Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - rotation

Yesterday I play golf down in Florida with a good friend who has a retirement place here. We were joined by two other transplants, one who came down to work here 20 years ago, and another who came here during Covid.

This was a microcosm of the rotation we have seen around our country, some of it the seasonal - snowbirds retiring somewhere warm - other secular - people moving where the jobs are strong - and still other cyclical - Covid.

We can expect those relative waves to ebb and flow at different paces but for now, they were all benefiting Florida, & there are few signs of an imminent recession here.

The markets also go thru this rotation - cyclical, secular & seasonal. In January with risk appetites higher, we tend to see this even stronger. With all of the data the last 2 wks, it is very interesting to watch.

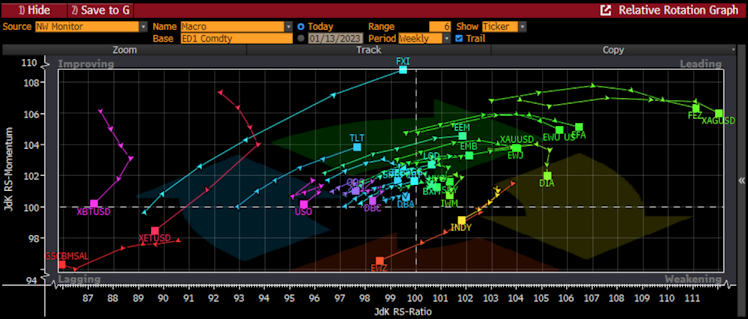

To see this in pictures I use the relative rotation graph & compare to cash. This is my macro dashboard so I can see assets around the world & what is moving relative to what & relative to cash in people's account, finally earning some money.

The upper left of improving assets and the bottom right of weakening are where the money is to be made because these are the early moves. However, you can see now they are empty because the moves have been in place.

The leaders the last month are old school - silver & gold, and rest of world assets like Europe, EMEA, UK, Japan, even Emerging Mkts. These assets have been leading the pack the last 6 weeks & aren't slowing down.

The laggards in the lower right are mainly the GS short interest basket meaning HF putting short risk back on in their favorite names. Bitcoin & Ether dropped here too given the news but I noticed the moves just yesterday with the FTX news so this bears more watching.

This is a very risk-on tone, not led by the US, but led by the assets that have lagged for several years. It is led by rest of world stocks that have lagged the US for 10 yrs and where many people would say there is no reason to invest. That is sometimes reason enough.

We need to dig more to know what of this is seasonal (short interest), cyclical (likely metals) or secular (I think ROW assets are set to do well the next several years). I plan to do just that but those those are my gut.

It is important to listen to the stories around you as you can learn a lot. I learned a lot playing golf yesterday. We can learn a lot by listening to the mkt story & ignoring the social media noise.

Stay Vigilant

#markets #investing #rotation #assetallocation

Already have an account?