Trending Assets

Top investors this month

Trending Assets

Top investors this month

Market Moods

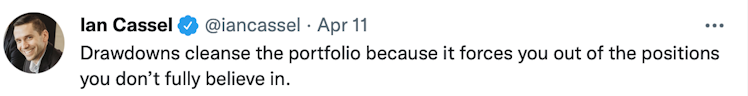

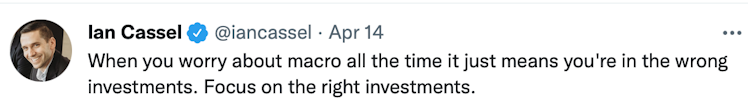

I am no expert in psychology, I defer to my friend & fellow investor @cosmocapital in that regard. However, I find one of the most fascinating aspects of investing to be one’s psychological mindset and how it impacts your performance. One of the best Twitter accounts that is a #FinTwit must-follow is @iancassel, founder of @microcapclub & @intelligentcm. I have several of his tweets posted in my office and attribute some of my personal growth and success to his wise words. As Helene Meisler says, “nothing like price to change sentiment” – and the current volatility can be trying for the psyche. Perhaps now, more than ever, we need to seriously consider our human fallibility and how we plan to approach the days ahead.

Humour & Empathy Welcome

Beyond the wealth of information available to users on Twitter & Commonstock, I have found the shared human experience to be among the most valuable. There have been many days where I have taken a loss and been left feeling down, only to find myself laughing at a meme someone has posted or taking comfort in the fact that someone else shares my pain. Commiseration has proven to be a ‘social glue’ that increases bonding and cooperation, as well as resilience, which in turn will likely increase your portfolio’s performance. Sharing your failures or challenges and having others empathize can be a powerful part of the community.

It’s remarkable the difference a dose of laughter can make when you’ve had a stressful day. Scientifically proven to decrease stress, it can lower your heart rate & blood pressure. A calm trader is a more effective trader. Make sure you follow a few accounts that bring you joy.

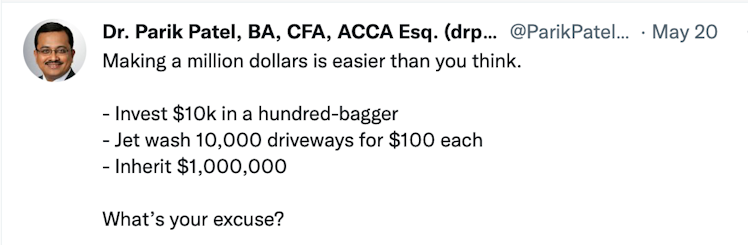

Some personal favourites of mine:

@parikpatelcfa

@johnwrichkid

@tininvestor

Choose Contradiction over Comfort

I have witnessed many disagreements during my Twitter tenure, and at times been profoundly irritated myself when someone presents a contradictory viewpoint to mine. I know all too well how tempting it can be to take the easy route and use the block button, but you’re likely only harming yourself. As https://www.entrepreneur.com/article/346101 states, “when you insulate yourself from opposing viewpoints, you are potentially depriving yourself of information needed to make a more informed decision.” It takes humility to acknowledge there may be holes in your thesis, but if someone else is able to point them out, we should be grateful. On the contrary, you may find your own argument to be reinforced and your conviction grows. I have added to positions following a debate, as my points were difficult for another to disprove. Living in an echo chamber can be dangerously comforting; evaluate evidence without emotion, and you will find opposing views to be surprisingly informative and beneficial.

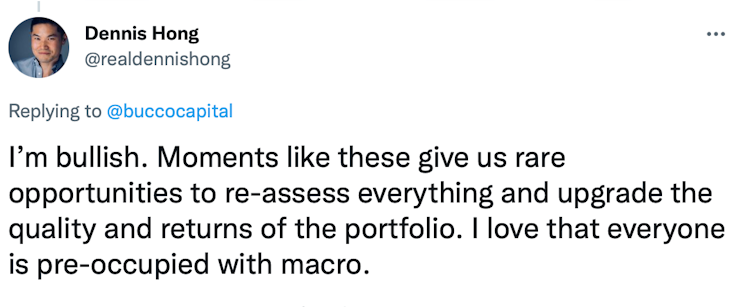

Macro Mania

Dr. Phil has said “no matter how flat the pancake, it always has two sides.” The vast amount of information from across the globe, as well as the number of differing viewpoints, can leave one feeling dazed and confused. There are more than two sides to the market pancake. It can be quite frustrating to read one expert’s view of macro, then turn around and see another pundit’s completely opposite take. It’s our job as investors to put in the hard work, seek out multiple sources of information, verify accuracy, and come to our own determination. Processing all the datapoints and expert opinions to form your own viewpoint is challenging; sometimes it can be beneficial to drown out much of the noise. In the end, successful investing usually amounts to the old adage “buy right, sit tight”. If you invest in companies with strong fundamentals, they are more likely to withstand market pressures and perform well in the long-term.

Patience is a Virtue

Warren Buffett lists patience as one of the six traits required to be a successful investor. It’s a virtue, and one of my greatest personal struggles. In a collapse or bear market, patience is your ultimate ally.

‘Instead of acting rationally during severe bear markets, many people tend to overreact and make matters worse. However, while many people panicked or were forced to sell assets at low prices, a small group of patient, methodical investors saw the stock market collapse as an opportunity.’

'Due diligence and quality research should inform your decisions about when to get in and out of trades, and allowing the price to catch up with the fundamentals can take some time.'

Summary

- Volatility & losses are opportunities for personal growth and will ultimately strengthen your skills as an investor.

- Twitter & Commonstock offer more than information, they offer a sense of community that can provide comfort. Don’t be afraid to seek solace here.

- Make sure you laugh. Hard & often. Your quality of life, as well as your trading, will significantly improve.

- Macro is mucho, don’t be overwhelmed by it and you won’t be confused. Buy based on strong fundamentals and in the long term, you’ll come out a winner.

- Patience is one of the most difficult skills to learn as a trader/investor, master that and you’ve won half the battle in trying times.

Regardless of market dynamics, everyone is facing their own private struggle. Life can be hard. If we choose our words carefully and engage in respectful discussion, the benefits to this shared experience are boundless.

Investopedia

Patience Is a Virtue for Traders

Waiting may be the biggest key to reeling in that trophy investment.

Already have an account?