Trending Assets

Top investors this month

Trending Assets

Top investors this month

Investment idea | Industrias Bachoco

Originally published in Valuabl on February 3rd, 2023.

•••

Thesis

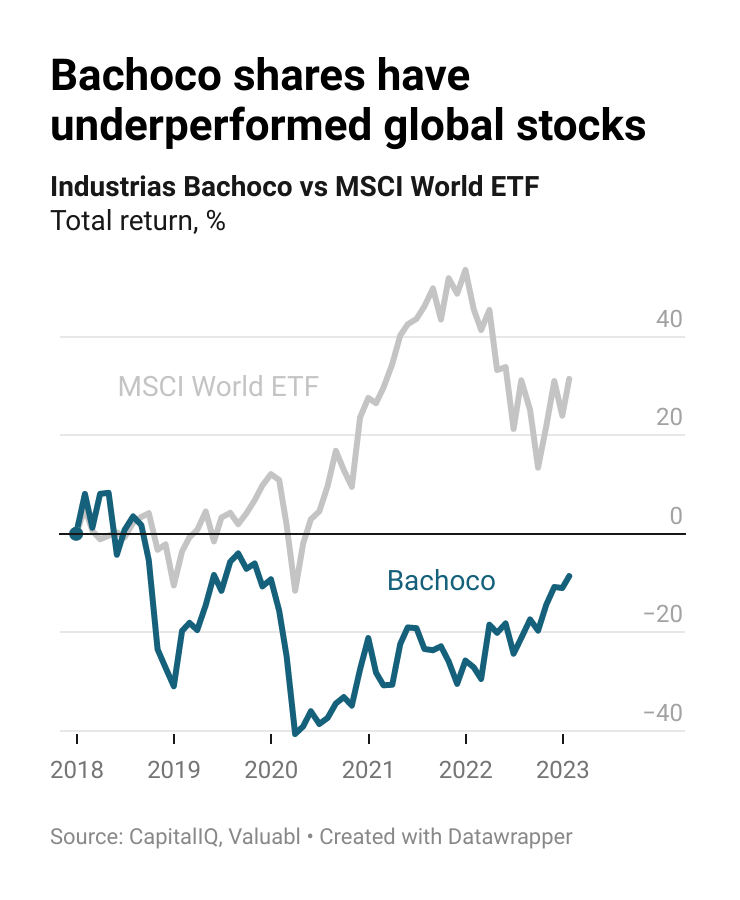

> Mexico’s biggest poultry producer is expanding into new markets, including pork production. The spread of avian flu and a trade spat over corn between Mexican and American lawmakers threaten to hurt the business in the short term. Still, the firm’s economies of scale and efficient operations will help them serve the growing demand for chicken. I rate the shares a Buy as they offer an 89% upside, 16% IRR, and have over half the market capitalisation in cash.

Summary

- Company name: Industrias Bachoco

- Ticker: BMV: BACHOCOB

- 52-week range: Ps65-88

- Market cap: Ps49bn

- Price: Ps82

- Target: Ps145–163

- Upside: +89%

- Recommendation: Buy

I) Story

Business model

Industrias Bachoco (Bachoco) is a vertically integrated Mexican chicken and pig company. The firm owns and manages 1,212 farms, 22 hatcheries, 23 feed mills, 20 processing plants, and 80 distribution centres across Mexico and the US. Bachoco is the biggest chicken producer in Mexico, accounting for 35% of the Mexican market, and the sixth largest in the world, processing almost 15m chickens per week.

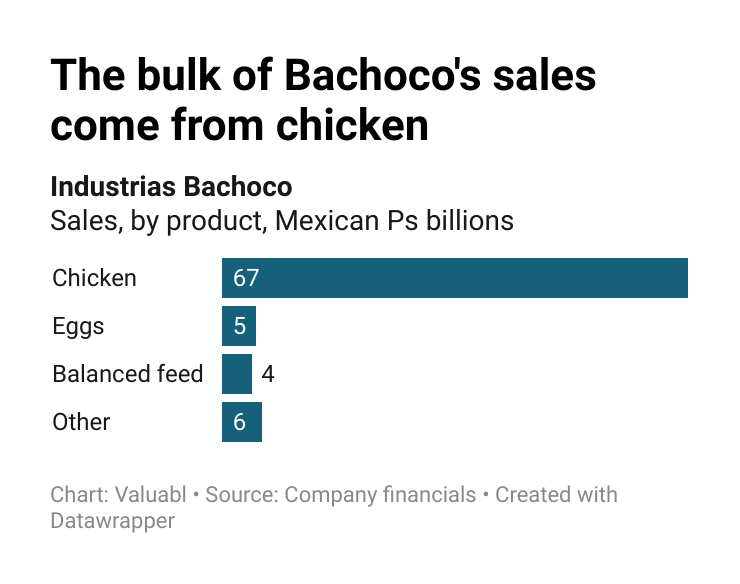

Three-quarters of the firm’s sales come from Mexico, while the remaining quarter comes from the US. While the company also produces eggs and animal feed, most sales come from chicken.

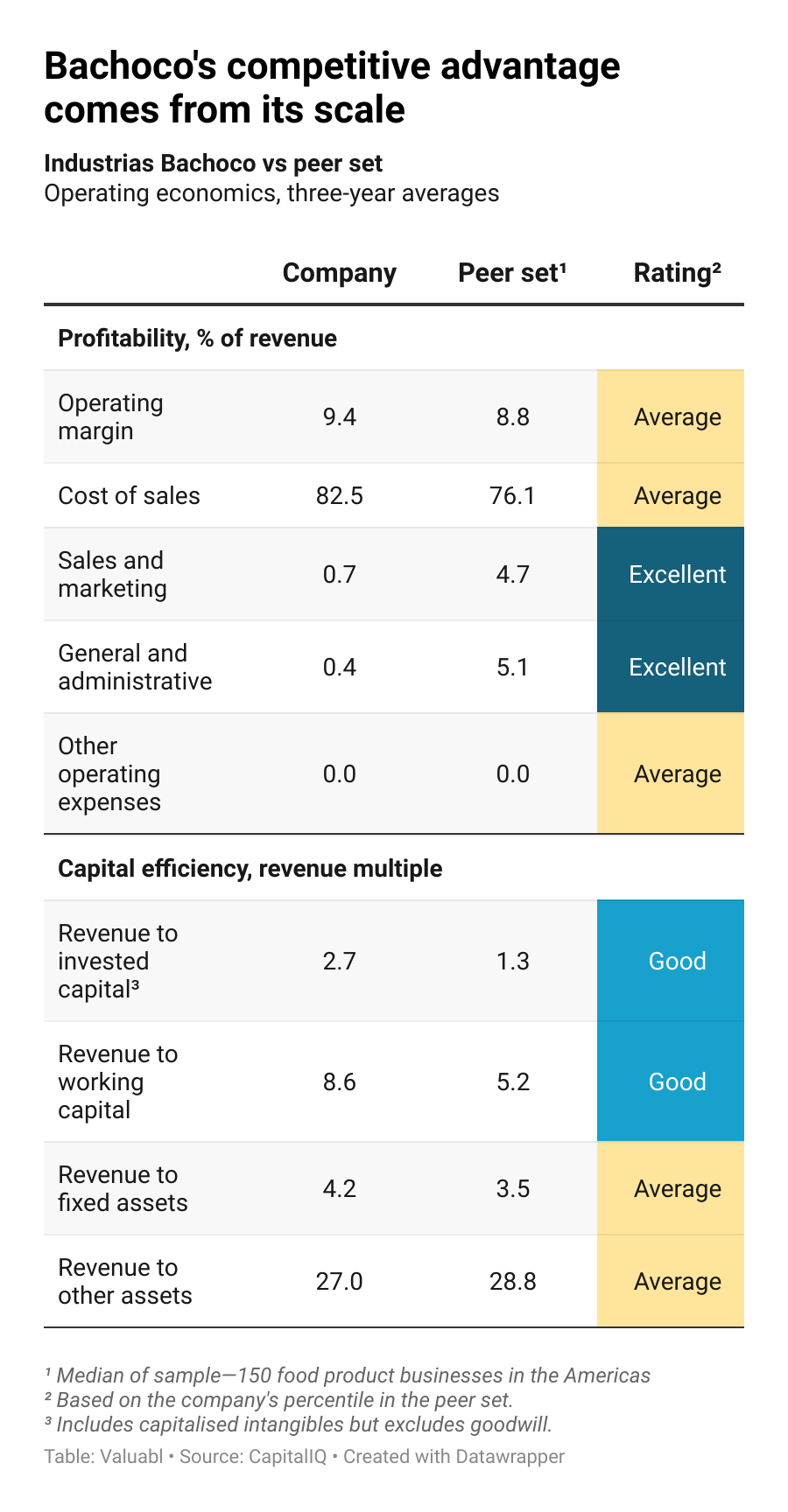

Competitive advantages

- Economies of scale: As Mexico’s largest poultry producer, the company can sell more and more chickens without increasing fixed costs. That helps to stabilise margins in an otherwise cyclical business and boosts the company’s capital efficiency.

Opportunities

- Acquisition-driven expansion: Bachoco agreed to buy Mexican pork producer Norson Holdings in December. By continuing to acquire other pork or poultry businesses, the company will grow faster. Further, the firm will lower its equity risk premium if it focuses on US-based acquisitions. The equity risk premium for business in Mexico is 7.3%, much higher than the 5.4% premium for doing business in America.

- Borrowing capacity: By borrowing more, Bachoco can fund acquisitions and lower its cost of capital. The firm owes much less than most of the food production companies I compared it to—its debts are just 8% of market capitalisation compared to 42% for the median of the peer set. Thanks to its strong credit rating—Fitch, a rating agency, rates the company AAA—Bachoco can borrow up to 17bn Mexican pesos (Ps) before its capital costs start rising.

- Diners prefer poultry to beef: Thanks to chicken’s high protein, and low-fat content, consumers are increasingly opting for it over beef. Furthermore, eco-conscious eaters also pick it as chickens produce a fraction of cows’ greenhouse gases. This trend will increase demand while helping Bachoco expand and raise its prices.

Catalysts

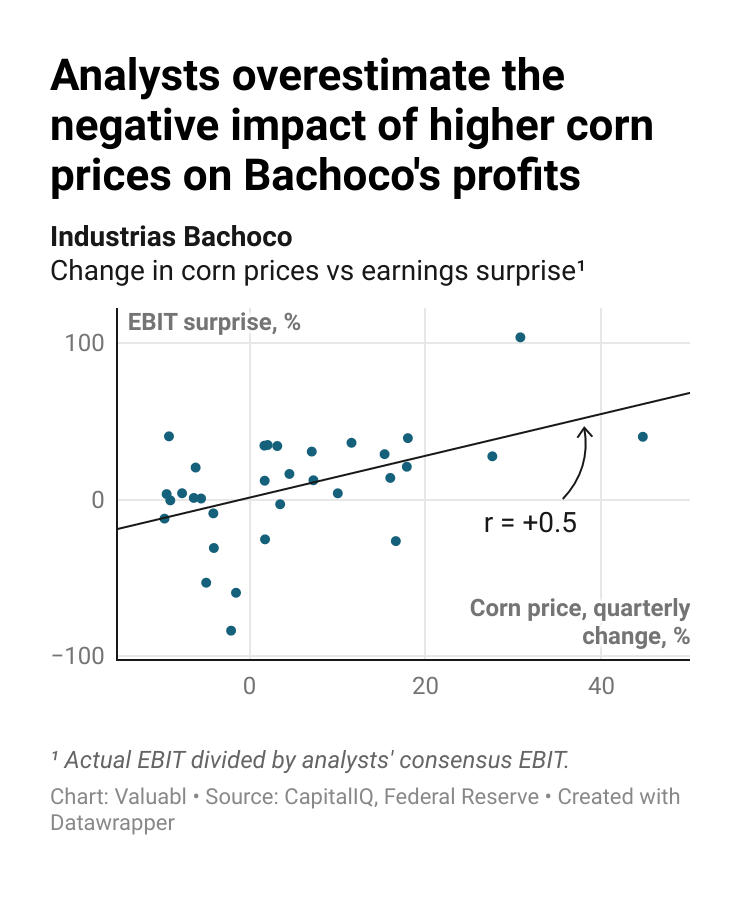

- Fourth quarter earnings on February 9th: Higher than expected top and bottom lines will make the stock jump. Analysts have rock-bottom expectations for the company’s fourth-quarter results. They reckon revenue will only be up by 4% compared to the third quarter, while profit margins will drop to 1.7%, below the 2.5% margin in the fourth quarter of last year. High corn prices, the key input to chicken feed, are to blame. But analysts underestimate how well the firm has reduced its exposure to this risk. Top-line growth beat expectations in the past nine earnings reports, and the company tends to exceed earnings expectations when corn prices rise—they hit $344 per tonne in October, up from $294 per tonne in August.

- Bank of Mexico’s interest rate decision on February 10th: Continued rate hikes as the Federal Reserve, America’s central bank, slow the pace of its rate hikes could further strengthen the Mexican peso against the US dollar. As the firm imports most (80%) of the corn it uses for chicken feed from the US, this would reduce the cost of goods and support margins. The Bank of Mexico’s policymakers cited high interest rates supporting the peso against the dollar.

- Credit rating affirmation in July: Elena Enciso, Fitch’s primary rating analyst for Bachoco, will likely confirm the company’s AAA rating in July. The firm has held this rating since 2015, and its financial ratios haven’t deteriorated since last year’s report. That release will draw attention to the company’s robust financials and credit worthiness.

Key risks

- NAFTA tension: Mexican lawmakers have planned to ban imports of genetically modified (GM) corn for human consumption. They have also said they may eventually ban GM corn used for animal feed despite importing $3bn worth per year. Despite any such restriction violating the North American Free Trade Agreement (NAFTA), a move towards it would increase the price of corn in Mexico and hurt Bachoco’s profit margins.

- Avian flu: If avian flu, a type of influenza adapted to birds, gets into the firm’s facilities, chickens would die from the disease, or farmers will have to cull them to reduce human exposure. Sales and profits would fall, and customers would look elsewhere. Since early 2022, the largest avian flu outbreak has killed millions of birds across North America. According to the World Organization for Animal Health (WOAH), more than 60m chickens in the US and 48m in Europe have died because of avian flu.

II) Numbers

Industry and key drivers

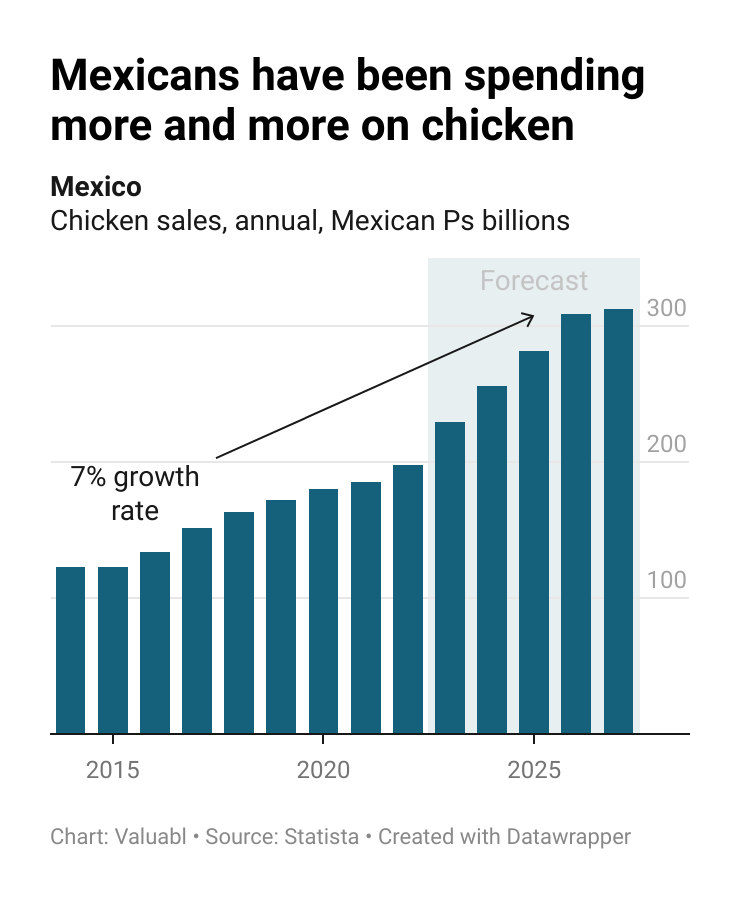

Mexicans are spending more on chicken

The Mexican chicken market has grown at 6% per year since 2014, and Statista, a market forecaster, reckons it will continue to grow at 10% per year until 2027. They estimate over Ps300bn will be spent on chicken in the country by 2026, up from the Ps198bn spent last year.

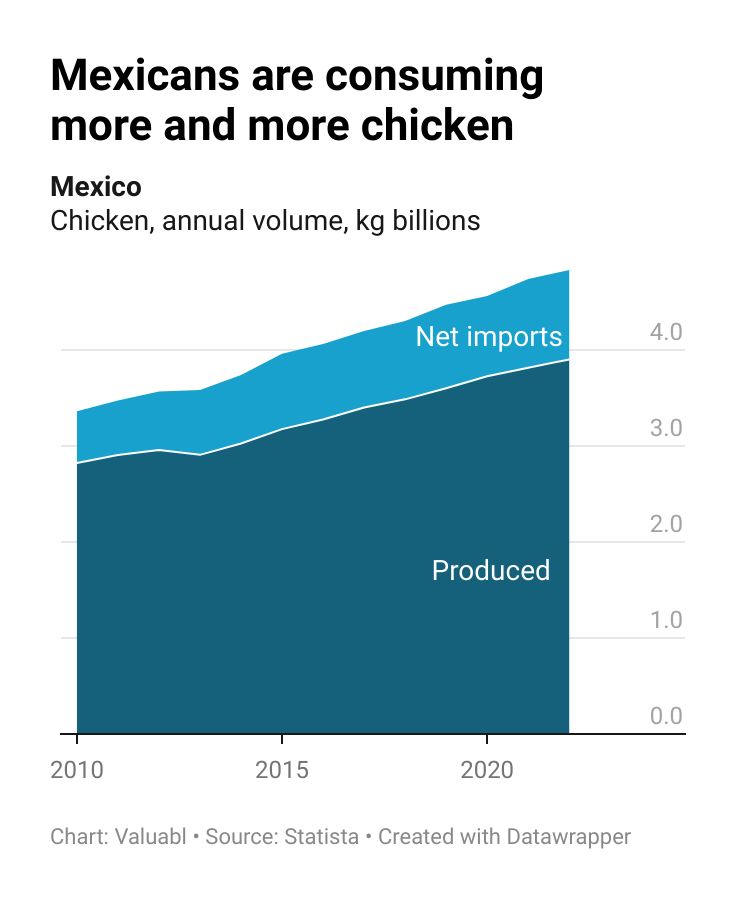

Because they’re eating more of it

Mexican chicken consumption has grown at 3% per year, and analysts expect that trend will continue. Mexican households, like their American and European counterparts, have started to prefer chicken to beef as it’s more affordable, higher in protein, and lower in fat.

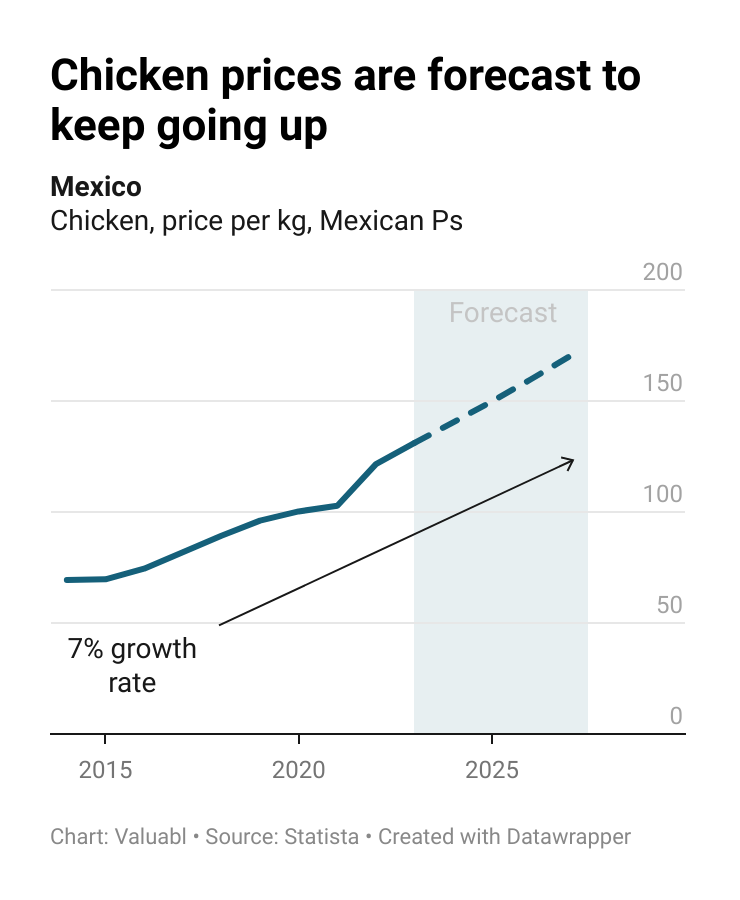

And prices are rising faster than inflation

International meat prices have surged recently as meat demand outpaced supply coming out of the covid19 crisis. But as consumption and production trends come back into balance, economists expect the price of chicken in Mexican pesos to keep going up. The per kilo price of chicken has risen 7% per year since 2014, faster than the 4% rate of Mexican inflation. Thanks to the relative demand for chicken, producers have been able to raise prices, and diners have had to swallow them.

Revenues and growth

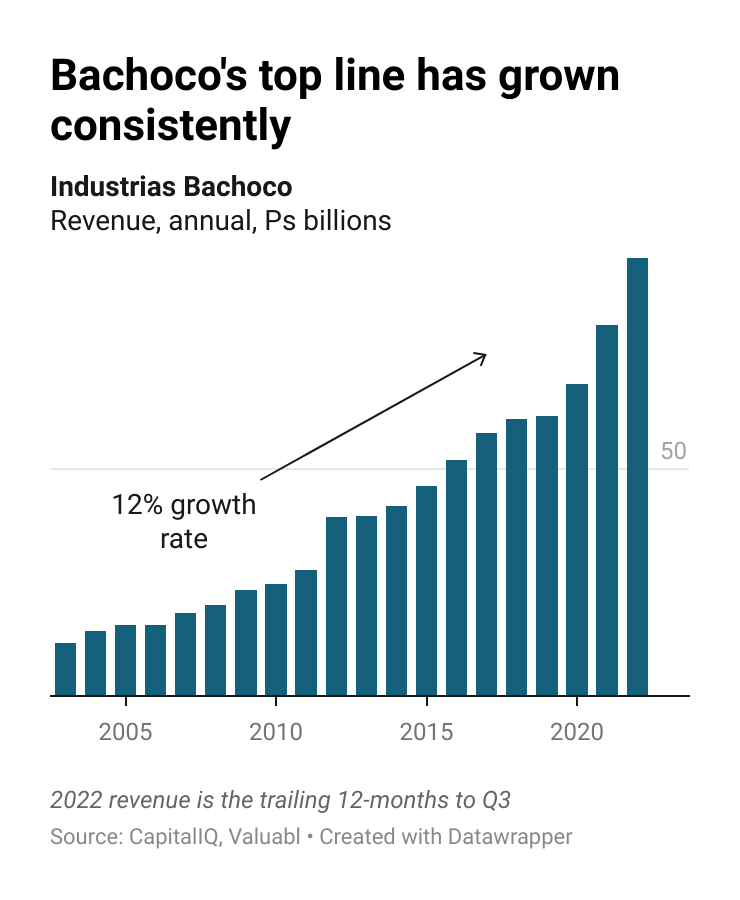

Consistent top line growth

Bachoco’s yearly sales have grown consistently. For the past 20 years, the company’s top line has grown at twice the 6% growth rate of the Mexican chicken market. Bachoco’s sales have grown from Ps12bn in 2003 to Ps97bn in the past year at 12% per year. But, over the past three years, the annual growth rate accelerated to 18%, above the 11% growth rate for the median company in my sample of 150 public food companies across the Americas.

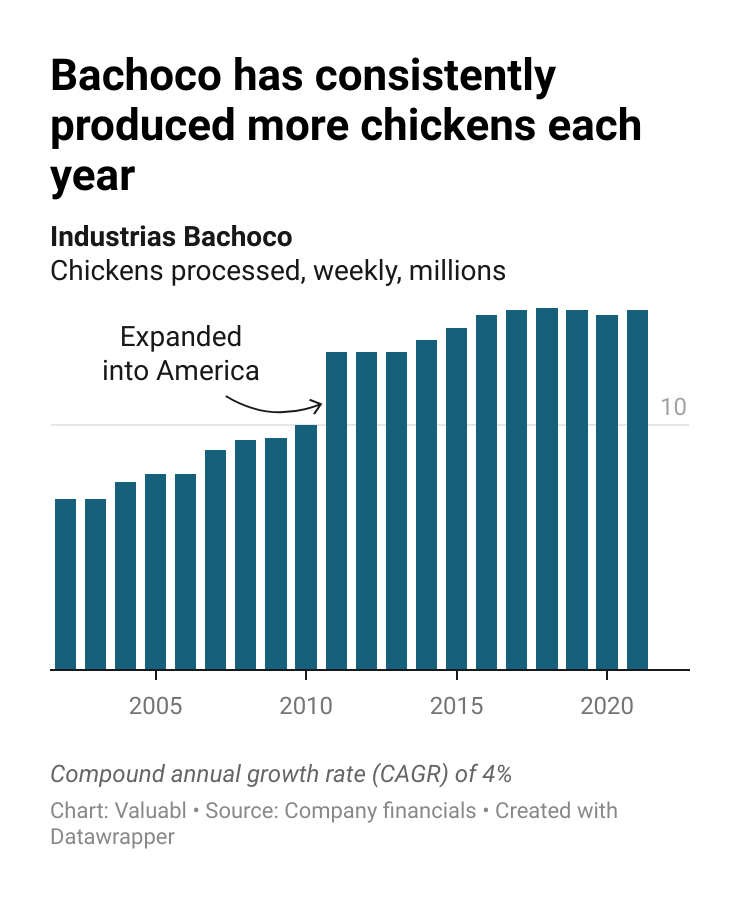

Thanks to steadily increasing production

The number of chickens the firm processes each week has gone from 7m in 2002 to almost 15m in 2021, a 4% per year production growth rate. The most significant jump was in 2011 when the firm bought O.K. Industries, an American poultry company.

Margins

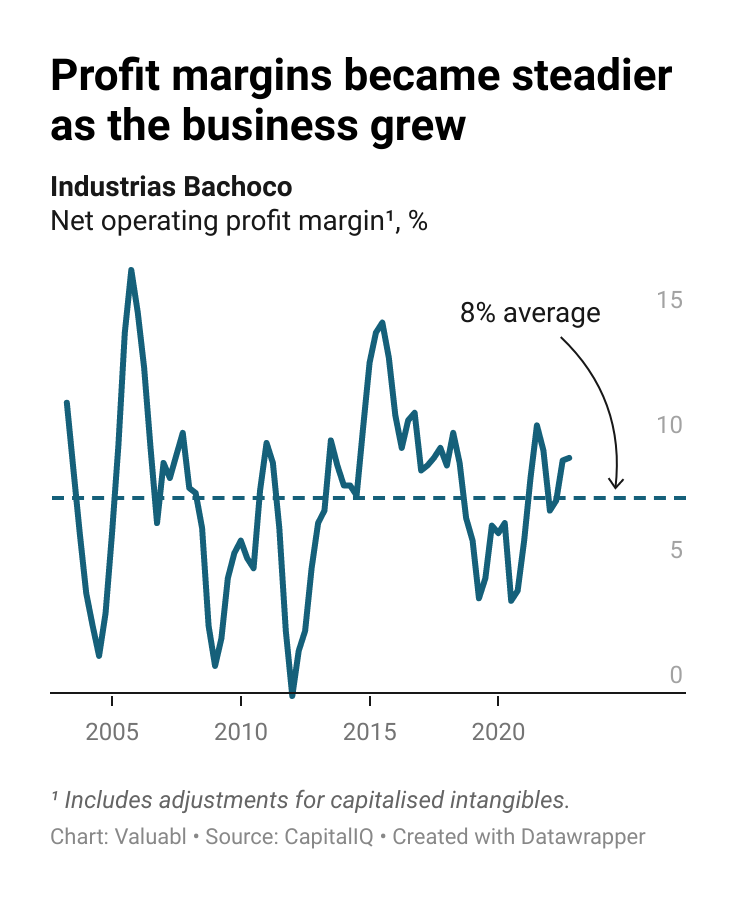

Profit margins used to fluctuate wildly but have stabilised

While still volatile, the company’s net operating profit margins have become steadier over time and are converging towards 8%, their long-term average. The poultry industry is naturally cyclical as higher prices and profits are followed by overproduction, leading to periods of lower prices and profits.

The most considerable cost for poultry producers is chicken feed, and the most significant component of that is corn. In Mexico, domestic crops are limited. Therefore, poultry companies import a large proportion of corn used to feed chooks from the US. In 2021, Bachoco imported 80% of its grain from North of the border. Corn’s price is volatile because of weather, harvest size, transport and storage costs, regulatory policies, and currency exchange rates. As a result, the firm’s cost of goods moves around a lot. But, to offset this, the firm hedges feed prices.

Despite this, Mexican companies importing corn have to pay more than American companies because of the additional trucking expense—which rose rapidly during the pandemic. The price of US corn was about $200 a tonne in 2017, while the cost of Mexican white corn was about $300 a tonne.

Over the past three years, the firm’s margins have been average compared to its peer set. Both gross profit and EBIT margins hovered around the median.

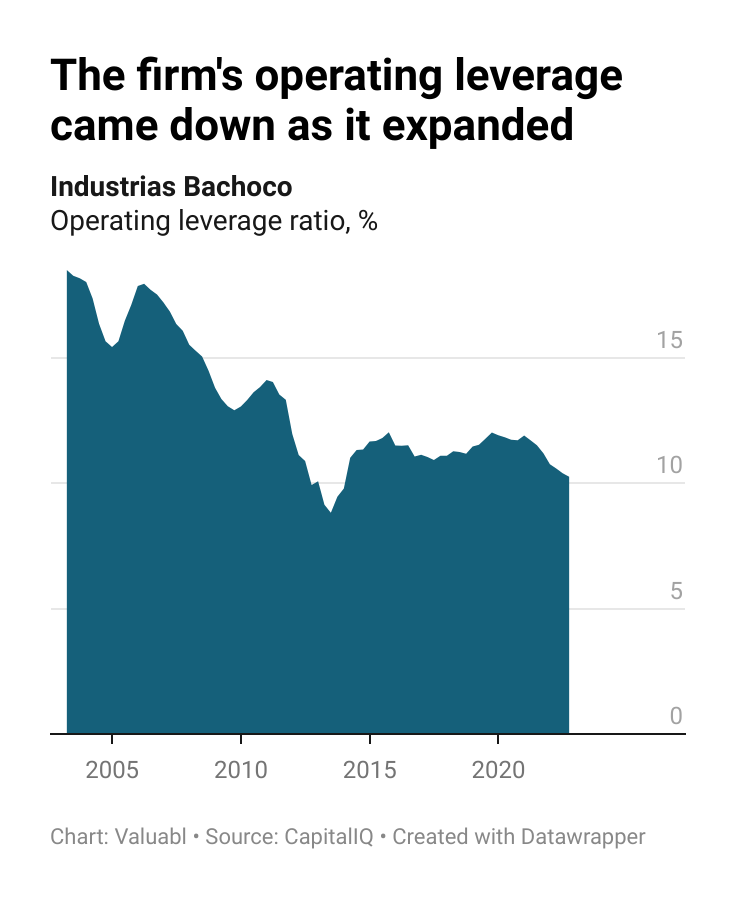

Because the firm’s operating leverage decreased as it grew

As the firm grew, fixed costs declined as a proportion of overall costs, and the operating leverage ratio came down. That helped steady profit margins as fluctuations in gross profit have less impact on operating profit.

Capital intensity

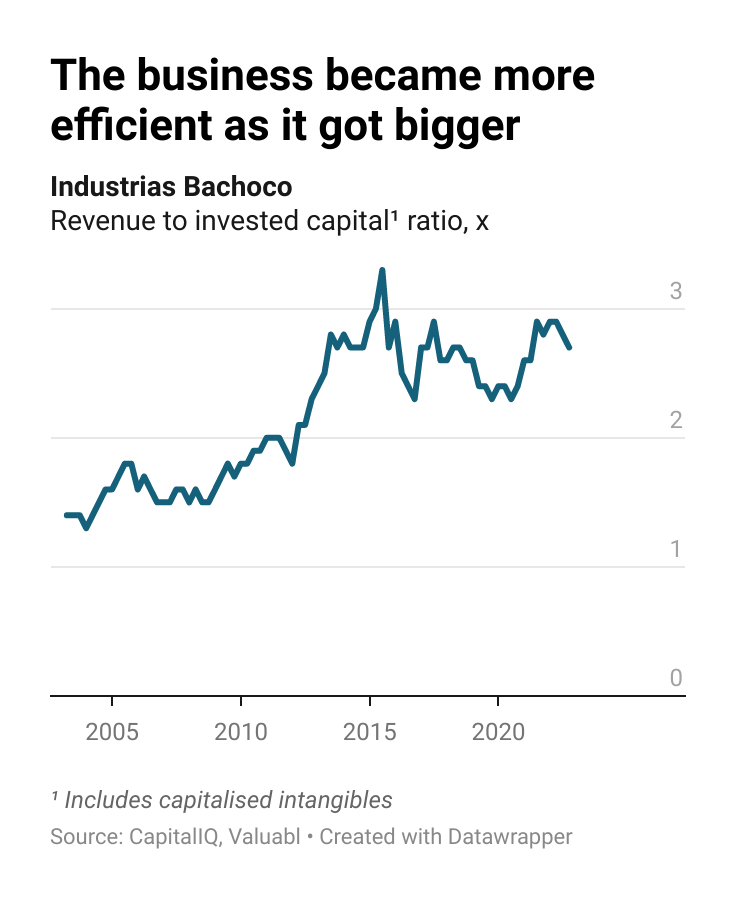

A highly efficient business

The company has benefitted from economies of scale and has become more efficient the bigger it is. It now produces Ps2.70 in sales for every peso of capital invested in operations. That is up from the 1.4x ratio two decades ago. Bachoco is more efficient than 80% of its peer set and is in the top quartile of working capital turnover, the ratio of sales to working capital.

Return on invested capital

A competitive advantage driven by economies of scale

Over the past three years, the firm has produced a pre-tax return on invested capital (ROIC), excluding goodwill, of 20%. That is above the 12% median of the peer set and puts it in the top quartile of food-producing firms. Its after-tax ROIC of 15% is above its cost of capital, suggesting the firm creates value.

The firm’s competitive advantage comes from its economies of scale. Because of its size within the Mexican poultry industry, the firm’s fixed cost base, as a proportion of total costs, is lower than its competitors. As it’s so big, vertically integrated, and operationally efficient, the company can produce more chickens than other companies, sell them for less, and deliver them faster than other food businesses. Its high revenue-to-capital ratios evidence that. The company doesn’t produce higher profit margins, but it does a lot more business, helping it make large profits.

III) Valuation and sensitivity analysis

> Story: Mexico’s largest poultry producer will grow as demand for chicken does. The firm’s economies of scale will help them keep costs down while they increase production and expand into the pork market. The company’s size and efficiency will help keep margins in line with its peers, while the low operating leverage helps de-risk cash flows. But with most of the firm’s operations in Mexico, it’s exposed to substantial country risk, increasing the cost of equity.

- Growth: I forecast Bachoco’s top line to grow at 9% per year. Statista, a market forecaster, reckons the Mexican chicken market will grow at 10% per year while the US one will grow at 6%. The firm’s economies of scale and acquisitions will help it maintain market share as it expands into the pork market and increases production.

- Margins: I forecast the firm’s margins to decline to 7.6%—their long-term average. As corn prices stabilise and the firm folds in acquisitions, economies of scale will help keep costs down. I expect margins to remain in line with peers as the company has a low-cost operation but sells at similarly low prices.

- Reinvestment and taxes: I model the company’s tax rate to rise to 29%, my estimate of its underlying marginal rate. I also model the firm’s revenue-to-capital ratio to decline from the current 2.5x towards the industry average of 1.1x as it acquires other businesses.

- Cost of capital: Bachoco’s weighted-average cost of capital (WACC) is 8.7% in Mexican pesos. The company has less operating leverage than average, little debt, a strong credit rating, and faces substantial country risk given its Mexican operations.

- Intrinsic value: Ps145–163

- Upside: +89%

- Implied IRR: 16%

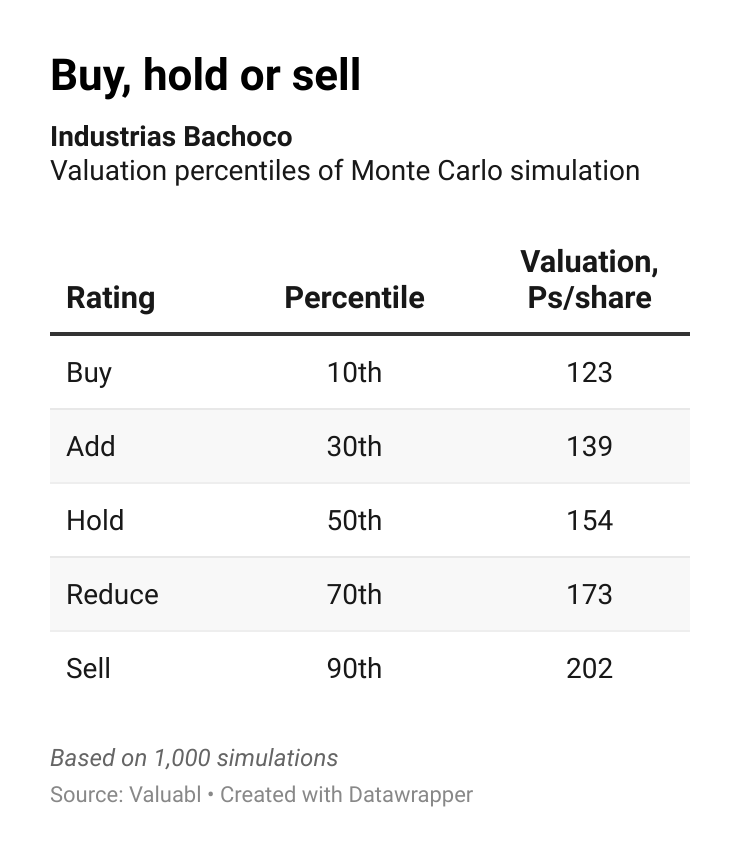

Sensitivity analysis and rating

Monte Carlo Simulation is used to model uncertainty by assuming that the inputs to the valuation model will come from probability distributions around the estimates.

Bachoco’s share price is below the first percentile on the Monte Carlo distribution and, as a result, has a Buy rating. The Mexican listed (BMV: BACHOCOB) shares are uncorrelated enough with what I own for me to start buying.

•••

If you want my best investment idea, just like this one, in your inbox every fortnight, subscribe to Valuabl.

valuabl.substack.com

Subscribe to Valuabl

Expert financial analysis in a straightforward style. Helping professional investors make sense of markets and find undervalued stocks. Click to read Valuabl, by Edmund Simms, a Substack publication.

Already have an account?