Trending Assets

Top investors this month

Trending Assets

Top investors this month

Debt Ceiling Drama, The TGA, and a Market Prediction

As the Treasury runs out of money we're likely in for another round of debt ceiling brinksmanship this month. Here's why I think the danger for markets comes immediately after the ceiling is raised, not before.

Once the banks started going under in March I wrote that I expect this Fed tighening cycle to end in yet another wave of liquidity being pumped into the markets to avoid a total collapse, and that when this happens it will send risk assets back to the moon, but we could be in for a very, very bumpy ride to get from here to there so tread carefully.

Now, about two months have gone by, we’ve had another bank go under last weekend in First Republic and three more are teetering on the brink, and we’ve gotten some incremental information from the Fed (two additional rate hikes ::clownemoji.jpeg::) and the Treasury (tax receipts lower than expected, debt ceiling to be hit in early June), so I think it’s a good time to revisit the thesis and update my expected timeline of events.

The Treasury General Account

Something I’ve learned over this cycle is that while the common market trope is “don’t fight the Fed” there is, indeed, one large account that dutifully fights the Fed whenever the Fed is attempting to unwind some of its balance sheet, and that’s the Treasury General Account. The TGA is the U.S. government’s piggy bank, used to pay things like Social Security, government employee wages, and Ukraine, and it is managed by the Treasury Secretary, who is currently former Fed Chairwoman Janet Yellen.

What ends up happening is that while the Fed is spending money via quantitative easing (QE - the direct purchase of government and corporate debt as well as mortgage backed securities), the Treasury soaks up some of that liquidity and refills its coffers by issuing treasuries it knows the Fed will buy, but while the Fed is sucking liquidity out of the system via quantitative tightening (QT - letting those assets it bought during QE mature and not reinvesting the proceeds), the Treasury counteracts it by spending down the TGA. I’m not sure if this relationship is coordinated or emergent, but it doesn’t really matter.

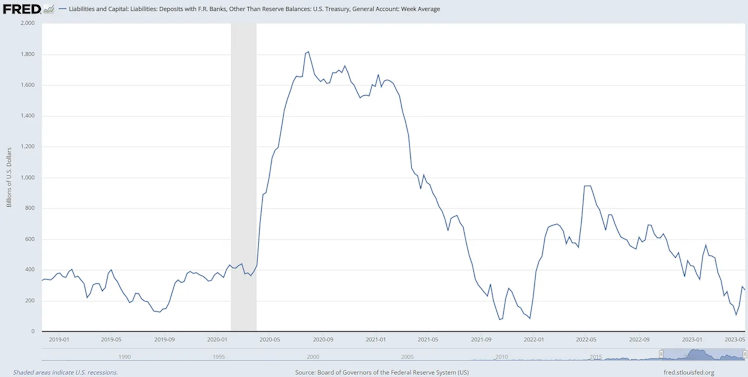

Here’s the TGA since 2019:

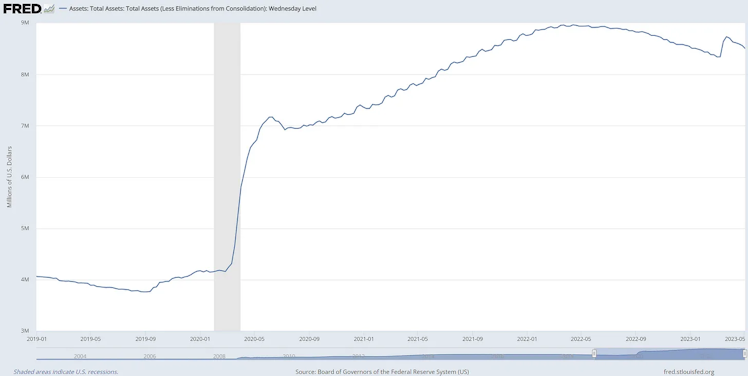

And here’s the Fed balance sheet:

So you can see they’re somewhat correlated, because remember they have an inverse impact on liquidity. Fed balance sheet up/TGA down → liquidity increasing; Fed balance sheet down/TGA up → liquidity decreasing, all else equal.

The huge Fed expansion of $3 trillion in a couple months during covid in March-May 2020 resulted in the Treasury running up the TGA by about $1.4 trillion to a high of about $1.8 trillion, which it subsequently spent all the way down by January 2022 as it funded things such as unemployment, PPP loans, stimmy checks and other fiscal aid during the pandemic. While the Treasury was spending down $1.8 trillion during this period, the Fed continued increasing its balance sheet by about another $2 trillion, so the net impact to liquidity over this period was accomodative to the tune of about $3.8 trillion. That’s why we had a ripping bull market in everything. That $3.8 trilly gotta find a home somewhere.

You can see also that the Treasury refilled the TGA over the first half of 2022 back up to just shy of $1 trillion (on the back of record tax receipts from the capital gains of 2021) while the Fed was conducting the last of its QE, with both the TGA and the Fed balance sheet peaking around May 2022. Since then, for the last year the Fed has been reducing liquidity by shrinking its balance sheet to the tune of ~$500 billion and the TGA has been drawing down by ~$700 billion, acting as a bit of counterweight to the Fed.

All this is to say that, when it comes to market liquidity, the Fed ain’t the only game in town.

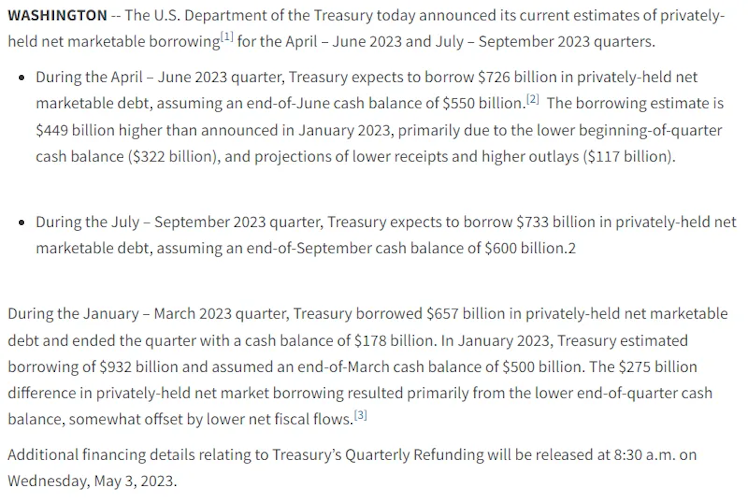

So that brings us to where we are today. The Fed is still determined to hike rates and continue with QT despite bank blow-ups; meanwhile, the Treasury is running out of money faster than expected because of lower than expected tax receipts (no cap gains in 2022!) and needs to issue more debt to refill its coffers:

What this says is the Treasury expects to borrow $726 billion in Q2, and basically needs to borrow at least $175 billion or it will run out of money, which would mean some combination of reduced or stopped entitlements (sorry grandma no social security check for you this month), government shut down and skipped interest payments on the country’s debt, otherwise known as a default.

No problem though, they’ll just borrow the money, right?

The Debt Ceiling

Yes, right, probably. But this is where the issue of the debt ceiling comes into play. Treasury can’t borrow any more unless congress raises the debt ceiling. So you’re going to see a lot of scary headlines and there’s gonna be a lot of political grandstanding over the next month as Republicans try to coerce concessions out of Democrats in return for voting to raise the debt ceiling. This has happened before.

But I’m not too worried about the market during this phase. While the headlines might be panicky, the fact of the matter is the TGA is going to continue drawing down until congress raises the debt ceiling, because it has to. Again, this is accommodative to liquidity and financial markets, a temporary counter force to QT. Money got to find a home.

Here’s my big prediction then: where it actually gets scary for markets is the moment they raise the debt ceiling, not during all the brinksmanship beforehand.

Here’s why: once they raise the debt ceiling, the Treasury is free to borrow more. But where’s the money gonna come from? The typical big buyers of treasuries are the Fed, foreign central banks, the U.S. commercial banking sector, and private market actors.

Well, the Fed ain’t buying right now.

Foreign central banks have been reducing their holdings of U.S. treasuries and increasingly opting for gold for some time now, led by China. I doubt they’re gonna reverse course and do us a solid by gobbling up $1.5 trillion in treasuries over the next six months.

The domestic banking sector is under severe stress and not in a position to buy treasuries. In fact, the BTFP was instituted just so the banks could survive without selling treasuries. Commercial bank buying of treasuries would need to be funded with new deposits, and as we know all too well deposits are currently fleeing the system.

That leaves us with the good ole free market. Private market actors might be enticed by 5% yields, and indeed when you move your bank deposits to a money market fund, you are de facto buying government debt.

But for the private market to take on another $1.5 trillion of treasuries, they would need to sell $1.5 trillion of other assets. Money gotta come from somewhere.

Do you see?

Absent a sudden reversal in Fed policy, money is going to need to come out of the stock market and other assets in order to finance the U.S. government’s fiscal deficit, and this is going to need to start happening the minute congress raises the debt limit and the Treasury can start borrowing again, likely sometime in late May or early June.

I think this is going to cause a stock market drawdown and I’m prepared for it to get ugly for a brief moment. But only brief.

The Fed tells the market when it’s raising rates and doing QT.

The market tells the Fed when it’s cutting rates and doing QE.

I think a crashing market will force the Fed’s hand back into rate cuts and QE in short order, and away we’ll go.

X (formerly Twitter)

Zack Morris (@proof_of_zmo) on X

The next 3 on the hit list:

$MCB

$PACW

$WAL

Already have an account?