Trending Assets

Top investors this month

Trending Assets

Top investors this month

Redfin - Book Value Per Share Tutorial

Tutorial time! As stated yesterday, Book Value Per Share is the total value of a company’s assets minus the company’s liabilities, divided by the number of shares outstanding. Let's take a look at where to find and how to derive this for Redfin ($RDFN), a company I was discussing two days ago.

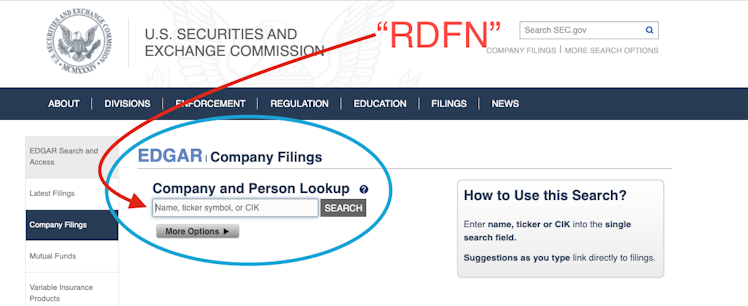

First off, you can find any company's financial documents at sec.gov

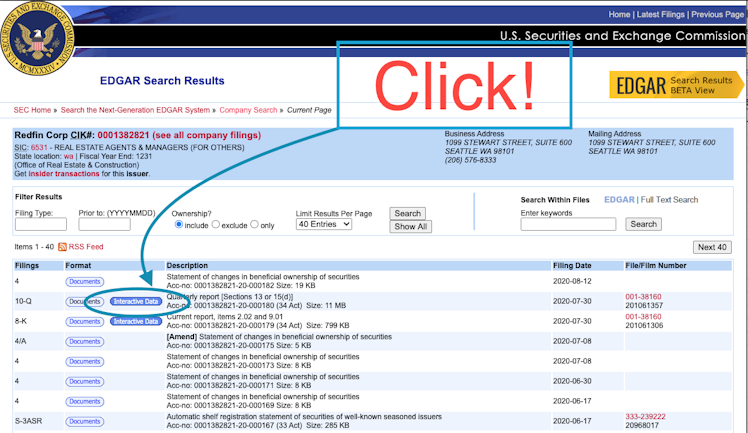

The most recent 10Q will work for us:

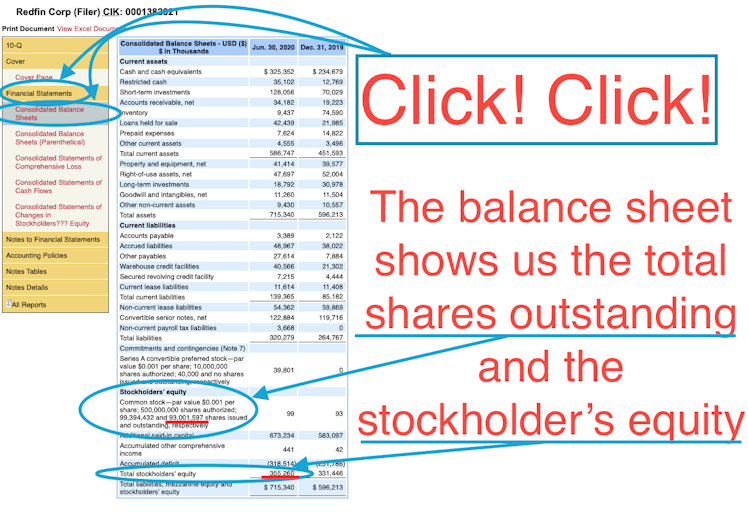

The balance sheet already gives us the stockholder's equity, so we don't need to do the calculation of assets - liabilities. That number is $355,260. We have to multiply this number by 1000 because the balance sheet states it in thousands.

It also shows us the total shares outstanding is 99,394,432.

So Redfin's book value per share is $3.57.

Hopefully this was a helpful way to get a little more acquainted with sec.gov and looking at financial statements.

www.sec.gov

SEC.gov | EDGAR Full Text Search

Already have an account?