Trending Assets

Top investors this month

Trending Assets

Top investors this month

Frontier Communications $FYBR aims to be the largest pure fiber broadband provider in the US

Remember Frontier Communications, the telecom company that was focused on providing DSL, cable, and fiber broadband to rural parts of the US? They bought Verizon Fios and other telecom broadband lines in order to grow and funded those acquisitions through debt. As interest rates grew, the company was burning cash. Meanwhile, the business continued to see customers reducing their consumption of Frontier's services and the business went bankrupt during the pandemic.

Well, that same company emerged form Ch 11 bankruptcy (similar to Hertz) and is now more focused to being the largest pure-play fiber provider in the US.

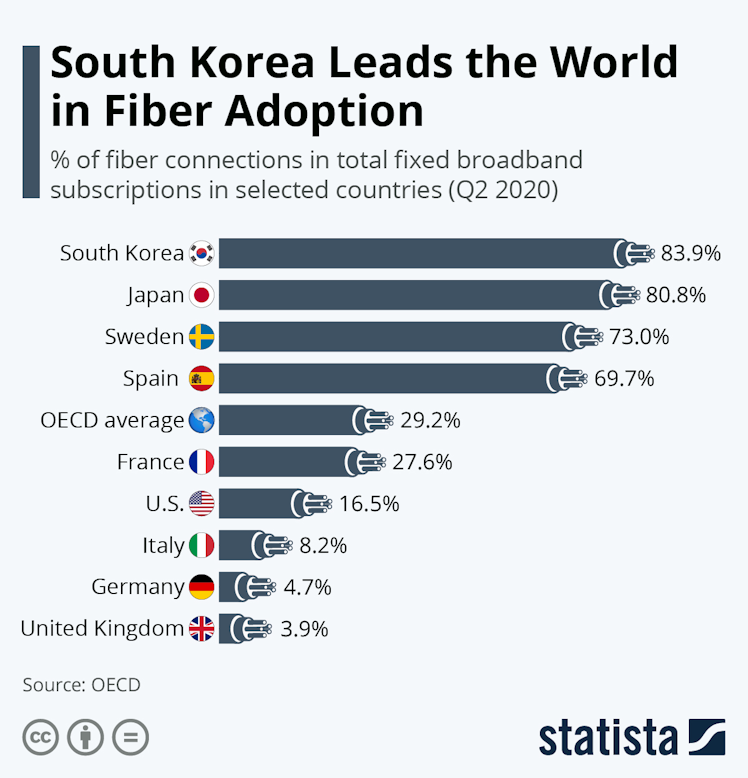

When looking at the adoption of fiber broadband throughout the world, we can see that only 16.5% of US residents have fiber broadband subscriptions. That's way lower than the average OCED nation (here's a list of OCED nations).

Regulations and legal fights that $CMCSA and $CHTR have done against pure fiber broadband proviers are a reason why many of these fiber broadband providers have struggled with building out more fiber in the country. Also, fiber broadband is more expensive than cable broadband and DSL.

Interestingly, cable cowboy John Malone, who owns a significant stake in Charter through $LBRDK, thinks that Frontier, $LUMN, and other fiber players are overbuilding fiber infrastructure. yet when considering the percentage of Americans that have access to fiber broadband in the first place, that number is very low.

Comcast is adapting to the growing threat of fiber broadband by upgrading their existing cable infrastructure, which cost 80% less than building a new fiber network. I wouldn't be surprised if Charter does the same and they both penny pinch their way in pleasing their customers before Frontier or anyone else comes in and offers fiber broadband.

With WFH and WFA remaining a major pandemic theme that continues to thrive in post-pandemic times, we need better internet more than ever. Without fiber broadband, we won't be able to adopt better WFH and WFA technologies that help us perform our work better. Software programs are going to start requiring more bandwidth. And cable transmission lines have their limits on bandwidth capacity.

Satellite internet isn't a threat to fiber broadband providers because the bandwidth that comes from satellites are a lot lower. The growth in 5G only creates more demand for optical fiber products and makes it more expensive for Frontier, Lumen, and other firms trying to build out more fiber broadband infrastructure because 5G towers need to be hooked onto fiber optic cables to transmit information.

Frontier is in a unique position to lead the growing adoption of fiber broadband in the US. Many telecom companies want to get in on the fiber broadband business and are looking for a build out partner. AT&T is one example, and they're working with Morgan Stanley to find that build out partner. T-Mobile is using Citi's help to find a partner for a fiber broadband joint venture. Both firms want someone to help them build out fiber broadband infrastructure and even to manage the infrastructure. Frontier is, in my view, best positioned to help these telecom companies with that. Plus, these telecom companies prefer to lease the fiber infrastructure than owning it since that's what they've been doing with cell towers for a long time. And these joint venture opportunities help Frontier expand into more populous areas, which brings more profits to the both of them.

Interestingly, according to AT&T, it's easier to sell wireless broadband to customers after they've been hooked onto fiber broadband services. AT&T has been busy ramping up its own fiber broadband business and the results are promising. While I haven't read much about T Mobiel or Verizon trying to expand into fiber broadband, all I know is that they're both busy with 5G and as mentioned before, T-Mobile is looking to get into the fiber broadband business.

$GOOGL is the only Big Tech firm that's getting in on the fiber game. Not many people talk about that business. Though its small compared to Google's other businesses, the large financial resources of Alphabet makes it a viable fiber broadband player and a player that has the best chances of dominating the industry, if it allocates more resources and attention to it.

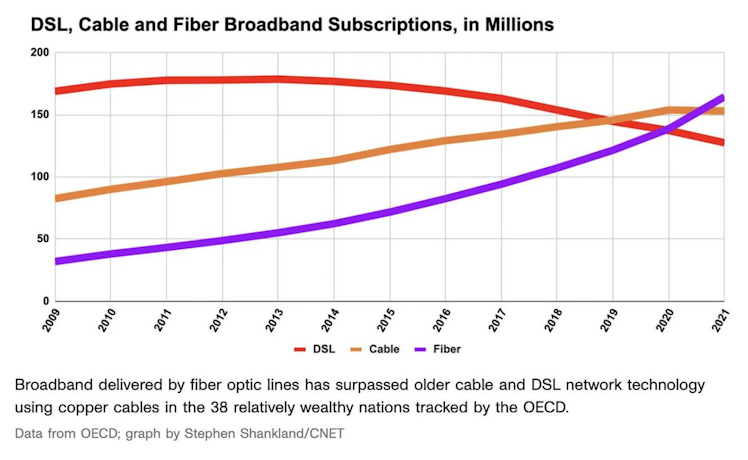

And when considering the chart below, it helps to understand why Alphabet would also want to get in on the fiber broadband business.

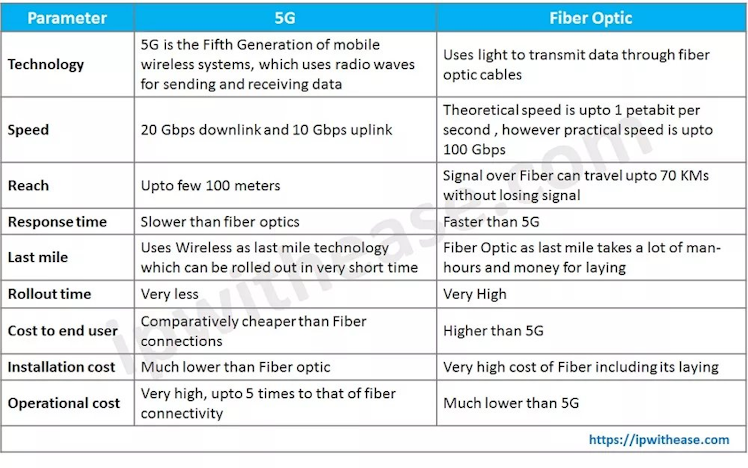

And if you're wondering about the difference between 5G and fiber broadband the economics of it, here's a handy chart:

Frontier Communications is in the business of having to deal with high installation costs, which makes growth very expensive, but once installed, Frontier enjoys the low operational costs. Meanwhile, telecoms have to deal with lower installation costs because they just need to install one tower per area than place various wires through each home and then have to deal with high operational costs. This is what investors should keep in mind.

I'm not sure if the operational costs come from the leases of the cell towers or that cell towers are generally costlier to maintain, but if you have more knowledge about it, please let us know in the comments section.

As the fiber broadband buildout accelerates, Corning $GLW is seeing its fiber optic product sales surge. After seeing this CNBC documentary, I learned that fiber optic cables last a lot longer than copper wires and are more flexible and there has been a boom and bust cycle in the fiber optic business. After the dotcom bubble burst, when demand for fiber optic cable use plunged, fiber optic cables were on fire sale. There was too much "glass" in the ground compared to the demand for transmitting data through that glass. And in 2012, we saw fiber optic cables enter another boom. That boom then entered a new level once the pandemic came and faster internet was more important than ever as people were working from home.

I believe that with our policymakers' seriousness on improving internet connectivity in America, that this fiber optic boom will persist. Fiber broadband will help position America to capitalize on more phases of innovation and boost productivity at the same time. Hopefully people can see their disposable incomes grow so they can afford the fiber broadband subscriptions that will one day be offered to them in the future.

And I believe that Frontier will lead the fiber broadband boom.

WSJ

Optical Delusion? Fiber Booms Again, Despite Bust

Skyrocketing Internet video traffic, ever-faster financial trading connections and soaring mobile phone use is driving demand for more fiber-optic cable, even though much of existing capacity is still unused.

Already have an account?