Trending Assets

Top investors this month

Trending Assets

Top investors this month

Terry Smith

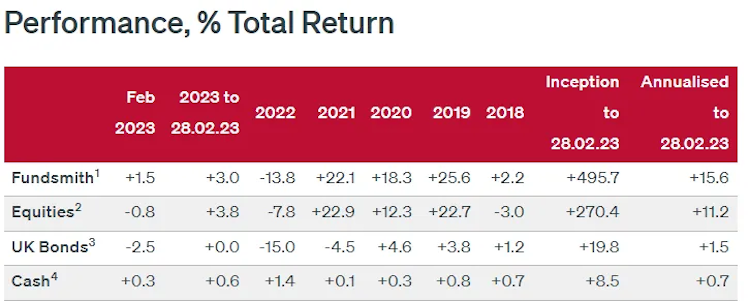

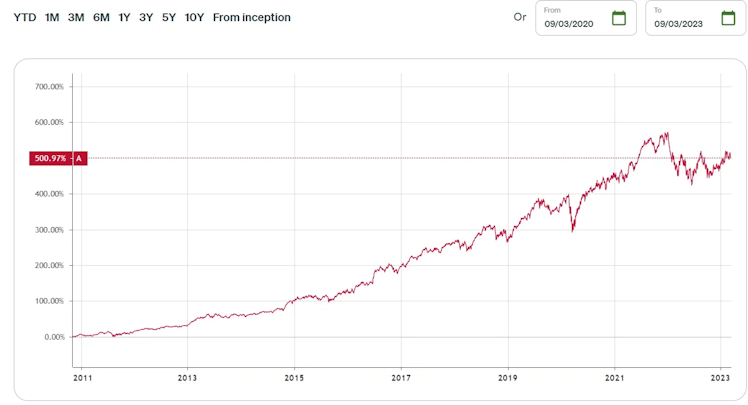

Often referred to as ‘UK’s Warren Buffett’, Terry Smith is the founder and manager of Fundsmith. The latter is a fund registered in the United Kingdom and continuously ranks among the most popular equity fund lists. Terry founded Fundsmith in 2010 and has kept an excellent track record, well above averages, having managed to compound returns at a 15.6% rate for the past 13 years. The fund’s assets under management currently stand at 22.8bn pounds.

A few weeks ago, I started and finished reading all of Terry Smith’s shareholder letters (they are not that many). As with Buffett, I’ll try to go over his investment philosophy, or at least the one I interpret from his writings.

Terry has a very similar approach to investing as Warren, in a broad sense. In his letters, he defines his style very simply:

“We continue to apply a simple three step investment strategy:

- Buy good companies

- Don’t overpay

- Do nothing”

This quote depicts where his focus is in the many verticals of the decision-making spectrum.

Step 1

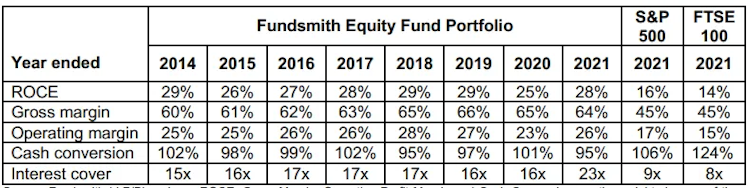

Terry’s definition of what a good company is, lays on the competitive positioning it has, the returns on capital it generates and if it has source of future growth. Companies with a strong moat and immersed in an industry with attractive fundamentals are contendents to achieve these high returns on capital over the long term. The business fundamentals allow them to exist and be achievable, and the barriers the company’s profits are protected with keeps competitors away from taking their share.

“In the Fund we seek to own companies which produce high cash returns on capital and distribute part of those returns as dividends and re-invest the remainder at similar rates of return” Jan, 2011

In his 2020 shareholder letter, Terry goes over an insight derived from Charlie Munger that sheds some more light into the matter.

“‘Over the long term, it's hard for a stock to earn a much better return than the business which underlies it earns. If the business earns 6% on capital over 40 years and you hold it for that 40 years, you're not going to make much different than a 6% return— even if you originally buy it at a huge discount. Conversely, if a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you'll end up with a fine result’ (emphasis added)”

Another common pattern that arises in many of his letters is how often he states the average foundation date of the portfolio’s holdings. The Lindy effect stands for a very curious idea, it basically proposes that the longer the period something has survived, the longer its remaining life expectancy. Perhaps what Terry intends to transmit by writing the average foundation date of the companies is the true resilience embedded in their business models. There are over 10 quotes like these throughout the 13 years of writings:

“The average company in our portfolio was founded in 1883” Jan, 2011.

One last thing I’d like to emphasize in this step is the attention Terry pays to a company’s management. Capital allocation skills are crucial for a company’s success. This group of people are the ones in charge of deciding what to do with the money generated by the company shareholders own. Given the broad range of possibilities one can do with cash, it’s in management’s capital allocation skills where our potential for compounding gains relies.

“Some 80% of the gains in the SPX over the 20th Century came not from changes in valuation, but from the companies’ earnings and reinvestment of retained capital” Jan, 2020

To finalize, a clear table on how he illustrates the fact of the fund owning good businesses:

Step 2

The price we pay for an asset is a 100% correlated with the investment returns we’ll get. Buying a great company can turn out being not a great investment if we pay far too much for it.

“We regard the greatest risk for our investors after the obvious potential for us to buy the wrong shares or pay too much for shares in the right companies, as being reinvestment risk” Jan, 2012

“deploy most of my time and effort on things I can control. Two of those are whether we own good companies and what valuation we pay to own their shares” Jan, 2017

“We are not simply hoping to on-sell the investment at a higher price” Jan, 2011

Step 3

Only over the long run can an investor truly benefit from a company’s superior fundamentals, hence the first reason for which the third leg of Terry’s strategy is “Do nothing”. On this front, I can introduce another component that makes up a huge part of his overall strategy, not trying to time the market nor operate based on forecasts, acknowledging the futility of doing so.

- “Macro views and developments have no bearing on our strategy” Jan,2013

- “The fact that we seem to have seen this movie before might lead us to conclude that we know how it will end” Jan, 2018

- “A bear market will occur at some point. We may indeed already be in one. The best stance is to ignore it since you can’t predict it or position yourself effectively to avoid it without impoverishing yourself by forgoing gains” Jan, 2019

- In all his letters, Terry believes the yearly portfolio turnover can act as the instrument of measurement in regards to how is the fund performing upon the third leg of the strategy.

- “Turning to the third leg of our strategy, which we succinctly describe as ‘Do nothing’, minimising portfolio turnover remains one of our objectives and this was again achieved with a portfolio turnover of 4.1% during the period.”

Keep in mind this is only one quote. Portfolio turnover oscillated between -3 and 9% approximately, most of years being between 2-5%. (Ranges are my own estimates as far as memory goes)

Further quotes

- “Only 1 stock in the fund does not pay dividends” (..) “dividends have historically provided a significant portion of the total return on equities” Jan, 2011

- “the fund generally invests in 20 to 30 stocks and so it is more concentrated than many other funds.” Website

- “When one of them looks likely to take a business with good, predictable returns and so something large, exciting and risky, we have a strong impulse to run away”

- “The commanding general is well aware that the forecasts are no good. However, he needs them for planning purposes”

- “The legendary investor Warren Buffett in his 1979 annual letter as Chairman of Berkshire Hathaway described ROCE as ‘The primary test of managerial economic performance’”

- “Equities are the only asset in which a portion of your returns are automatically reinvested for you”

Already have an account?