Trending Assets

Top investors this month

Trending Assets

Top investors this month

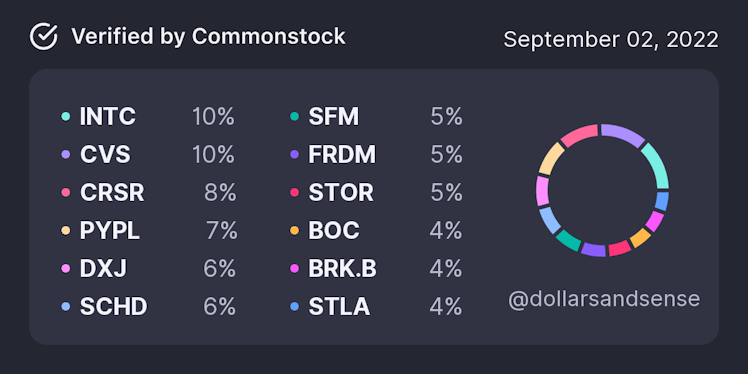

Portfolio Update, August

Finally got a chance to sell out of $BBBY at a modest gain. Other than that added to $INTC, $DXJ, and a new position in $SLV

0.5) $BBBY, Using the meme craziness as exit liquidity seems to be a solid strategy.

1.) $INTC: After contemplating earnings for a while and seeing the relative weakness across the semiconductor space, I decided to add to Intel again. I am still confident that their plan to regain leadership in the semis space will mostly play out and I get to collect a more significant dividend while I wait.

2.) $DXJ, Already one of the best-performing holdings this year I continue to add to this fund in particular. One of the reasons why is the currency hedging strategy WisdomTree employs to protect against the large movements in FX. Also a big dividend payer despite being made of larger Japanese companies.

3.) $SLV, The newest addition to my portfolio is direct exposure to Silver. I have contemplated getting exposure in various forms but ultimately decided I like the value prop of this fund. I think there are plenty of reasons to like silver from its industrial uses to its use as a hedge against falling interest rates. I would ideally like to get exposure to Gold as well. The current candidate is a small mining company in Canada that I think looks solid.

Overall I continue to believe having a portfolio of high cash flow companies will prove to win going into the end of the year. This is pretty common across my entire portfolio from $CVS to $PYPL and the funds $SCHD and $DXJ. That said I do want to use the next few months to significantly increase my holdings in $BOC, $SLV, and a new position I am working on, all companies with questionable cash flows, ironic.

Other than that very pleased with portfolio performance in the 1 Year and YTD.

1M: -1.5%

YTD: -3.9%

1Y: -4.5%

Already have an account?