Trending Assets

Top investors this month

Trending Assets

Top investors this month

3 Reasons to own $RICK

On my ninth day of my "3 reasons to own" series, we have something spicy. RCI Hospitality holdings aka RICK is a serial acquirer and operator of gentleman clubs/strip clubs and an operator of a sports bar chain.

1st reason: The core business of nightclubs is a highly fragmented industry where RICK owns just 2.5% of the market. The company has 500 clubs that meet its M&A criteria(more on that later) in their sights. New nightclubs are rare because most cities don't give out new licenses anymore, so it's a game of consolidation for the existing clubs. This gives them a deep moat.

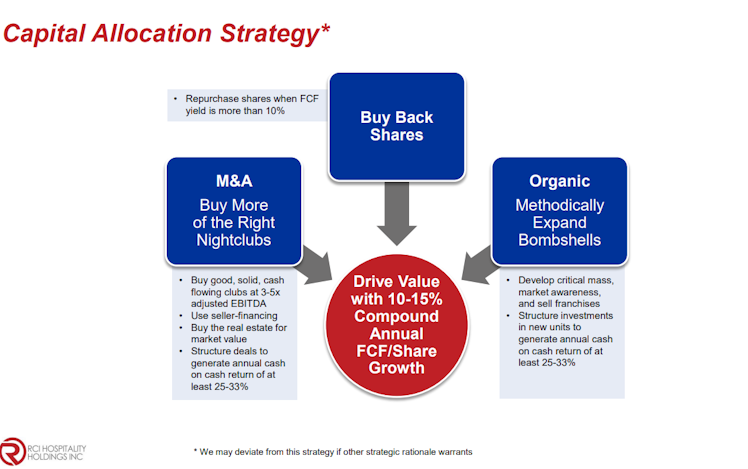

2nd reason: In 2016 the CEO read "The Outsider CEOs" by William Thorndike and established a great capital allocation strategy with the company. The focus switched from the revenue maximization focus to FCF/share focus. The strategy includes M&A of high-quality nightclubs at 3-5x EBITDA depending on the quality of the business, organic growth through expansion of their bombshell sports bar concept through company-operated and franchisee locations and opportunistically buying back shares at a FCF yield of 10% or higher.

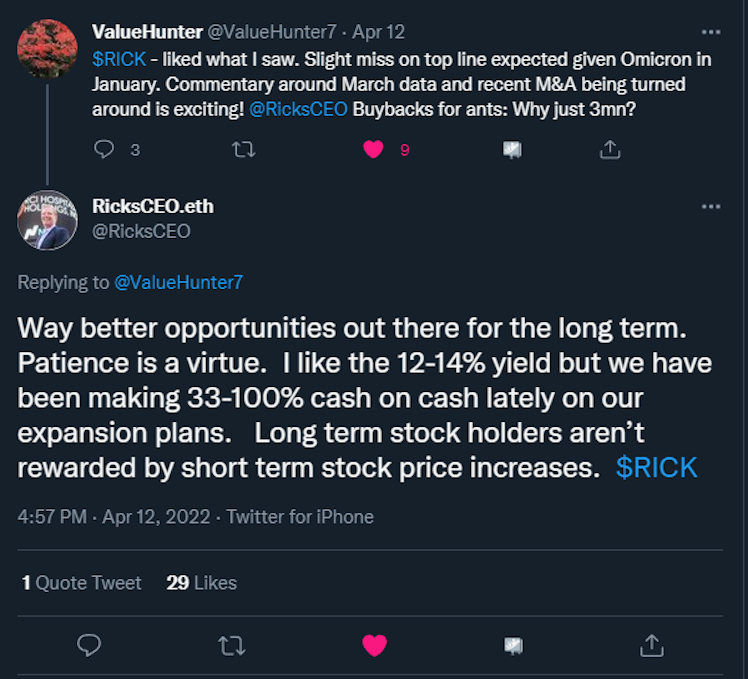

Recently the CEO made a comment about the very small buybacks, even though they are currently around 12-14% FCF yield. They are able to get 33-100% cash on cash returns on deals lately, so buybacks at a 12-14% yield don't seem that lucrative.

3rd reason: RICK has a very high margin profile, generating an 84% gross margin, 32% EBITDA margin and a 13% FCF margin. The company also has great cost controls. Even in the lockdown quarters they managed to stay at a minimal positive Free Cash Flow.

I hope you enjoyed this post, tomorrow I'll be back with $MELI

Already have an account?