Trending Assets

Top investors this month

Trending Assets

Top investors this month

A Catalyst-Rich Phosphate Pick

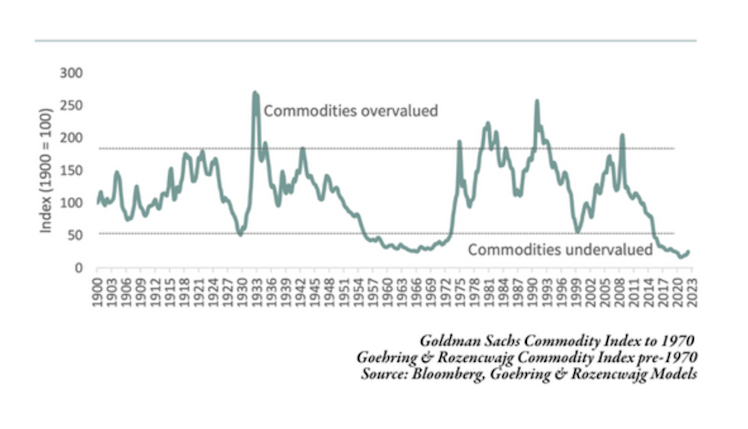

For those new to my Commonstock timeline, I often suggest that commodity investors read Goehring & Rozencwajg research reports. The firm has provided some excellent analysis of the natural resources sector and the free download below, “The Commodity Bull Market Has Only Just Begun”, is a must-read:

Over the last 130 years, there have been four times when commodity markets became radically undervalued versus the stock market: 1929, the late 1960s, the late 1990s, and today. After each period of radical undervaluation, commodities entered into large bull markets and then proceeded to become radically overvalued. If you had invested in commodities or commodity-related equities in any of these three previous periods, the returns on both an absolute and related returns basis were huge -- even in the 1930s.

Constructing a natural resources equity portfolio that consisted of 25% energy, 25% metals and mining, 25% precious metals, and 25% agriculture would have significantly beaten the stock market in each of these cycles.

Given the current state of global affairs and their impact on the supply chain, a potential recession, the energy transition & associated government-funded initiatives, global food shortages, and high energy prices, a powerful case can be made to invest in commodities, allocating as GoRozen has suggested.

My personal portfolio was skewed rather heavily toward metals and energy, so I had been searching for agriculture equities that could provide significant upside. Most fertilizer companies had seen quite a run up after the war in Ukraine began, and though they have declined somewhat, many seem to be in a fairly reasonable valuation range.

$MOS and $LXU are planned long term holds for me, please read my previous CS posts below if you are interested in either company:

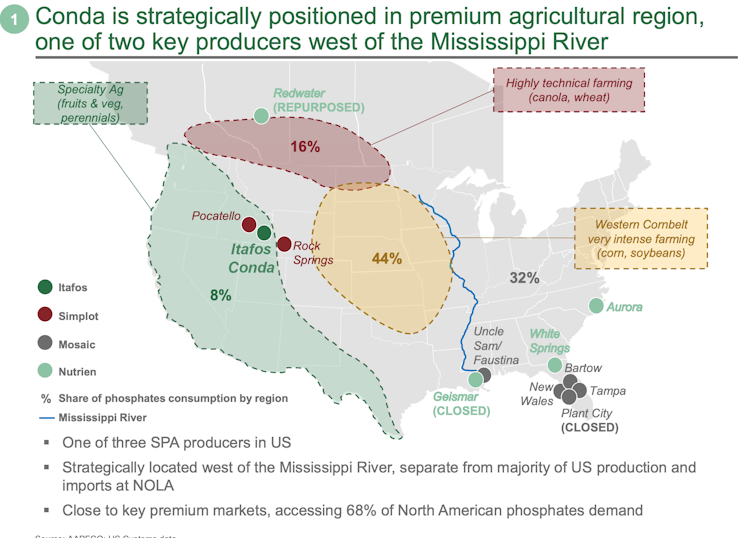

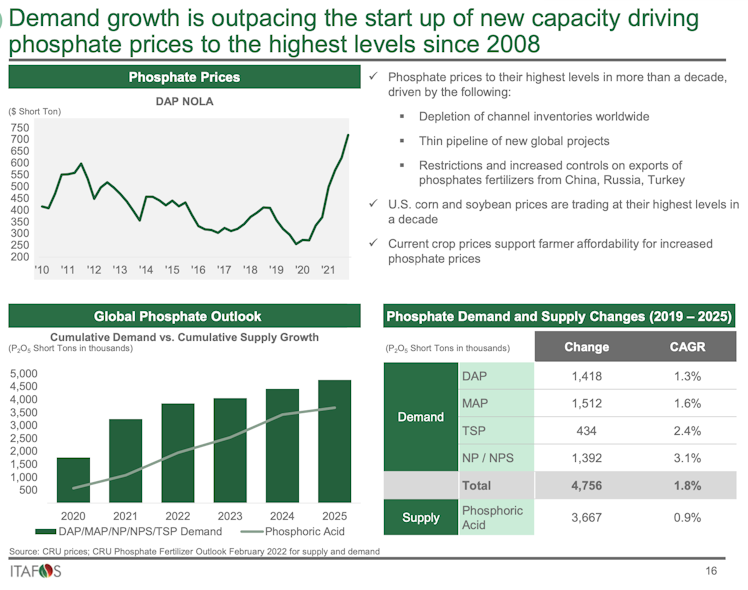

Mosaic and LSB Industries provide exposure to phosphates, potash, ammonia, nitrogen, and sulphuric acid, as well as other fertilizer products in short supply across the globe. Though I have reasons to be bullish on all of these, phosphate is of particular interest to me given the growing demand for lithium manganese iron phosphate (LMFP) batteries. CATL is the world’s largest battery maker and intends to mass produce LMFP’s within the year. Even companies that don’t directly supply phosphate to battery manufacturers stand to benefit as supply is diverted for that purpose.

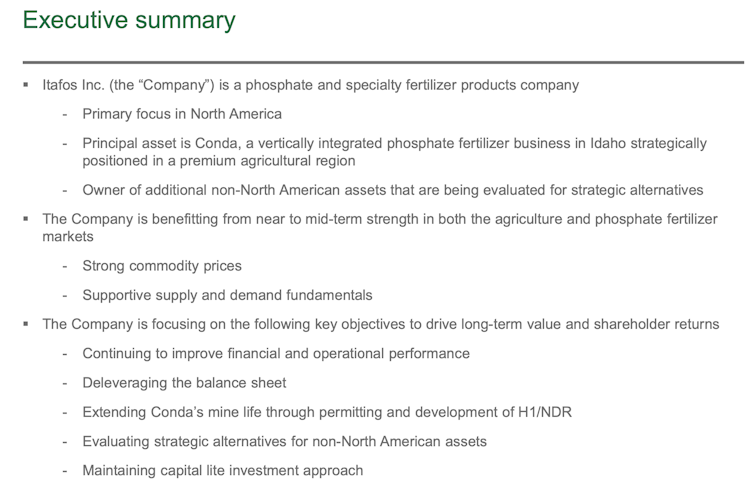

I decided to increase my phosphate exposure by adding $IFOS.V. In a report dated August 17, 2022, Raymond James analyst Steven Hansen reiterates his “Strong Buy” rating on the company with a price target of $5.75 ($IFOS.V closed at $2.01 on Friday).

“Based upon another record quarter, demonstrable deleveraging progress, and a constructive phosphate price outlook…coupled with strategic initiatives designed to de-risk the platform and surface additional value, we believe the outlook is catalyst-rich with significant upside.”

- Itafos consolidated 2Q22 Adj. EBITDA surged 89% YoY setting a new quarterly record of $63.6 million.

- Conda is expected to run well through the second half of the year, and first material sales of hydrofluorosilicic acid are expected.

- Itafos’ Brazilian asset, Arraias, increased sulphuric acid sales as earlier mechanical hurdles were resolved.

- Management bumped its net income & EPS expectations based upon improved tax efficiencies. Capex ranges were also tightened versus prior expectations.

- Itafos had another sizable cash build to $140 million, and reduced net debt and leverage ratios to 0.7x, versus $211 million and 3.6x in 2021.

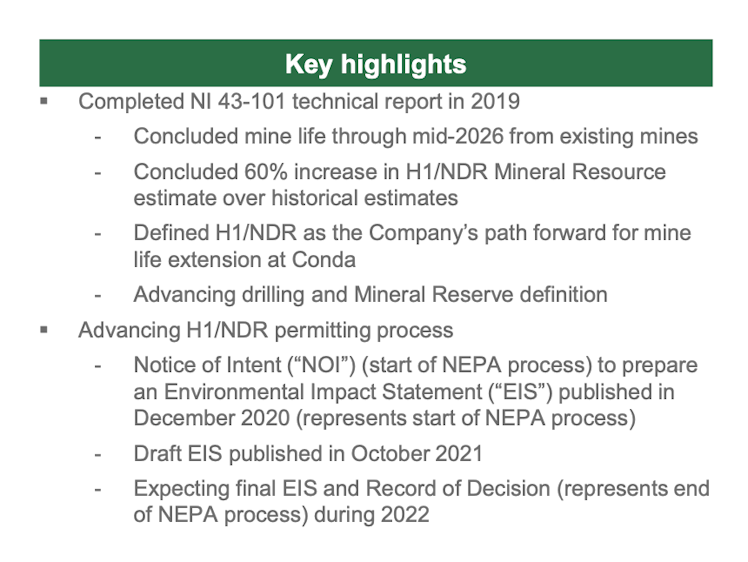

Raymond James continues to see material upside optionality as management makes steady progress toward monetizing its non-core assets in Brazil & Guinea-Bissau, and remains optimistic with regards to the company’s LOM (life of mine) extension efforts at H1/NDR.

Having added Itafos to my portfolio, I am closer to reaching the 25% agriculture allocation suggested by GoRozen. Content now with my phosphate exposure, I will remain on the hunt for a potash pick with potential. BHP’s CEO Henry has called potash one of the “future-facing commodities” – with copper, iron ore, nickel, and potash essential to a growing, but decarbonized, global economy.

Now about that precious metals allocation...

The Globe and Mail

BHP pivots toward ‘future-facing’ commodities with Saskatchewan potash project

In building the world’s largest potash mine in Saskatchewan, BHP CEO Mike Henry looks to heal old wounds and pivot the global giant away from oil and gas

Already have an account?