Trending Assets

Top investors this month

Trending Assets

Top investors this month

Archer Daniels Midland - We have a New King 👑

Following the Q4.2022 report published last Thursday, $ADM announced a +12.5% dividend increase, making it 50 years of consecutive dividend increases. As a result, this +100-year-old company is now in the same category of stocks as $KO, $PG, or $JNJ, to name a few.

Here is my take on this $46B business after it close FY 2022 👇

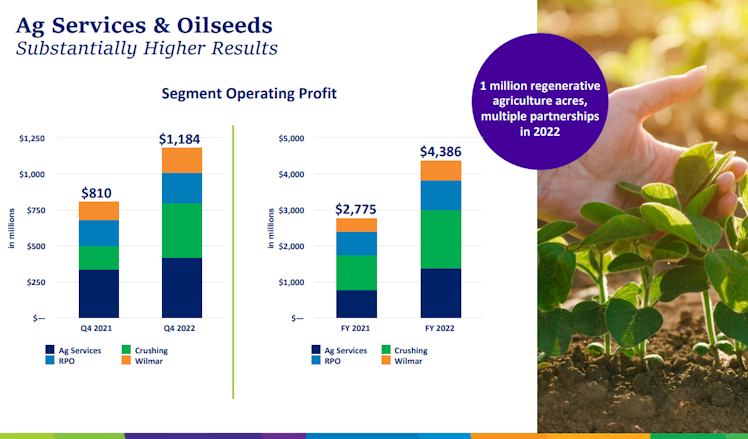

$ADM operates under four different units, and all of them stamped a Y/Y increase in profits, with the biggest result on the Ag Services & Oilseed, that is accounted for more than 65% of the total company profits.

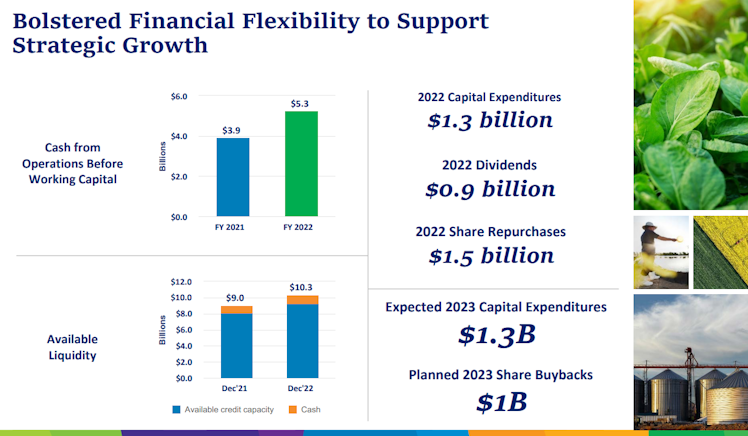

The actual environment is for sure helping $ADM to produce such performance, but we also need to congratulate the management for being able to keep Capex at the same 2021 level; such a combination brings the result of much more cash available to reward shareholders, which mean $1.5B buyback program already executed and a great dividend hike for such a mature business.

Happy to see that also, for 2023, the goal is to keep Capex at the same level and also plan an additional $1B buyback.

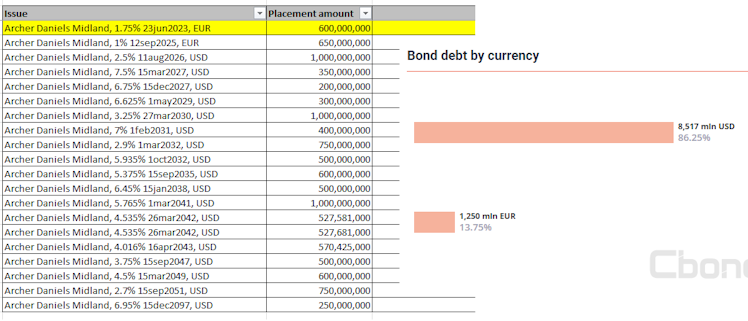

With such a level of cash and no big debt dealing on the horizon, I think shareholders can sleep quietly for all of 2023 and even more.

The screenshot (eye punching, I know) below shows that only one bond of 600M EURO expires in 2023, and the next one is in 2025.

The company also holds an A/stable rating according to S&P Global and an A2/stable or Moody's.

I published a Video about the Q4.2022 report of $ADM yesterday, so if you want more details, you can check it out. 👇

YouTube

Breaking Down ADM Q4 2022 Earning Report - A new Dividend King

Hello fellow investors 👋Here are my takes on the ADM Archer-Daniels-Midland $ADM Earning Report Q4.2022Websites I used in this video:🔸KoyFin - https://www....

Already have an account?