Trending Assets

Top investors this month

Trending Assets

Top investors this month

Glass half full in commodities

Recession talk - doom & gloom sells. I like to look at potentially positive news as well.

If you're invested in commodities, here are a few reasons to remain optimistic - hope you'll read if the market has you feeling down.

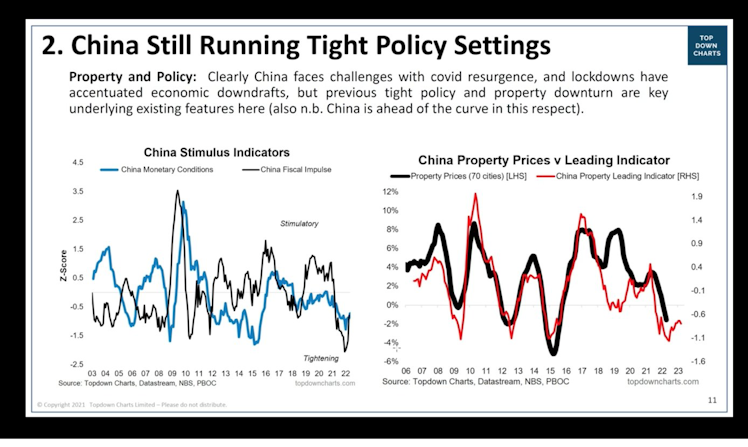

Twitter's Topdowncharts has an excellent presentation on various scenarios for a recession.

Of note, China is ahead of the curve in their economic cycle. Being the 1st into tightening/downturn, expect them to be the 1st out and into policy easing.

In which case, look to Chinese equities to recover first & remember that China has yet to reopen and experience "reopening relief euphoria" :

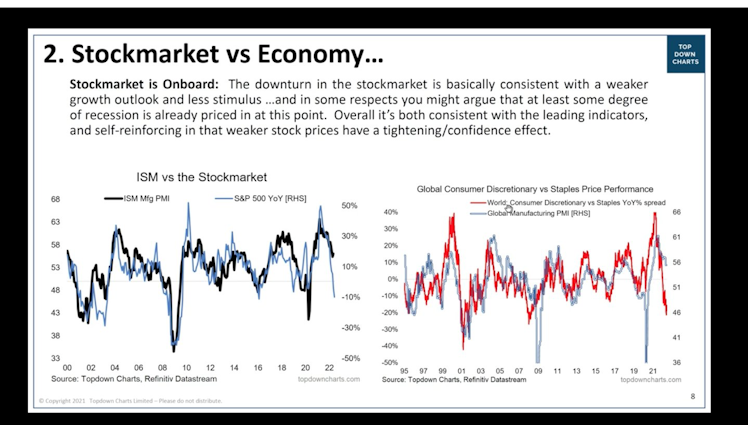

To what degree has the market already priced in a recession?

Some would argue a severe recession has been priced in as of this week:

"Even in the long and storied history of market meltdowns, the breadth of losses is without equal, based on data that goes back to the Great Depression."

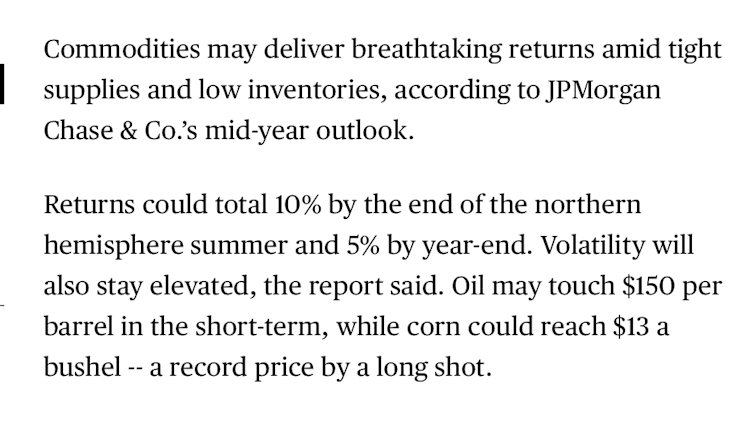

Thursday's Bloomberg article: JPMorgan Sees Commodities Returning 10% This Summer

- Tight stocks and low inventories will push prices higher

- Agricultural commodities will potentially deliver 30%

Found it interesting to see the sell-off in energy on Friday when hurricane season hasn't even hit yet and the NOAA is calling for a rough one - note the Bloomberg article above was on THURSDAY calling the entire commodity complex a BUY:

"How Stocks Perform Before, During, And After Recessions May Surprise You"

I'm not blind to the potential downside ahead but I also don't believe in living in a 'dystopian echo chamber'.

As Topdowncharts stated, "this is a very unusual business/financial/market cycle."

If top economists can't agree on the severity given unusual circumstances, don't fall for the trap of believing your favourite social media account has it right.

"This is one of the most difficult times in history for economic forecasters. Even GS’ President Waldron admitted this is “among—if not the most—complex, dynamic environments” that he’s ever experienced. BofA believes we can "avoid a recession altogether"

Lastly, remember some GoRozen stats:

Constructing a natural resources equity portfolio (25% each mining & metals/ag/energy/PMs) would have significantly beaten the stock market in each of these cycles.

Maybe I am a fool, but I choose...

Fortune

The U.S. is hurtling toward a recession. Here's the best-case scenario for how it could play out—and the worst

With recession fears rising and inflation stuck at four-decade highs, consumers are slowing their spending, and they’re not happy about rising costs. Allianz Trade’s Dan North says that's a bad sign: “If consumers are concerned about the future, they're almost always right.”

Already have an account?