Trending Assets

Top investors this month

Trending Assets

Top investors this month

$BABA Review (Part 1)

Dang this also took quite a while, trying to research and write about such a huge company while not having access to more detailed financials since it doesn't file 10-Qs and its fiscal year being different from the calendar year (kinda annoying).

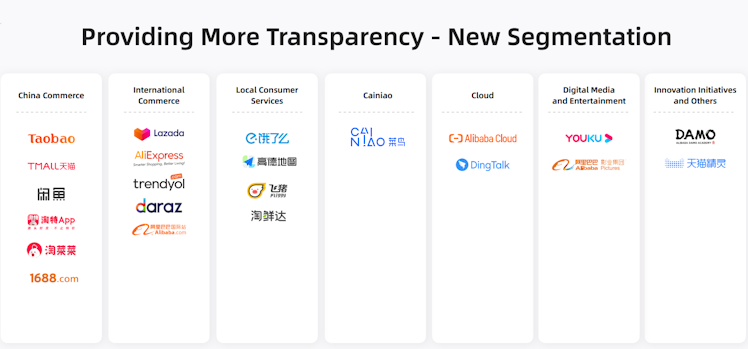

Anyways, part 1 focuses more on getting a brief understanding of the various components that make up BABA to get a qualitative picture of the company. Definitely, one can go much deeper into each category.

Part 2 will include an analysis of BABA from an investment perspective, going through its most recent earnings report, concerns, expectations for the future and valuation.

BABA is a complex company with an assortment of business units. Taking some time to properly understand each part of the company, as well as it as a whole, is crucial as a long-term investor in it. With BABA, you get:

- the largest e-commerce ecosystem in China;

- growing e-commerce presence in SEA, Turkey, Europe;

- a logistical infrastructure, fulfilment and delivery company;

- a profitable cloud service provider;

- a food-delivery and navigation services startup;

- a streaming company; a film company;

- an investment arm with net cash and AUM of 831.6B CNY, or ~130 billion USD.

Chinese e-commerce:

BABA’s legacy businesses include Taobao, Tmall and [1688.com](1688.com). Taobao’s merchants are primarily individuals and small businesses; whereas Tmall’s merchants are more established and bigger local/international brands with users who are more willing to pay for more premium and branded goods (as compared to Taobao). [1688.com](1688.com) serves as their local wholesale ecommerce platform. BABA makes money via charging merchants platforms/service fees. As BABA serves as the platform provider, this part of their business is what has given them the high margins we saw during their earlier years.

BABA has also ventured into direct retail, through their businesses like Freshhippo, Tmall Supermarket and Sun Art. This is part of its “new retail” strategy, integrating technology, digital features and delivery capabilities into the shopping experience of offline brick-and-mortar stores. Since BABA serves as the retailer now, the integration of such business ventures has resulted in a natural decline in margins.

BABA has estimated that they have onboarded 99% of China’s tier 1 and 2 cities’ online population. Thus, their last avenue for user acquisition resides within the more rural parts of China, representing a lot of untapped potential customers. Their latest efforts have been focused on this.

Taobao deals was launched in 2020, and aims to deliver the cheapest products to consumers without compromising on quality by connecting consumers directly to manufacturers, an M2C model. This provides the most value for budget-conscious and price-sensitive consumers in lower-tier cities as BABA attempts to bring them into their ecosystem.

Taocaicai is another recent venture, which rides upon the community group buying trend within China. This is a big movement that BABA is trying to capitalise on. It involves local communities coming together to order cheaper bulk purchases directly from farms and manufacturers, which will be delivered the next day to selected spots for them to self-collect. The e-commerce and subsequent delivery of groceries and fresh produce have traditionally been challenging due to their perishable nature. BABA’s expertise in coordinating delivery fulfilment and key logistical capabilities like cold-chain management, alongside the nature of pre-ordering has allowed for lower attrition, less wastage and successful uptake of the e-commerce of such perishables. Furthermore, the self-pickup nature has allowed BABA to circumvent the most expensive part of the delivery process — the last mile.

Overall, BABA has a differentiated mix of e-commerce offerings that appeal to all consumers, from the budget-conscious to those desiring more premium products, as well as diversified fulfilment models and various product segments for consumers to choose from. This positions it as a one-stop-shop for Chinese consumers’ retail (though still heavily e-commerce focused) needs.

International e-commerce:

Consumer retail offerings include Lazada for SEA, Trendyol for Turkey, and Aliexpress (global); with its wholesale one being Alibaba.com. While revenue growth numbers have been encouraging thus far, this segment is still unprofitable, due to large marketing spending and price subsidisation amidst much tougher competition overseas.

Personally, this is something I don’t pay much heed to / less bullish on. BABA’s will face much greater challenges in this area as they have to adapt and tailor to each local market and consumer behaviours, which will differ from the home market they have grown in, and with their logistical capabilities and reach not being as integrated and strong as compared to in China, whilst competing with businesses who may be more proficient in both. (Shopee > Lazada imo as a Singaporean)

I won’t be surprised if they decide to pull out or spin-off these ventures.

Logistical infrastructure, capabilities, and delivery fulfilment — Cainiao:

Cainiao is BABA’s own logistical fulfilment and supply chain network based in China, and works with many partners overseas. It has strong capabilities and capacities, handling single-day (11.11) goods with GMVs greater than black friday, cyber monday and Amazon’s prime day combined. There is a lot of synergy with BABA’s e-commerce businesses, whether providing BABA’s platform merchants, or BABA’s own direct retail businesses the delivery fulfilment support and capabilities. It has and will always be an integral part of BABA’s ecosystem. Cainiao is also close to achieving a positive operating margin, operating at an adjusted EBITA margin of -(1-2)%.

Cloud Computing — Alibaba Cloud:

China’s and APAC’s leading cloud provider. The cloud computing industry and market are still in their early stages and have a long runway for the foreseeable future. This has been one of BABA’s biggest growth drivers (3y CAGR of 65%) and will continue to be moving forward. BABA’s own digital and computing requirements are of course enabled by its own cloud computing platform.

Recent growth numbers have been relatively weak due to the loss of a large customer (TikTok), however, the effect will soon be lapped in the next quarter or two and we can expect a decent reacceleration in the growth rate of this segment. Currently, it stands at about 8.5% of BABA’s total revenue, up from about 5% 3/4years ago. Furthermore, it has recently achieved a positive adjusted EBITA margin for the latest 9 months ending 31 Dec 21, as reported by BABA, and margins are expected to continue expanding and contributing to the bottom line as the industry continues maturing.

Local Consumer Services:

These refer to platforms that provide high-frequency services, with its two largest being Ele.me (food and groceries delivery) and Amap (navigation, ride-hailing, hotel booking). These are relatively recent ventures that started being reported within their own segment in 2018. While they present decent growth metrics, they remain highly unprofitable at -40%+ adjusted EBITA margins. Given the notorious unprofitability of food delivery and ride-hailing services, I do not expect much from this segment.

Investment Portfolio:

BABA’s most famous investment would be its stake in Ant Financial (the company behind Alipay, China’s dominant payment platform), which hit global headlines after the cancellation of what was going to be the world’s largest IPO. Beyond that, as reported in its latest quarter, BABA had 678.12B CNY worth of equity securities, stakes in other companies, and other investments, alongside a net cash position of 153.5B CNY. These add up to 831.6B CNY, or 130.5B USD, against its market cap of ~280.5B USD. This is important to us investors as the change in the value of its investments will be reflected in its GAAP net income, which added more than 10% of revenue in their fiscal years ending 31 Mar 2019, 2020, and 2021. The poor earnings in FY22 thus far can also be attributed to the huge drawdown in Chinese markets over the past one year that affected their investments.

Moving forward, if conditions and sentiments in Chinese markets do stabilise after a period of widespread fear and uncertainty, it will be very likely that Chinese markets would see a relatively strong recovery. Thus, we can expect their investment income to contribute a wider margin to their reported bottom line.

Digital Media and Entertainment + Innovation Initiatives:

Includes video streaming platform Youku, film production company Alibaba Pictures, and other venture-style moonshot bets that they are funding. Honestly, I don’t really care about this segment and is more or less negligible to me haha.

Ele.me

饿了么

“饿了么”2008年创立于上海,是中国领先的本地生活平台。截至目前,饿了么在线外卖交易平台已覆盖全国2000个城市,加盟餐厅130万家,用户量达2.6亿

Already have an account?