Trending Assets

Top investors this month

Trending Assets

Top investors this month

iShares Core S&P Small-Cap ETF $IJR

This an interesting blog post about Small Cap strength Vs Large Caps in a rising interest rate environment. (Link at bottom)

I've been looking to utilise ETFs in my Investment Portfolios.

TL;DR

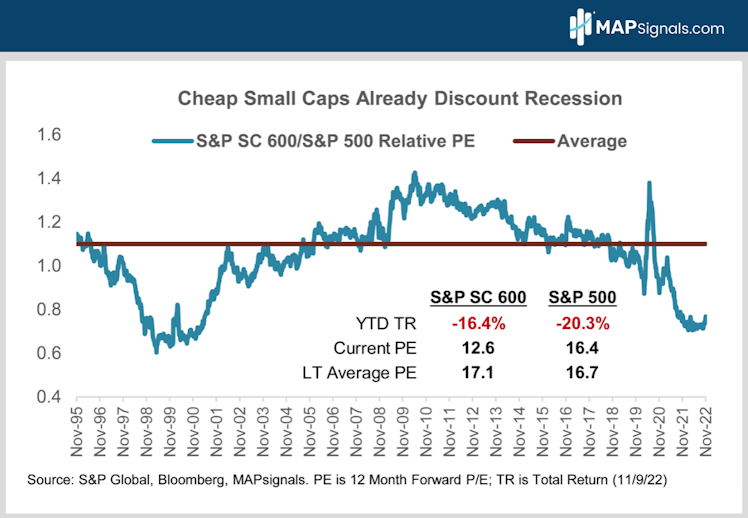

Cheap valuation compared to SP500

- SP600 Small Cap: 12-month forward earnings of 12.6x Vs Long-term average of 17.1x

- Discount of 23% against SP500 current 12 month valuation of 16.4X

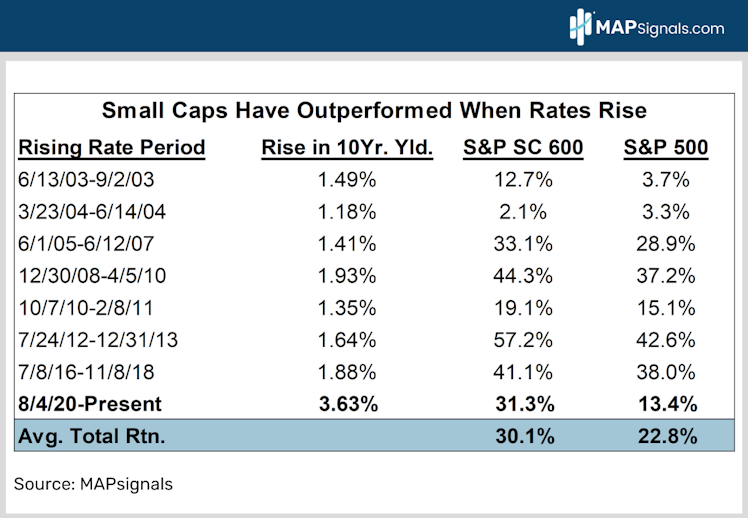

Less sensitive to rising interest rates

- Small caps historically outperformed large caps when rates rise. Held true during this cycle.

- 31% gain for small caps Vs 13% for Large Caps

Less sensitive to dollar strength

- $ Strength hits large caps as they derive 40% of sales from overseas Vs 21% for Small Caps

How to play

Excerpt from the blog;

- The S&P 600 index is a higher-quality slice of the small-cap universe because it requires its constituents to be profitable. 30% of Russell 2000 constituents lose money. That makes IJR a better choice if we hit a recession and/or rates keep climbing. Money-losing companies rely heavily on debt to stay afloat, leaving them vulnerable as the economy cools or the cost of capital rises.

Already have an account?