Trending Assets

Top investors this month

Trending Assets

Top investors this month

A Short Story

Despite having been friendly with many short sellers, I had never actually shorted a stock myself.

I wanted this to change.

2022 had been such down year and there were plenty of actionable short ideas. My curiosity needed quenching.

Some people are against short selling (betting a stock will go down)— which I can respect. They see it as 'profiting off of failure.'

However, short sellers keep the market honest. They offer a counter-balance to euphoria— providing a mechanism for unchecked bullish mayhem.

And if a short is wrong, you can lose MORE than 100% of your money.

Seems like a short seller will lose his shirt long before you need to shame him.

But be warned, you who thinks of short selling— there are risks abound. Do not try this unless you understand what you are doing. Even if you understand, shorting is not a tool that most people should be using.

So with the risks in mind, I scanned the horizon for a short opportunity to jump out at me.

One did on November 29th, 2022.

China had announced the end of Covid-lock downs and many Chinese stocks were pumping.

In particular, $NIO the Chinese electric car manufacturer, was up 5% on the day because of the news.

I knew:

- Nio was losing money, and only had enough cash to survive a couple more years

- Gross profit margin was decreasing

- The delivery forecast in Nov. 2022 was the best piece of news that had come out in a while from Nio. But I didn't trust that they could hit their numbers.

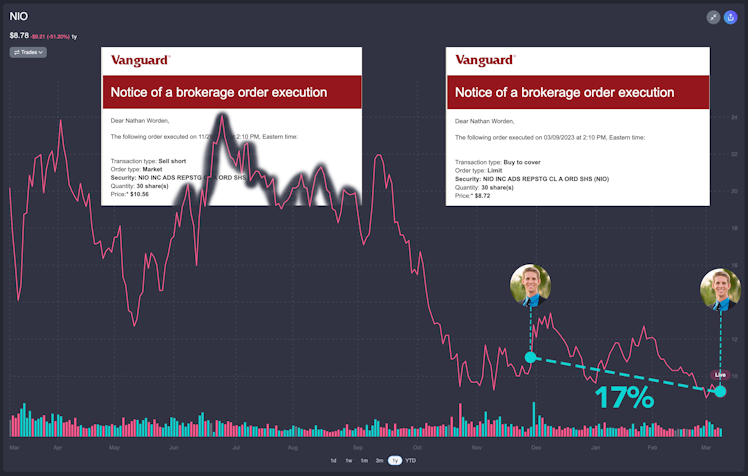

So I borrowed the stock and sold it for $10.56 a share.

What happened next?

$NIO proceeded to go UP 30%, as the market got even MORE excited about the end of Covid lockdowns.

Since this was a speculative trade, it probably would have been wise to have a mental stop-loss. Say, sell when the stock moves 10% against me. But nothing had changed other than the news about China. Once the news died down, shouldn't this stock come back down too?

Yes. It did.

The news blew over, Nio revised their delivery estimates down and the stock plummeted.

It was a wild ride, but today Nio closed 17% lower than when I shorted it.

So I bought the stock at $8.72 (which was 17% less than when I sold them for $10.56 in November) and returned the shares I had borrowed, keeping the 17% spread.

Lessons learned

- Things can immediately go bad to begin with. This doesn't mean your busted, but the risk is elevated immediately. Shorting isn't low stress.

- Accept delays in your thesis, but only to a certain point.

- Shorting is a tool. It's not good or bad, just something you can use in certain situations. These situations often tend to be more speculative in nature.

Have you ever shorted a stock? What happened?

Are you looking at shorting anything now?

Already have an account?