Trending Assets

Top investors this month

Trending Assets

Top investors this month

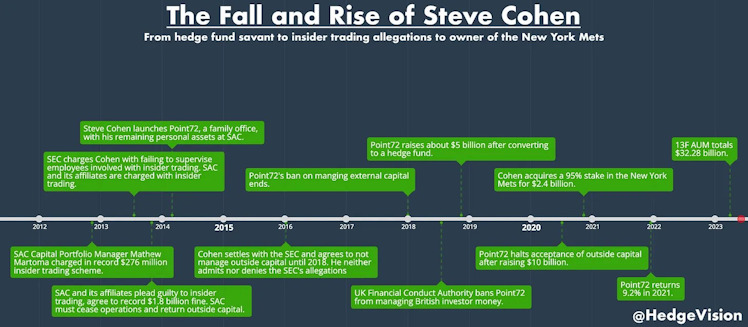

The Insider Trading Investigation That Almost Brought Down Billionaire Steve Cohen

Steve Cohen had it all.

After founding SAC Capital in 1985, the hedge fund only experienced 3 losing months in its first 7 years.

That means in 84 months, returns were only negative for 3 months, demonstrating a monthly success rate of 96.42%.

The rumor on Wall Street was that Cohen paid sky-high commissions and fees to brokers and other financial firms so that he could receive the first notice on actionable information, such as stock upgrades/downgrades and trading flow.

According to former SAC traders, other strategies that Cohen used included the “reverse desk” and “take the Street” tactics.

Reverse desk involves purchasing a relatively small amount of stock and then subsequently selling it off through various brokers.

“When word gets out that SAC is selling, the Street goes nuts and also starts unloading big blocks,” said a former SAC trader. These big blocks would then cause a plunge in price, which opens up an opportunity to buy at a lower price.

In take the Street, SAC would buy large blocks of a stock through several brokers at the same time in an attempt to empty their inventory.

Some of these brokers would then have to buy back the shares on the open market to refill their inventory, thus lifting up the price.

In 1992, SAC became the first ever hedge fund to manage more than $1 billion. In 1999, it became the first hedge fund to manage over $10 billion, and in 2006, the first fund to manage over $20 billion.

Throughout this stretch, SAC was often responsible for as much as 3% of all daily trading volume on the NYSE.

Then, the SEC came knocking.

Read the complete story here: https://hedgevision.substack.com/p/the-insider-trading-investigation

hedgevision.substack.com

The Insider Trading Investigation That Almost Brought Down Billionaire Steve Cohen

From insider trading allegations to owner of the New York Mets, this hedge fund manager has managed to defy all odds

Already have an account?