Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update

Stocks are mixed to begin May. Both $SPY and $DIA are marginally higher, while $QQQ is slightly lower. Domestic stocks are coming off both a winning week and a winning month.

For economic data today, the ISM Manufacturing Index increased to 47.1 in April, just above expectations of 46.7. It was the 6th straight month the sector contracted. Of the 5 subindexes, the only one that is in growth territory is Employment.

One survey respondent in the primary metals industry had an interesting comment: “We seem to be in a season of contradictions. Business is slowing, but in some ways, it isn’t. Prices for some commodities are stabilizing, but not for others. Some product shortages are over, others aren’t. Trucking is more plentiful, except when it isn’t. There’s uncertainty one day, but not the next. The next couple of months should provide answers — or not. It’s hard to make projections at the moment.”

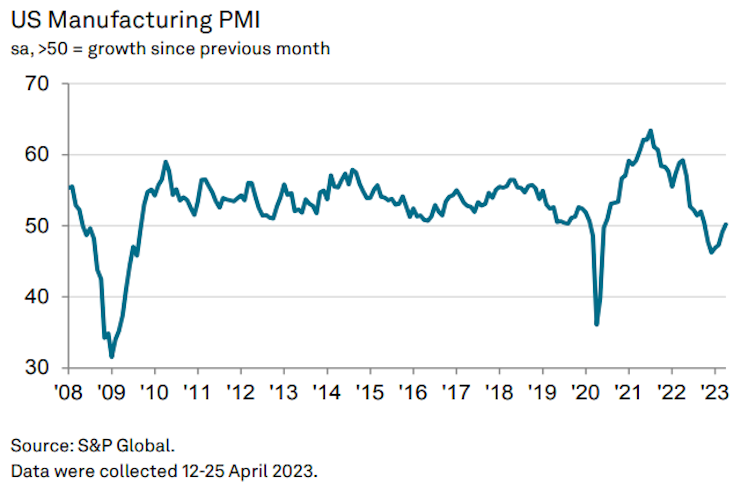

Elsewhere, the final print of the April S&P Global Manufacturing PMI was revised slightly lower 50.2. Output and employment rose with a new upturn in sales. Input costs and price inflation picked up pace despite great improvements in vendor performance.

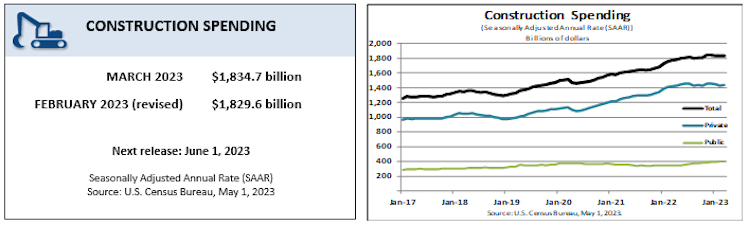

Lastly, US construction spending rose 0.3% in March, above expectations of 0.1%.

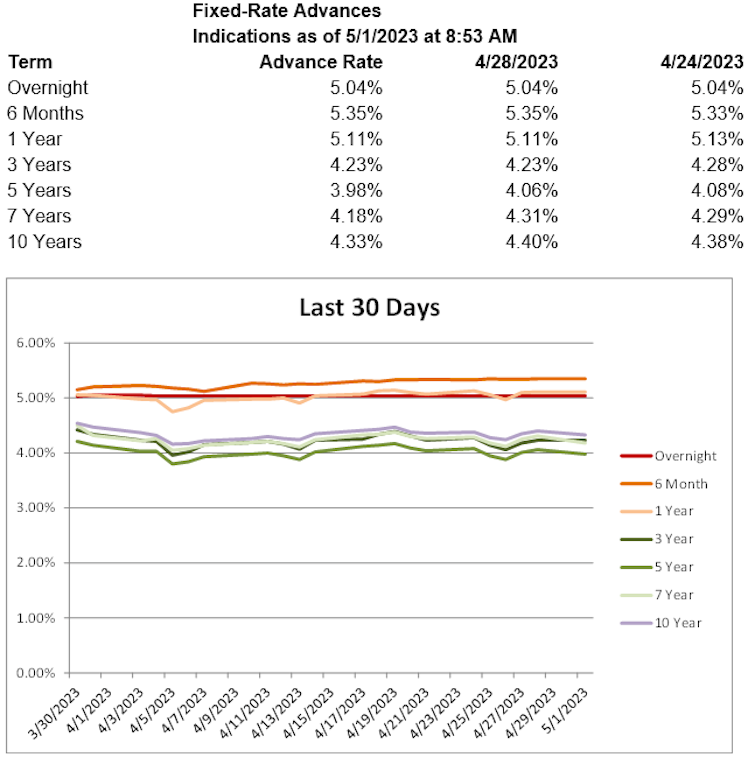

US Treasury yields are higher, with the 2-year T yield up 7.3 basis points to 4.14%, the 5-year T yield up 5.5 basis points to 3.59%, and the 10-year T yield up 6.7 basis points to 3.52%. Advance rates are lower throughout most of the curve today.

Already have an account?