Trending Assets

Top investors this month

Trending Assets

Top investors this month

$FISV Q1 2023 Resutls

Fiserv reported first quarter 2023 results on April 25, 2023. The company's adjusted revenue increased 10% to $4.28 billion, while adjusted earnings per share increased 13% to $1.58. These results were driven by strong growth in the company's Merchant, Payments, and Fintech segments. Fiserv also generated $1.13 billion in net cash provided by operating activities during the quarter.

For those unfamiliar with $FISV, they are a leading global provider of payments and financial services technology solutions. The company's solutions are used by financial institutions, merchants, and other businesses around the world. Fiserv has a strong track record of innovation and growth, and it is well-positioned to continue to grow in the years to come.

The company's Merchant segment, which provides payment processing and other services to merchants, grew 18% year-over-year. The Payments segment, which provides payment processing and other services to financial institutions, grew 13% year-over-year. The Fintech segment, which provides cloud-based financial services software and solutions, grew 3% year-over-year.

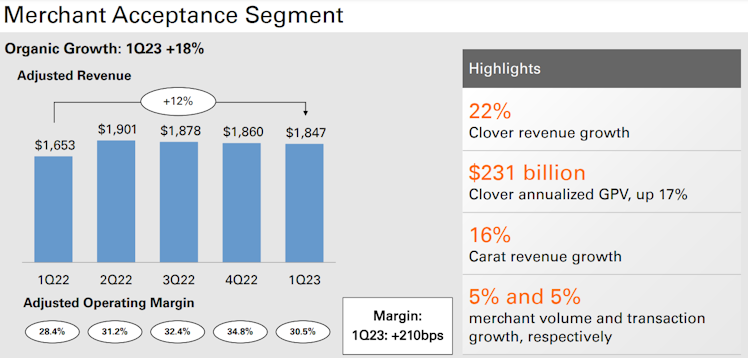

Merchant Segment

The Merchant segment, led by Clover, grew 18% for the quarter, with Clover growing 22%. The acquisition from First Data continues to pay dividends for the company, leading to growing revenues, along with expanding margins. Carat, the omnichannel enterprise solution grew 16% for the quarter

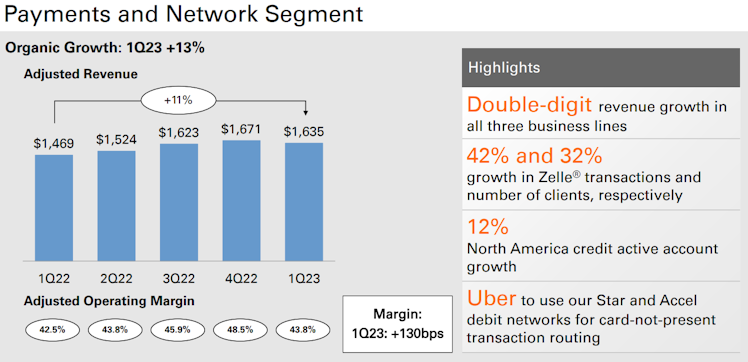

The Payments and Network Segment

The payments and network segment also producted a strong quarter with 13% organic growth, including all three business lines.

These business lines include:

- Issuer solutions relying primarily on card issuing and output.

- Card services, including debit processing along with debit networks STAR and ACCEL

- Digital payments which includes Zelle and bill pay.

Zelle continues to be a big driver of growth, with 42% and 32% growth in both transactions and customer usage. $FISV remains one of the largest providers of Zelle.

Debit card processing, while not as profitable, does help grow the revenues for the business, and offers more opportunities for growth in other regions such as LATAM, particularly Brazil.

Financial Technology

Next up we have the core operations for $FISV which is the core banking solutions, or the Financial Technology segment.

This segment, legacy for Fiserv, handles all the fun back of house banking stuff, like account maintenance, ATM processes, online banking, and so on. Super exciting, I know.

This is segment is by far the slowest grower of the company, with 2% last quarter, although the company continues to maintain its 4-6% organic growth targets. Fiserv competes with $JKHY and $FIS in this space, but focus primarily on larger banks, while the others focus on credit unions, and smaller regional banks.

"Free cash flow came in at $861 million for the quarter, up 43%, driven by improved working capital. We remain confident in achieving our outlook of $3.8 billion in free cash flow this year. Based on higher organic revenue growth, coupled with our focus on operational excellence, which supports our margin expansion outlook of more than 125 basis points, we are raising our full year adjusted EPS guidance range from the previous $7.25 to $7.40 to a new range of $7.30 to $7.40, representing growth of 12% to 14% over 2022."

Robert Hau, CFO

Fiserv's CEO, Frank Bisignano, said that the company's strong first quarter results reflect its leadership position and focused execution in an uncertain economic environment. He also said that the company is well-positioned to continue to grow in the years to come.

All in all a wonderful quarter for the company, and they continue to see growth from the First Data acquisition, ala Clover and Carat. The company has done a great job of incorporating the newer tech, along with keeping their hands in other cookie jars to give them additional revenue streams and optionality. They fly a bit under the radar, but remain a strong biz in the overall payments space.

As Frank said recently in a previous call, paraphrasing here, "we are not in the business of out competing others for sales, our job is to act as an enabler and work with many different companies to make payments easier for everyone."

FYI - long $FISV, if you hadn't already figured that out, lol.

h/t to the biggest $FISV bull besides me, @christian7621

Already have an account?