Trending Assets

Top investors this month

Trending Assets

Top investors this month

Wal-Mart raised its guidelines for next year ahead of schedule, but the market didn't buy it?

The retailer's super financial report season kicked off. Before the market on May 18, it was listed as a big brother $WMT After the announcement of Q1 financial report, the revenue and profit both exceeded expectations again, and raised the expectations for the remaining quarters of 23 years and 24 years. According to the script that these two earnings seasons should have, this performance deserves a big rise, but it was yesterday $NDAQ After hitting a new high since August last year, with an increase of 1.51%, it only barely rose by 1.3%. Although this result is still the best in the retail sector, because the financial report of rival TGT is sluggish, which is much worse by comparison.

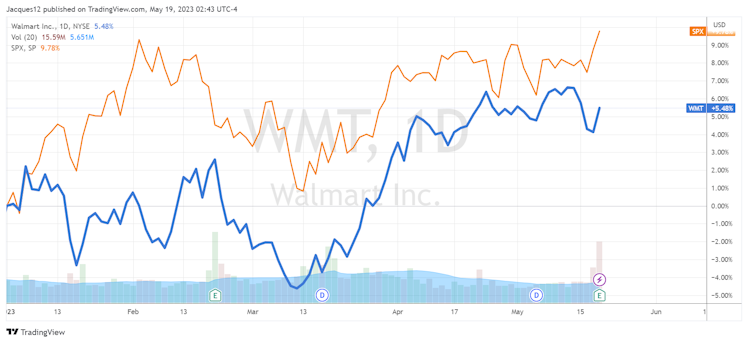

WMT vs SPX (YTD)

Investors are in a bad mood for the overall retail sector. On the whole, Wal-Mart's Q1 financial report far exceeded expectations.

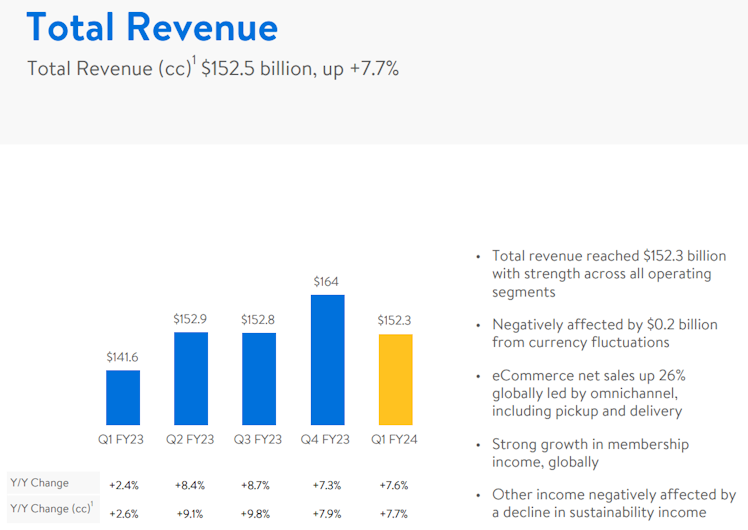

Revenue was US $152.3 billion, a year-on-year increase of 7.7%, higher than the market expectation of US $148.7 billion;

Adjusted earnings per share was 1.47 US dollars, a year-on-year increase of 13%, which was also higher than the expected 1.31 US dollars;

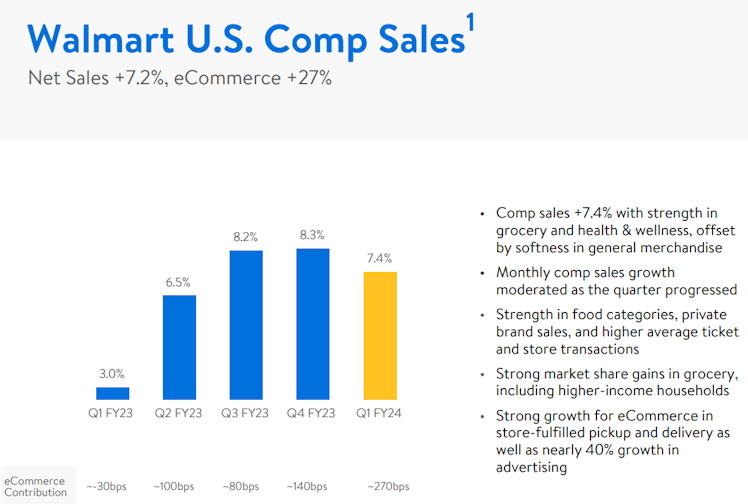

Comparable sales of Wal-Mart stores increased by 7.4% year-on-year, higher than the expected 5.23%; Comparable sales at the Sam Club, a high-end membership store, rose 7% from a year earlier, beating expectations of 6.8%.

At the same time, in terms of guidelines, the company expects Q2's revenue to increase by about 4%, which is the same as market expectations, but the comprehensive operating profit will decrease by about 2%, and the adjusted EPS is 1.63 to 1.68 US dollars, which is lower than the market expectation of 1.70 US dollars;

Interestingly, the company boldly raised its forecast for fiscal year 2024, and predicted that the annual revenue would increase by 3.5%, which was higher than the previous forecast of 2.5% to 3%. At the same time, the adjusted EPS was 6.10 to 6.20 US dollars, higher than the previous forecast of 5.90 to 6.05 US dollars and higher than the market expectation of 6.14 US dollars.

Raise expectations and bet against recession. Why is the market lack of confidence?

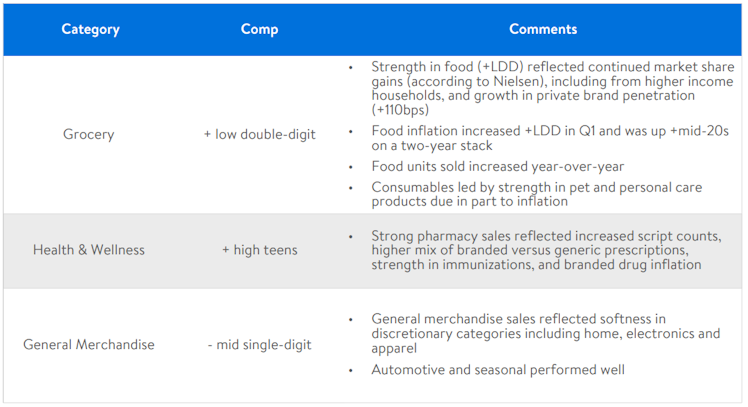

Consumers' action of shrinking clothes and dieting lowered their performance expectations for the remaining quarter of fiscal year 23.Q1 performed better than expected, with gross profit margins falling slightly by 0.1%, which the company also explained was due to consumer spending shifting more from non-essential general goods with higher profit margins to necessities such as groceries and health care products. And this is also $TGT Sales of food, beverages, household necessities and cosmetics are all strong, but the overall sales trend remains weak, as inflation is strong and consumers buy more necessities.

It's really too early to raise the forecast for 2024, and investors would rather believe it.At present, CPI is basically supported by highly viscous housing, so it also occupies a lot of people's expenses. At the same time, the excess savings accumulated during the epidemic period are being consumed step by step. At the current rate, it is expected that Q4 will be consumed in 2023, so there is no more foundation to support the strength of retail sales. If the Fed does not cut interest rates in due course, the current interest rate will continue to put more burden on households with higher loans. Under such circumstances, Wal-Mart directly raised its forecast for 2024, which is too optimistic.

However, compared with its peers, Wal-Mart's biggest advantage is that with the strong price positioning, its own brand and omni-channel support, grocery stores may still become the strongest business in the next few quarters.

Already have an account?