Trending Assets

Top investors this month

Trending Assets

Top investors this month

Edwards Lifesciences ($EW) investor day

For a quick background on Edwards $EW I have a blog post here: https://www.gpmgrowth.com/blog/core-portfolio-insight-edwards-lifesciences-ew

Edwards held its investor day on Dec 8 (https://ir.edwards.com/events-presentations/

)

The key takeaways were:

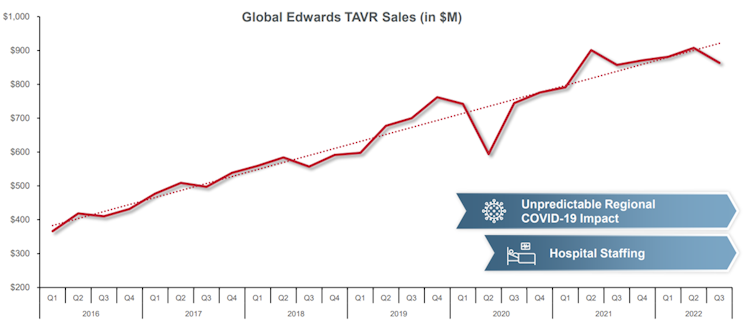

-After a decade of double-digit organic growth, growth paused in 2022 due to hospital staffing issues. Expecting a return to 9-12% growth in 2023.

-Edwards continues to invest the highest percent of sales into R&D (17-18%) of its peers. Its 2000+ engineers drive strong DD organic growth over time. Edwards does not rely on large acquisitions to grow.

-Edwards’ competitive advantage is that it has a singular focus on large unmet needs of structural heart. This allows it to have the best technology when it goes into hospitals to sell its mission-critical applications.

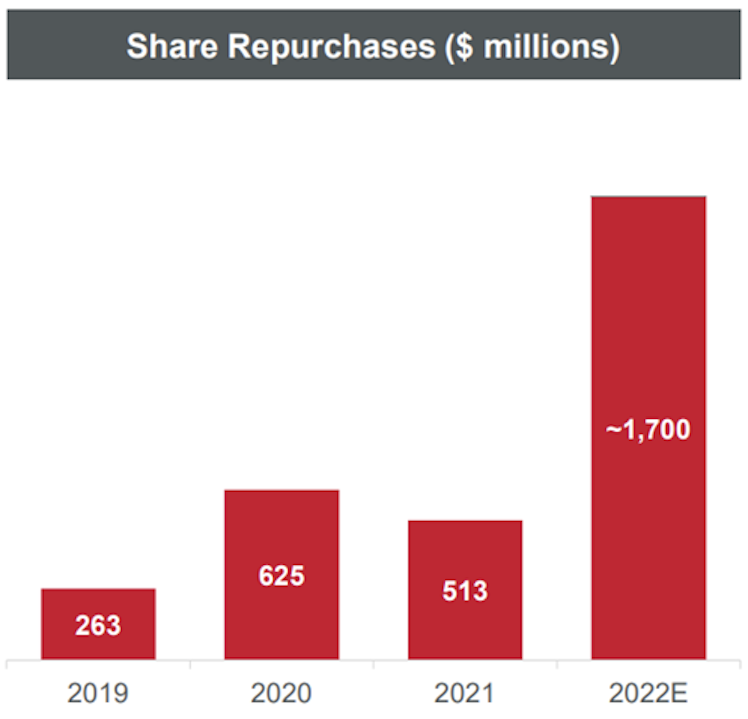

-Share buyback activity picked up greatly with the latest share pullback. Management says that temporary headwinds, which are out of Edwards’ control, are causing an anomaly in growth rates this year. This is not indicative of Edwards’ long-term potential, making this a strong share repurchase opportunity. Management has picked up buyback activity at opportune times in the past (Note the last couple large repo years were late ’16 into ’17 and ’20 when the stock pulled back 35%+ each time).

-Analysts have called an end to TAVR growth multiple times in the past (2016, 2018) but global TAVR still grows DD annually overall.

(Source: investor day slides)

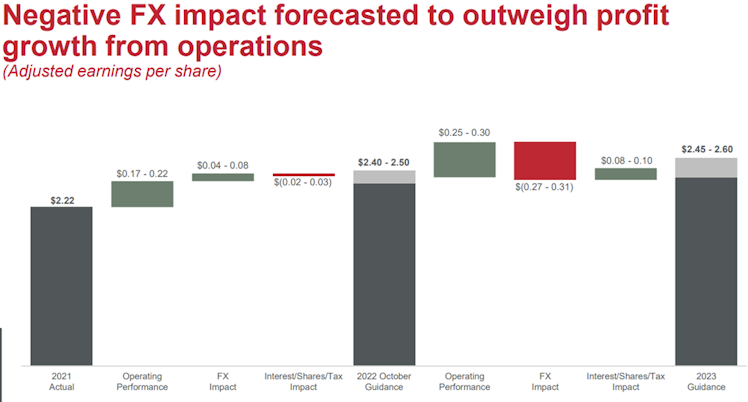

Guidance details:

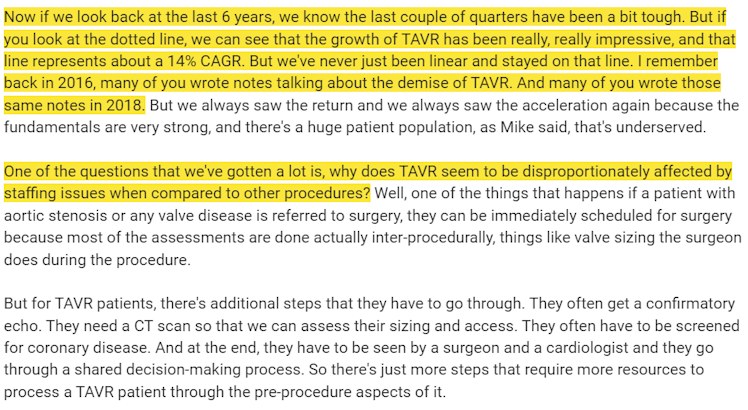

FY Guidance (2022):

Reaffirms revenue low end of $5.35-5.55B vs FactSet $5.36B [25 est, $5.35-5.44B]

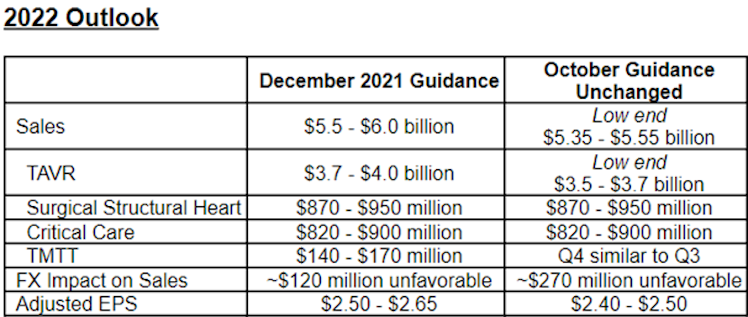

FY Guidance (2023):

EPS $2.45-2.60 vs FactSet $2.52 [24 est, $2.39-2.62]

Revenue $5.6-6.0B vs FactSet $5.72B [25 est, $5.46-6.12B]

(source: company press release)

(source: company press release)

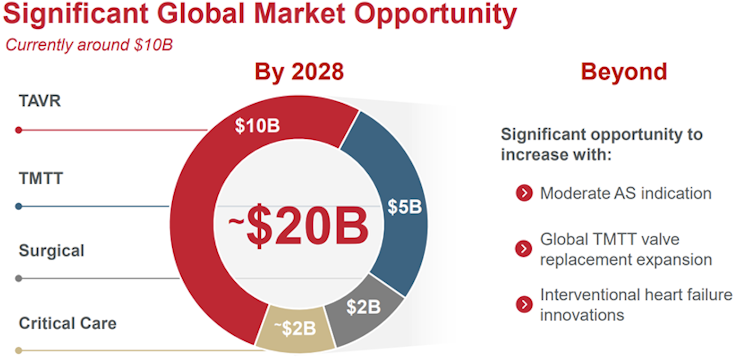

-Global market opportunity across 4 product groups projected to double to nearly $20 billion by 2028

-TAVR market opportunity $10B by 2028

-TMTT market opportunity $5B by 2028

(No change compared to last year’s long-term targets)

-Prior long-term target was TAVR global opportunity of $7B by 2024 and TMTT $3B by 2025

Q: Why maintain 2028 targets when Edwards missed guidance this year?

A: Without FX, Edwards only missed by about $250M which is insignificant in terms of 2028 targets.

Q: Competition?

A:

Key charts:

-All operational EPS gain to be wiped out next year by FX

(Source: investor day slides)

-Share repurchase activity picked up meaningfully with the large decline in share price this year

(Source: investor day slides)

-No change to long-term 2028 guidance despite the slow down this year

(Source: investor day slides)

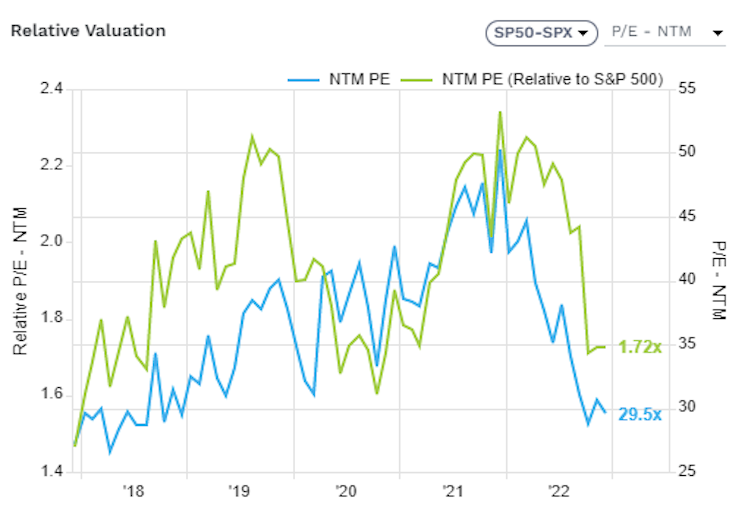

-EW's P/E multiple dropped significantly to 29.5X NTM EPS

(Source: FactSet)

Lastly,

Edwards Lifesciences announces retirement of CEO Michael Mussallem, 70 years old, effective 11-May-23

-At the 2023 annual meeting, Mussallem will stand for election as non-executive chairman of Edwards' board.

-He will be succeeded as CEO by Bernard Zovighian, currently corporate vice president and general manager for Edwards' Transcatheter Mitral and Tricuspid Therapies (TMTT) business. Bernard has been with Edwards for 8 years. Before that, he worked at various J&J from 1995-2014.

-Zovighian will serve as president of Edwards Lifesciences effective 1-Jan until he becomes CEO in May, working closely with Mussallem, the board and the Executive Leadership Team on a smooth transition.

-Larry Wood is taking on an expanded role, with responsibility for both TAVR and Surgical. Larry has been with Edwards since 1985.

ir.edwards.com

Edwards Lifesciences Corp - Events & Presentations

Already have an account?