Trending Assets

Top investors this month

Trending Assets

Top investors this month

Things Are Too Easy / Are We In A Bubble?

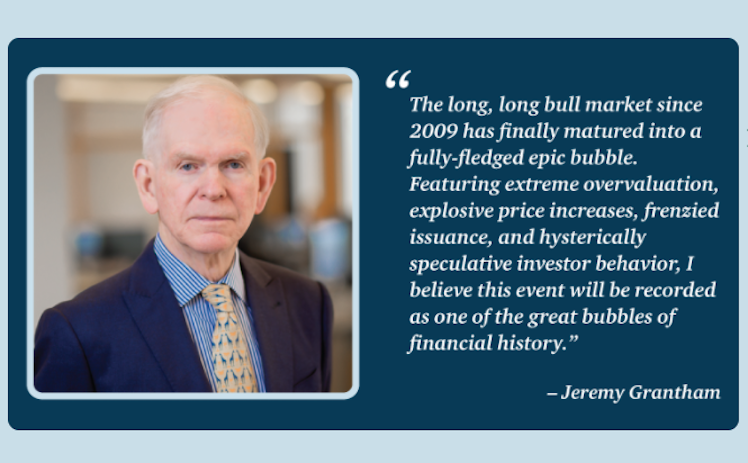

This piece titled "Waiting for the Last Dance" by Jeremy Grantham of GMO Partners is making the rounds, which makes the case that the market is now checking off all the emotional characteristics of a major bubble.

It's definitely worth a read, but here is a quick summary:

Grantham thinks that we are in the midst of one of the biggest financial bubbles in history, on par with the South Sea bubble of 1929 and the Dot Com crash of 2000.

The reasons he cites are:

- Most of the time major asset classes are reasonably priced relative to one another. But right now asset prices have moved far away from fair value.

- Bubbles are typically marked by crazy speculation. Grantham points to speculation in Hertz, Kodak, Nikola, and Tesla as current examples.

- Grantham observes that at Tesla's current market cap- now over $800 billion, amounts to over $1.25 million per car sold each year versus $9,000 per car for GM.

- The "Buffett indicator" which is total stock market capitalization to GDP broke through its all-time high 2000 record.

- In 2020 there were 480 IPOs, including an incredible 248 SPACs, which is more new listings than the 406 in 2000.

- There are more than 150 non-micro-cap companies (that is, companies with a market capitalization of over $250 million) that have more than tripled in the year, which is over 3 times as many as any year in the previous decade.

Personally, while I think it prudent to be prepared for a crash in equity prices, the bullet points above feel like they could use a lot more discussion. It feels as though Grantham's main point is "things have run up a lot, and eventually there has to be a correction."

To which @sraone aptly pointed out: "More money has been lost anticipating a Market Correction than the Market Correction itself"

But I do think Grantham makes a good point regarding the catalyst for a downturn, namely, once the Covid vaccine is rolled out, the most pressing issue facing the world economy will have been solved. Market participants will breath a sigh of relief, then look around and realize that the economy is still in poor shape, stimulus will shortly be cut back with the end of the Covid crisis, and valuations are still sky-high.

Grantham's solution is to move to Value and Emerging Market stocks.

www.gmo.com

Waiting for the Last Dance

The long bull market since 2009 has matured into an epic bubble, featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior.

Already have an account?