Trending Assets

Top investors this month

Trending Assets

Top investors this month

XP 1Q22 Earnings Digest

XP reported weaker-than-expected 1Q22 results after the market close. A softer quarter was already expected after KPIs were published on Apr 13th, but the numbers were disappointing.

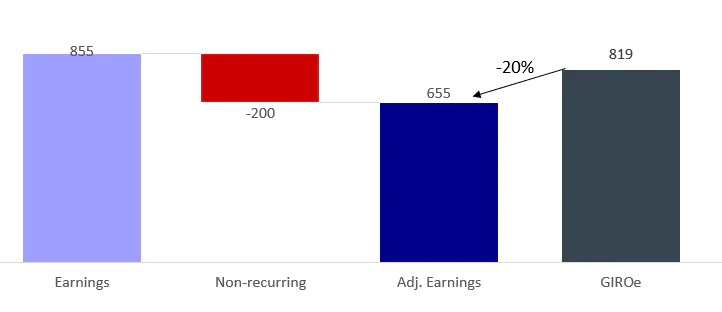

GAAP net income of R$855mn (-3% vs. Street), contracting 14% QoQ and expanding 16% YoY, which should be okay considering the weak KPIs reported a few weeks ago.

However, the bottom line was enormously helped by abnormally strong institutional revenue growing 68% QoQ and 86% YoY, supported by derivatives (high demand for hedging positions). Accordingly to the statement, the market should not expect it as a recurrent result.

According to our estimates, the non-recurring the institutional revenue helped the bottom line by ~R$200mn or 23% of XP’s net income (-20% vs. our numbers). So, without it, the earnings would be a huge miss.

Source: Giro Lino, XP.

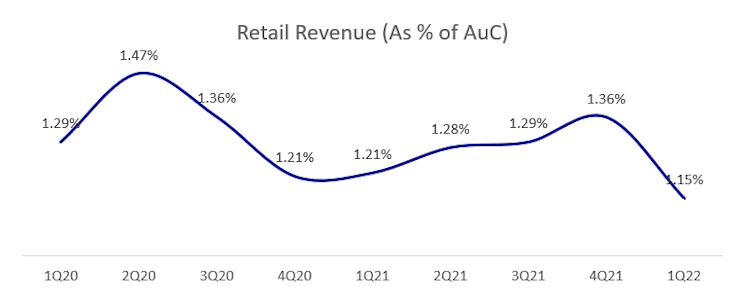

The resilient take rate in the last quarter showed a material sequential contraction in 1Q22, the main negative highlight of XP's results.

Even though the mgnt stated during the call that retail revenue yield should improve in the Q2 since March’s revs alone were already ~40% better than Jan/Feb average. Nevertheless, it is fair to say Q1 results pose downside risks to the Street.

Also, due to more challenging macro conditions in Brazil, issuance results severely dropped 55% QoQ and down 48% YoY, chiefly driven by weak DCM and ECM activities in 1Q22, changing the sales mix dramatically.

Also, XP's earnings bring an essential flag for the asset management industry in Brazil.

Already have an account?