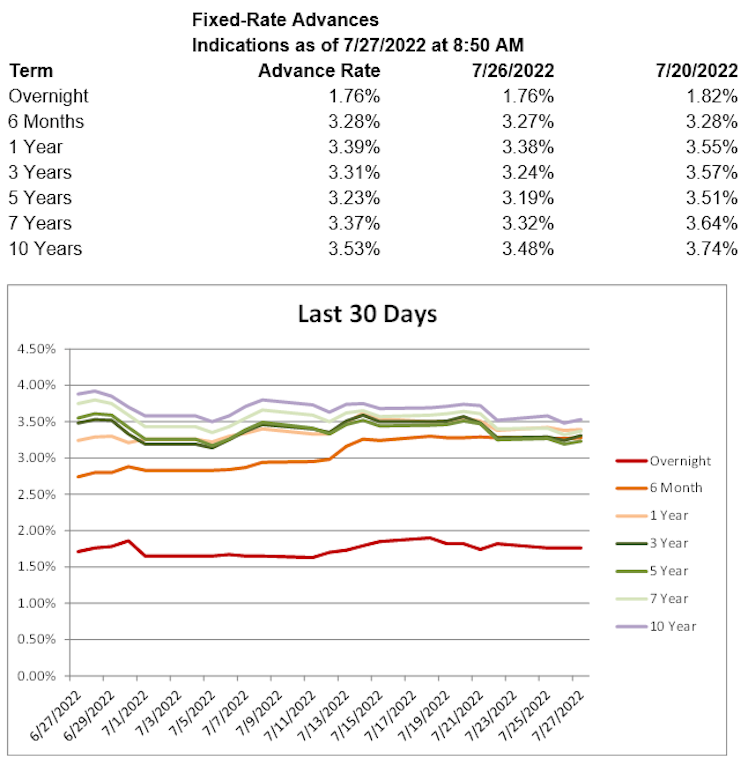

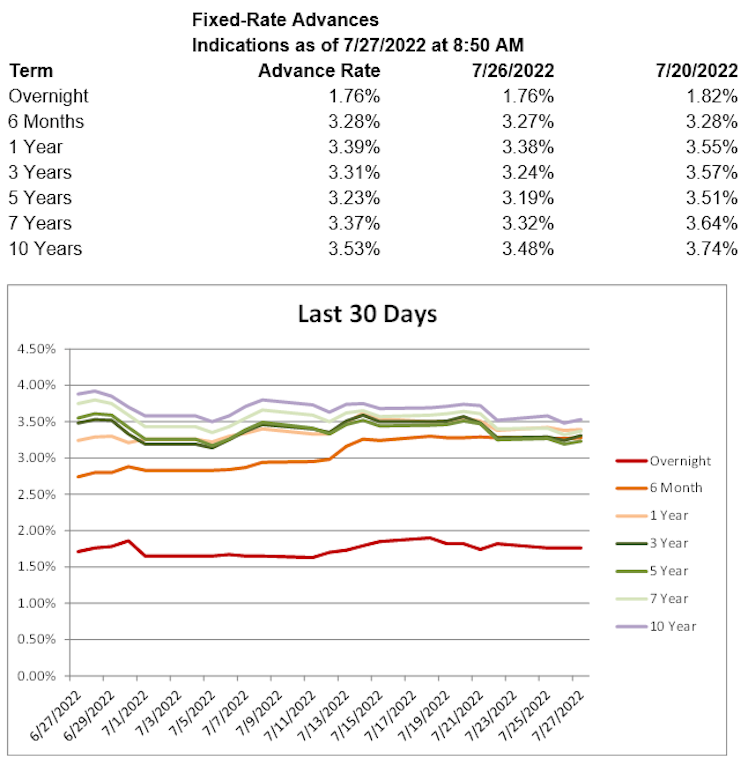

Treasury yields are higher, with the 2-year T yield up 4.5 basis points to 3.04%, the 5-year T yield up 2.7 basis points to 2.85% and the 10-year T yield up 2.2 basis points to 2.76%. Advance rates are higher on 6 month terms and longer.

Already have an account?