Trending Assets

Top investors this month

Trending Assets

Top investors this month

Chart of the Day - Ball of confusion

The song was originally released by The Temptations in 1970. It was covered by Love and Rockets in 1985. The lyrics seem just as appropriate today as when originally released:

"Oh yeah, that's what the world is today

Woo, hey, hey

The sale of pills are at an all time high

Young folks walking round with their heads in the sky

The cities ablaze in the summer time

And oh, the beat goes on

Evolution, revolution, gun control, sound of soul

Shooting rockets to the moon, kids growing up too soon

Politicians say more taxes will solve everything

And the band played on

So, round and around and around we go

Where the world's headed, nobody knows"

For the mkts, a major source of confusion is the labor mkt. For some, strength in the labor market is a lagging indicator & so less important to consider because leading elements of the economy such as housing and new orders have already fallen. It is just a matter of time before jobs fall.

For others, it is a sign of risk. The Fed has a dual mandate of full employment & price stability. As long as the labor mkt is strong, the Fed has carte blanche to raise rates as aggressively as it wants. Thus, a strong jobs mkt means more risk for stocks.

Building on my 'what if' theme yesterday, the labor mkt is potentially also a source of a soft-landing. This would like be driven by jobs holding up well,allowing the secular strength in household formation combined with low inventory of homes and rentals to drive housing.

So which is it? Depends on your horizon. However, that is not the only source of confusion.

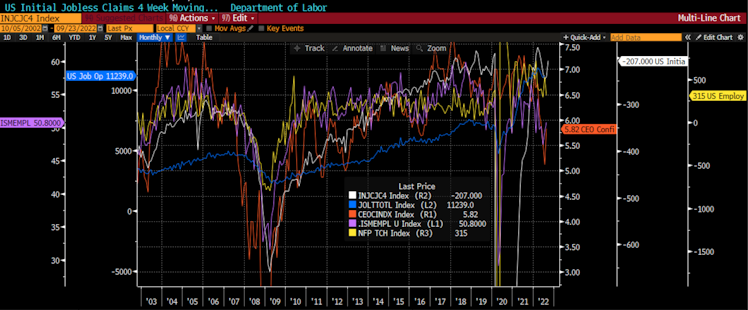

We are trying to guess the future direction of Non-farm payrolls in yellow. I have two indicators that say further strength and two that say future weakness. I will let you decide.

In the weak corner, we have ISM employment numbers and CEO Confidence surveys. Both make sense. Asking companies what the expectation for hiring will be should impact future employment. Both of these are quite negative now. Both would point to NFP below 0.

In the strong corner we have Job Open and Labor Turnover & Jobless Claims numbers. Yes JOLT may be secularly higher because of online postings but even within that it is persistently high. 11 mm openings. Jobless claims which had weakened from April to August has been on a stronger trend for 7 weeks. The latter at least is hard data and not survey data. Do you give it more credence?

It isn't easy. First we need to figure out what will happen with jobs. Then we need to figure out if good, bad or indifferent.

"Fear in the air, tension everywhere

Unemployment rising fast

Rockets new record's a gas

Eve of destruction, tax deduction, city inspectors, bill collectors

Solid gold in demand, population out of hand, suicide

Too many bills, everyone movin' to the hills

People all over the world are dying in the war"

Ball of Confusion.

Stay Vigilant

Already have an account?