Trending Assets

Top investors this month

Trending Assets

Top investors this month

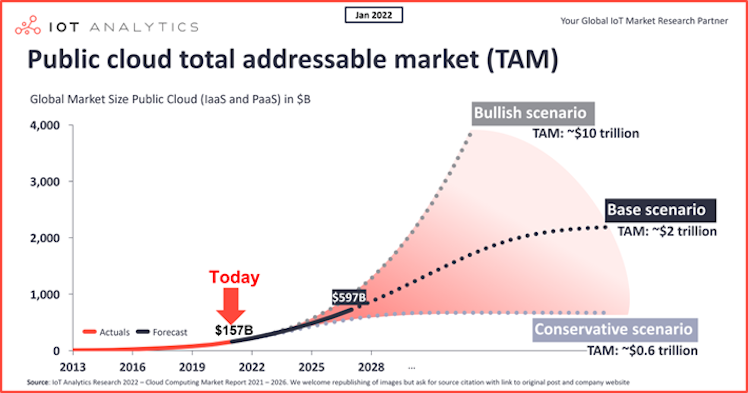

While macro slowdowns have been a concern for many companies, cloud spending appears to be unaffected as $MSFT, $AMZN, and $GOOG all released stellar cloud results. @analyticsiot estimated TAM is enormous and we are still in the early stages.

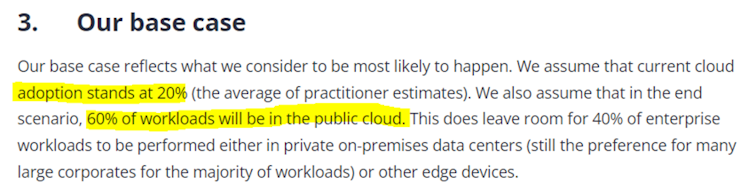

The three major cloud companies combined had >$40 bn in revenue and were all growing at >25% YoY. The runway is huge as @analyticsiot estimates only 20% of workloads happen in the cloud. The continued adoption will be a huge tailwind for the cloud.

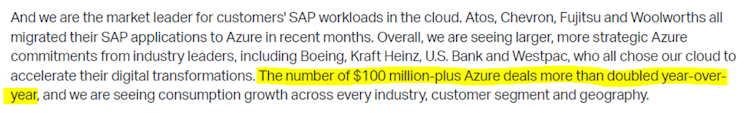

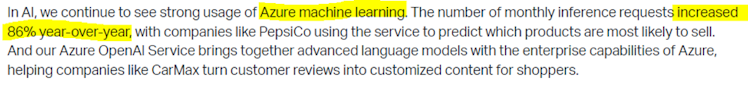

$MSFT revenue in intelligent cloud equaled 19.1bn and increased 29% in CC while total cloud spend equaled over $23bn in revenue. They have doubled $100 million dollar plus customers and are seeing lots of growth in machine learning now that companies have their data in the cloud.

$AMZN AWS had $18.4bn in revenue which was up 37% YoY. AWS now has an impressive $74bn run rate. They are continuing to invest heavily in the infrastructure of the cloud as they expect demand to increase and need to be able to support the future demand.

$GOOG cloud is still a major player, but a distant third. They had 5.8bn in revenue which was up 44% YoY. They are investing heavily into different products on their platform including, cybersecurity and data warehousing.

These cloud figures give me cautious optimism for $SNOW earnings report on May 25th. However, harsh market reactions to high-growth companies that miss estimates should be considered as well.

Link to IOT Analytics article https://iot-analytics.com/cloud-market/

IoT Analytics

The case for a $2 trillion addressable public cloud market

The global public cloud market (hyperscaler IaaS and PaaS) reached $157 billion in 2021, according to our recently released Cloud Computing Market Report 2021–2026. The cloud market is dominated by

Already have an account?