Trending Assets

Top investors this month

Trending Assets

Top investors this month

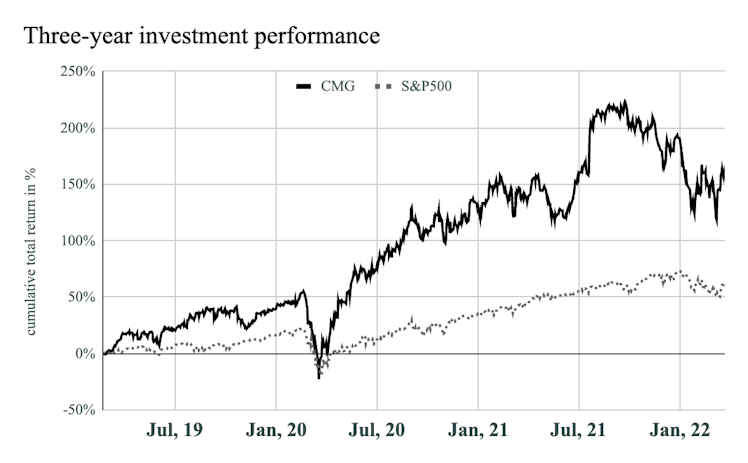

Chipotle Mexican Grill, Inc. (NYSE: CMG), valuation on March 23, 2022

Last week, I asked the community to nominate and vote on a company for me to value. Conor Mac (@eggplant) nominated Chipotle ($CMG) and it got the most upvotes. You can see the post here.

•••

Summary

- Stock: Chipotle Mexican Grill, Inc. (NYSE: CMG) common equity

- Market cap: $43.0bn

- Rating: Reduce

- Price: $1,590

- Target: $1,192

source: S&P Capital IQ

•••

Setting the stage

Chipotle Mexican Grill, Inc. (NYSE: CMG) owns and operates fast-casual Mexican restaurants. The company makes money in two ways: First, they sell burritos, burrito bowls (a burrito without the tortilla), quesadillas, tacos, salads, and drinks. Second, if the customer wants their order delivered, the company charges them a fee for either handling or outsourcing the delivery to a third party. The company started in Denver, Colorado, in 1993 and now has 2,918 U.S., 44 international, and four non-Chipotle restaurants.

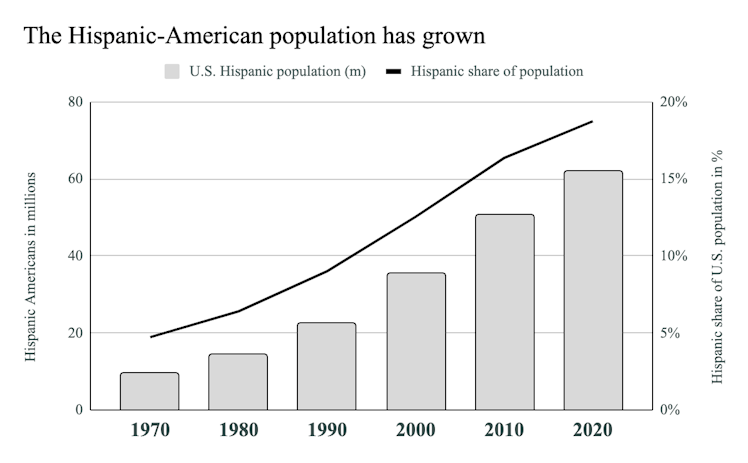

Over the last few decades, demand for Mexican food in the U.S. has exploded. Mexican food is now the most popular ethnicity of food in the 27 South-Western-most states, while Chinese is the most popular in the 22 to the North-East, and Thai is the most popular in Alaska. Migration and changing consumer tastes drove these trends. Hispanic migration to the U.S., especially the South West, grew significantly from 1970 to 2020. The most significant proportion of new arrivals were from Mexico. According to The Pew Research Center, the Hispanic-American population grew by 2.3% per year, going from 9.6m in 1970 to 62.1m in 2020. This rate was much faster than for the total population, which grew at just 0.8% per year. Hispanic-Americans are now 19% of the total population. These expats introduced new tastes, techniques, and food cultures to the places they moved, and demand took off.

sources: The Department of Homeland Security, The Pew Research Center

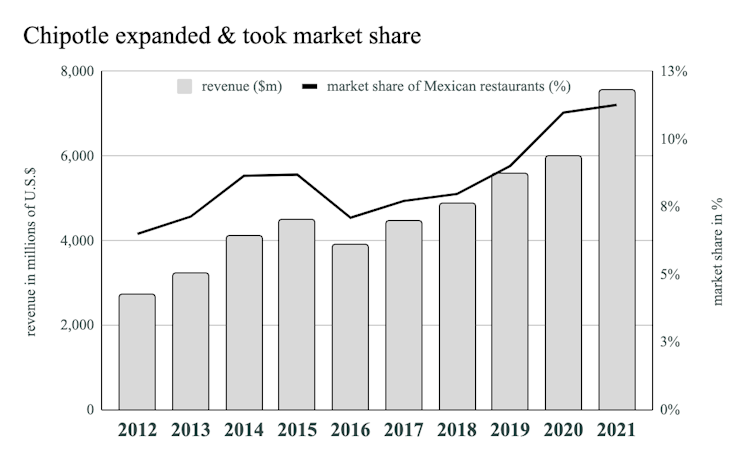

Rising demand made way for increased supply, and new Mexican restaurants opened. Over the last decade, the number of these restaurants in the U.S. has grown at 2.5% per year, going from 38k in 2012 to 47.5k in 2021. Moreover, people are eating and spending more at these restaurants. In 2012, the Mexican restaurant sector turned over $42bn. In 2021, it did $67bn. Chipotle rode this wave by expanding aggressively to grow and take market share. In 2012, the company brought in $2.7bn in revenues giving them 6.5% of the market. In 2021, they brought in almost 3x that, $7.5bn, and had 11.3% of the market.

sources: company financials, Statista

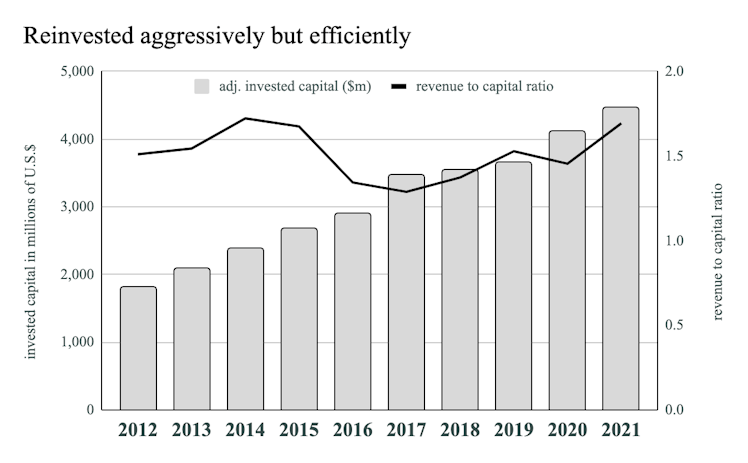

This growth came from the company opening new restaurants, attracting more customers, and raising prices. From 2012 to 2021, the company opened 1,556 new restaurants on a net basis, while revenue per restaurant increased from $1.9m to $2.5m. However, growth isn’t free, and new restaurants require capital investment. In 2012, the total amount of operational capital invested in the business was $1.8bn, or $1.3m per restaurant. In the decade since, the company has ploughed $2.65bn net of depreciation, or $1.7m per new restaurant, back into growing the business. This reinvestment was aggressive and efficient. New restaurants didn’t cannibalise sales from existing ones, and the company’s revenue to capital ratio averaged 1.5x.

Adjusted invested capital includes capitalised leasehold commitments. source: company financials

It hasn’t been all smooth sailing for the burrito chain, though. Salmonella, norovirus, Clostridium perfringens and E. coli outbreaks between 2015 and 2018 destroyed the company’s profitability and reputation for fresh, sustainable, and healthy fast food. After eating at Chipotle, more than 1,100 people got sick over those four years. The Justice Department charged the company with violating federal law by adultering food and fined them $25m. In 2016, following the 2015 E. coli outbreak that closed their 43 Oregon and Washington restaurants, the company hired a new head of food safety and upgraded its food safety program. Changes included having all employees wash their hands every half hour, having two employees verify food sterilisation instead of one, and using pressure to pre-treat ingredients.

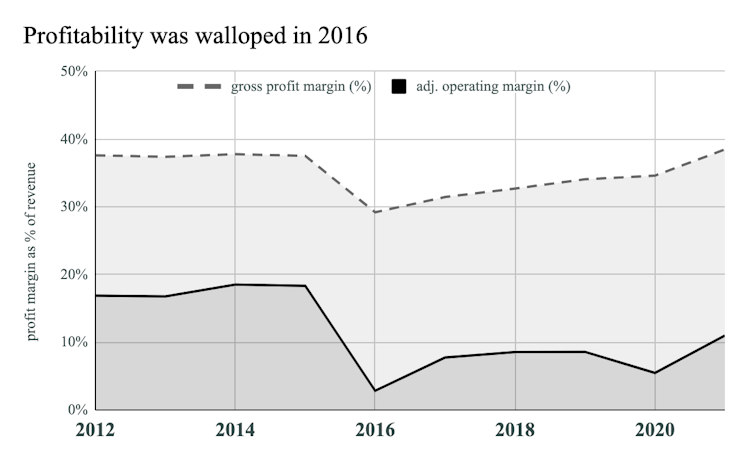

Adjusted operating margin includes the effect of capitalising leasehold commitments. source: company financials

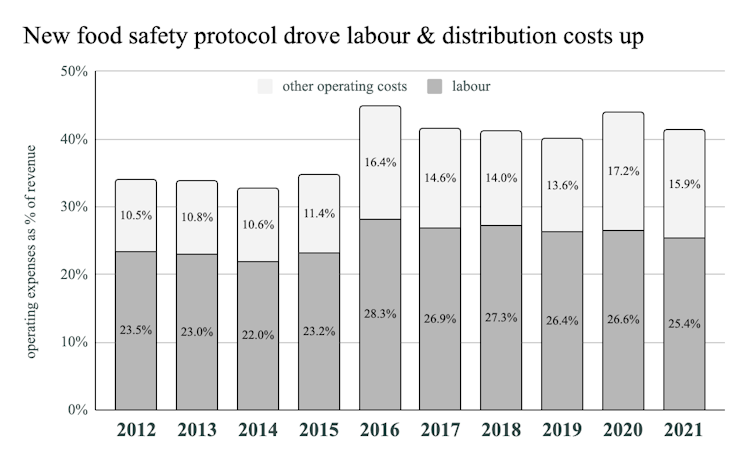

These health scandals meant the company wasted lots of food, driving the cost of goods up. But the most significant increases were in labour and distribution spending to support the new safety processes and marketing to bring customers back. In the four years leading up to the 2016 scandal, the company spent an average of 23% of revenue on labour and 11% on other operating expenses, including distribution and marketing (1%). These expenses have averaged 27%, 15%, and 3% in the years since.

source: company financials

Chipotle has put these scandals behind them, improved food safety, and won back customer trust. The company’s gross profit margin, which fell from 38% in 2015 to 29% in 2016, has steadily crept back to its pre-scandal level and is in line with its six largest listed peers (McDonald’s Corporation, Starbucks Corporation, Yum! Brands Inc., Domino’s Pizza Inc., Restaurant Brands International Inc, and The Wendy’s Company), but better than 70% of all listed U.S. restaurant businesses.

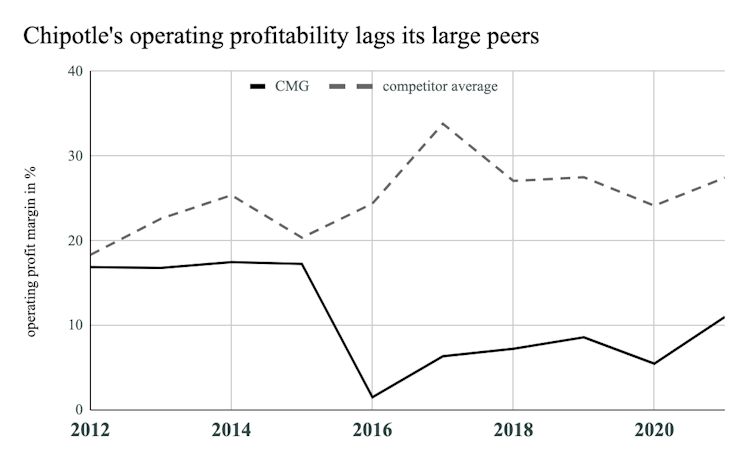

Paying for the food safety program has meant that Chipotle’s operating margins, although they’re in the industry’s top quartile, are still below pre-scandal levels. In 2015 they were 17%, but in 2021, despite recovering from their 2016 low of 2%, they have only recovered to 12% and are far below the average of their large peer set. The difference between the company’s margins and its peers’ margins was 3% before the scandal. Since then, the gap averaged 21% but shrank to 16% in 2021.

source: S&P Capital IQ

This difference is caused by increased costs and by the owner-operator model. Of the 50 largest fast-food businesses in the U.S., Chipotle and In-N-Out Burger are the only ones with no franchise model at all. All the others are predominantly franchised. For example, Taco Bell, often considered Chipotle’s biggest rival, has 93% of restaurants run by franchisees. As a result, when costs go up, the Taco Bell restaurant franchisee bears the cost while the parent company, Yum! Brands Inc., continues to collect royalties. On the other hand, Chipotle has to eat all the costs itself. Operating a restaurant is a dramatically different business model to rent and royalty collection.

•••

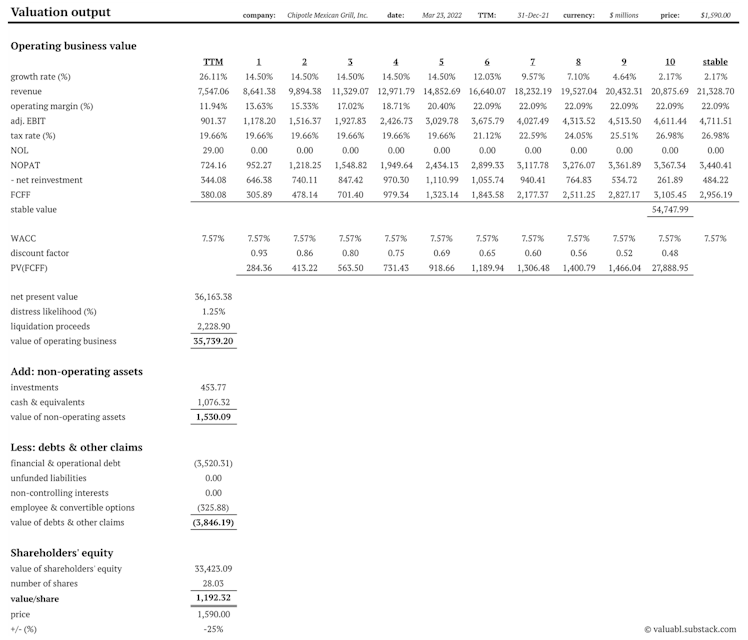

Story & valuation

Chipotle Mexican Grill, Inc. is a U.S.-focused Mexican fast-casual restaurant owner and operator. Analysts expect the domestic market for Mexican restaurants to grow at 6.7% per year, while Chipotle will expand its market share by opening new restaurants; they’re targetting 250 next year. Improved scale and a focus on operational efficiency within the restaurants and through distribution will help contain costs. However, inflationary pressures will build, and Chipotle will have to continue raising prices. The scale and pricing power will power margins up to the top decline of the industry, but they will never be as high as the big franchisers.

Growth: Economists forecast the U.S. Mexican restaurant market to grow from $67bn in 2021 to $93bn by 2026. Management expects to open between 235 and 250 additional restaurants next year, an increase of 8.5%. The attractiveness of the Chipotle brand and the quality of the product will help them continue raising prices at or above the inflation rate. By adding new sites, improving operational efficiency to service more customers per site, and growing digital sales, the company will be able to expand its market share from 11% to 16%. I forecast the company to grow at 14.5% per year and almost double its revenue to $14.8bn by 2026.

Margins: As the business grows, the increased scale will reduce the relative size of their fixed costs. Labour and distribution costs will decline relative to revenues. Moreover, by not franchising, the company will maintain control of the brand and quality. As they distance themselves further from the food-safety scandals of the past, the company will be able to maintain pricing power and reduce the amount it spends on marketing. By not franchising, they capture all the profitability, but margins will remain tethered to the operator’s model, and margins will never hit the heights of the big franchisers. I forecast operating margins to climb to 22.1%, putting them in the top decline of U.S. restaurant businesses.

Reinvestment & taxes: The company produces $1.69 per dollar of capital invested in operations. I expect they will maintain this capital efficiency as they expand. The management has a history of selecting appropriate locations for new restaurants, and the economics of opening new sites will not change dramatically. Further, the rise of digital ordering and delivery will add sales without consuming large amounts of capital. I forecast that Chipotle will need to reinvest $4.3bn into growth assets over the next five years. I also model the company’s tax rate rising from the current effective rate to the geographically weighted underlying marginal corporate rate of almost 27%. It also has $29m of net operating loss tax assets that will act as a small tax shield.

Free cash flows: The company will remain FCF generative and not need to raise capital.

Cost of capital: The company is a restaurant operator that has more operational leverage (0.45x) than most in the industry due to not franchising. The company generates 98.5% of its revenue in the U.S. and the remaining 1.5% overseas, exposing it to some additional, though tiny, country risk. Based on the company’s interest coverage ratio after capitalising leaseholds and imputing the interest expense, I have assigned an A2/A credit rating and the corresponding 1.3% cumulative chance of distress within 10 years. I estimate the company’s cost of equity is currently 7.93%, its after-tax cost of debt is 2.48%, and market debt-to-equity ratio is 7% giving it a WACC of 7.57%.

Add non-operating assets: The company has $1bn in cash and equivalents. It also has investments I value at $454m.

Less debts & other claims: The company owes $3.5bn to landlords, and there are 364k stock-only stock appreciation rights, which I have valued as options, outstanding.

source: Valuabl

Each share has an intrinsic value of $1,192 and at the current price of $1,590 the investment has a 25% downside.

•••

Sensitivity analysis & rating

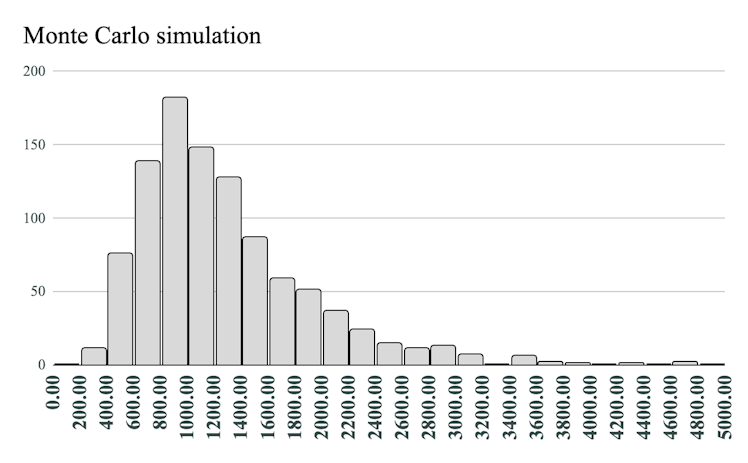

Monte-Carlo Simulation is used to model uncertainty by assuming that the inputs to the valuation model will come from probability distributions around the estimates.

source: Valuabl

Buy •••••• 10th: $626

Add •••••• 30th: $891

Hold ••••• 50th: $1,121

Reduce ••• 70th: $1,442

Sell •••••• 90th: $2,105

The current price of Chipotle Mexican Grill, Inc. (NYSE: CMG) common equity is $1,590 and is at the 77th percentile of the Monte Carlo sample of intrinsic values. For this reason, it has a rating of Reduce. The shares are slightly overvalued. I do not already own these shares, but if I did I would be trimming my position.

Already have an account?