Trending Assets

Top investors this month

Trending Assets

Top investors this month

$MPW An Overlooked Hospital REIT

One overlooked sector that has also been getting killed this year is REITs. The Real Estate companies saw a brief resurgence in relevance with inflation fears pushing some investors into "real assets." Today I want to look at a REIT that has 25% YTD and figure out if it's worth digging further into.

Medical Properties Trust or $MPW is a Real Estate Trust formed in 2003 mostly to acquire and in some cases develop Net-Leased Hospitals.

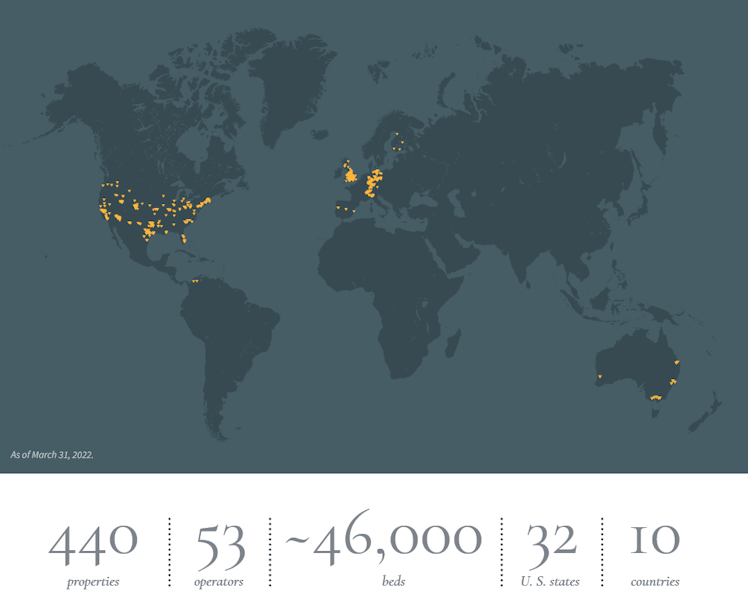

As you can see it owns quite a bit even with its short history. Closing in on 50k beds around the world across three continents. About as diversified as it gets.

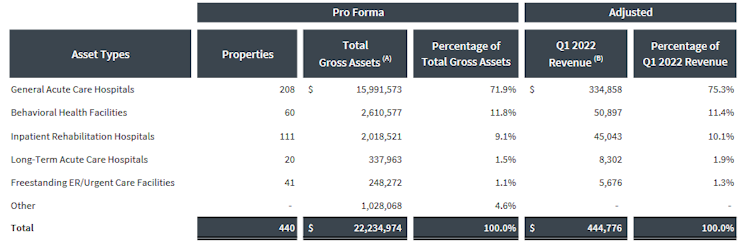

From the full breakdown of $MPWS portfolio, it does appear to be mostly hospitals and other miscellaneous healthcare facilities as well.

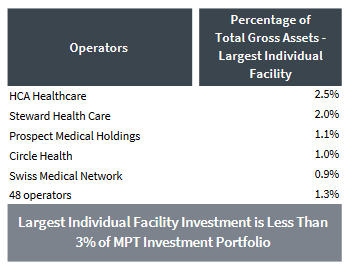

It's also important to see a diversification of assets. In case for some reason, a hospital was to close down it better not be a large portion of the portfolio. $MPW addressed this by showing their largest single facility accounted for less than 3% of the company's total portfolio.

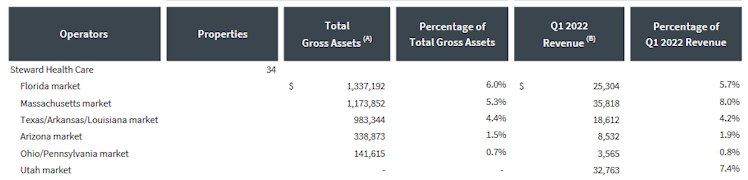

The total breakdown of all assets and revenue sources is interesting.

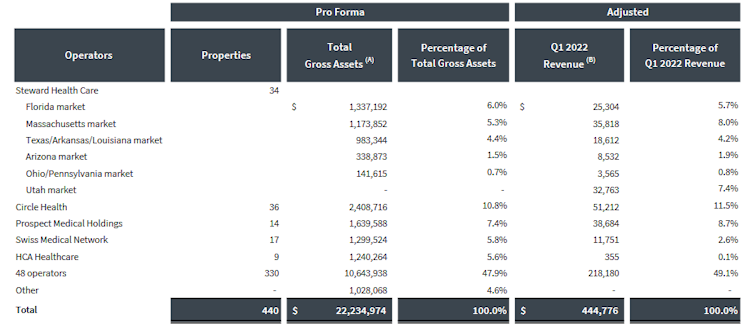

Steward is by far $MPWS largest holding accounting for 17.9% of the company's total assets and 28% of their total revenue. Not great to see, however....

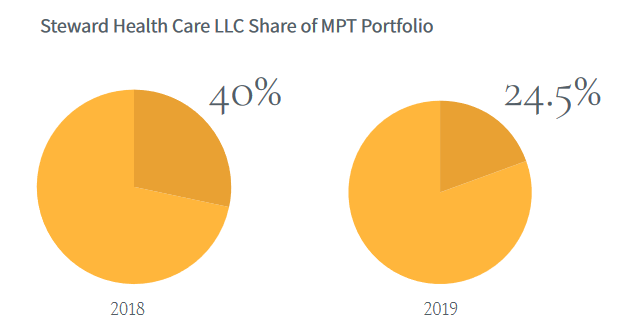

This graph from their 2019 annual report shows the share of total assets and revenue has shrunk dramatically.

$MPW is increasingly diversifying revenue both across individual properties and geographies.

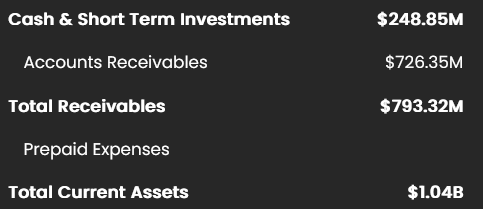

In terms of financials the company has quite a bit of current assets, some in cash, mostly in receivables.

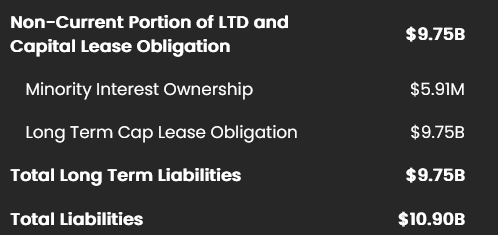

Naturally, 90% of $MPWS total debt is long-term capital leases on building with the current debt being lease payments and other general expenses.

$MPW is an interesting REIT, to say the least. Owning hospitals across the globe and committed to the expansion and further asset diversification. The only big worry for me is the overreliance on Steward Health as it accounts for nearly 30% of their total revenue.

Otherwise, I think $MPW is a strong REIT with a dividend yield clocking in at an impressive 6.4% and it may even offer some inflation protection. It's a company I have had my eye on for a while and may just get into if the price continues to fall.

Already have an account?