Trending Assets

Top investors this month

Trending Assets

Top investors this month

How Euro-Dollar parity could effect my portfolio

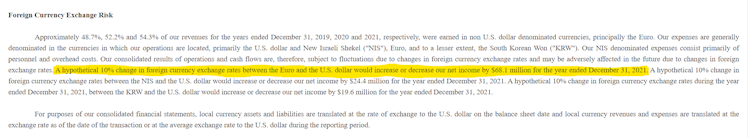

To follow up on my Buy The Dip Pitch for $SEDG I think it's relevant to mention how the Euro/Dollar parity storyline effects SolarEdge. As outlined here in their 2021 10-K : "A hypothetical 10% change in foreign currency exchange rates between the Euro and the U.S. dollar would increase or decrease our net income by $68.1 million for the year ended December 31, 2021"

In 2021 Net Income was $169m with an EPS of $3.24/share

If this this hypothetical 10% swing did occur that could shift net income to $101m dropping EPS to $1.94/Share

That's a potential 40% decrease in EPS

Core to my pitch for SolarEdge is the fact that it earns about ~40% of their revenue in the United States & ~45% in Europe but this geographic mixture introduces currency exchange risk. SolarEdge translates everything back to dollars for their financial reporting and has some operating expenses that are paid with the Euro or Israeli new shekel. The company is fully aware of these risks as they actively employ hedging derivatives to dampen the potential impact of the dollar strengthening or dollar weakening.

So while the currency situation doesn't really concern my investment thesis I thought it was a really interesting example of how impactful currency fluctuations can be to a company's perceived performance. The company may be firing on all cylinders with increased demand & improved operating metrics but have their bottom line severely impacted by the macro environment.

www.nytimes.com

Euro Falls to Equal the U.S. Dollar for the First Time in 20 Years (Published 2022)

In recent months, pressure on the euro has been mounting while investors have been flocking to the U.S. dollar, a haven in times of economic upheaval.

Already have an account?