Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update

Stocks are moved higher Thursday as investors continue to digest corporate earnings and the FOMC rate decision from yesterday. The Fed elected to raise rates by 25 basis points, as expected. Fed Chair Jerome Powell did not indicate that the Fed was ready to pause rate hikes, but did acknowledge that inflation was slowing.

For economic data today, initial jobless claims unexpectedly fell to a 9-month low of 183,000. Claims were at 186,000 last week and were expected to jump to 195,000. Continuing claims edged lowered to 1.66 million.

The initial U.S. productivity estimate rose by 3.0% during Q4 quarter. Productivity had been estimated to increase by 2.4%. Productivity was down 1.3% in 2022 overall. Unit labor costs rose 1.1% during the quarter and jumped 5.7% during 2022.

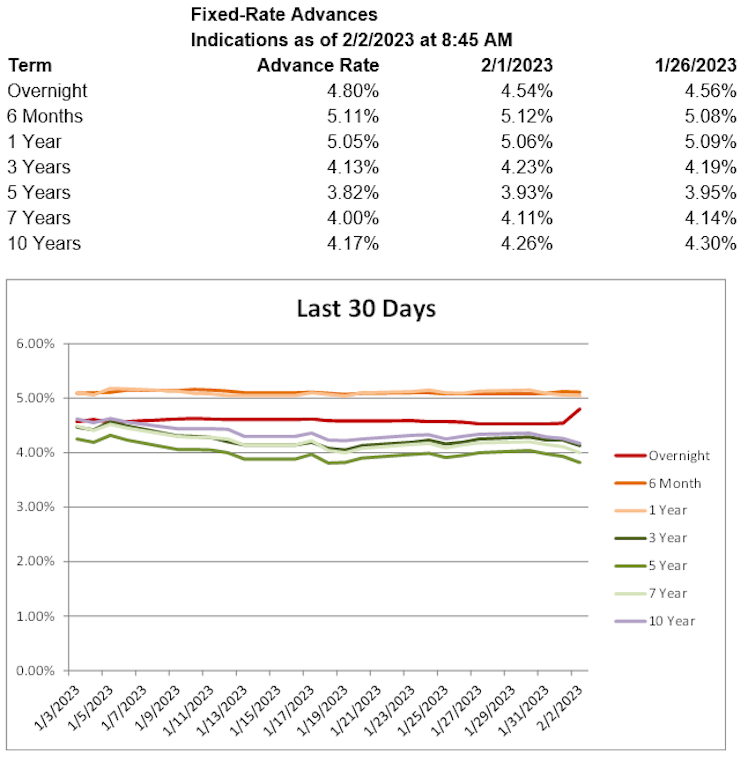

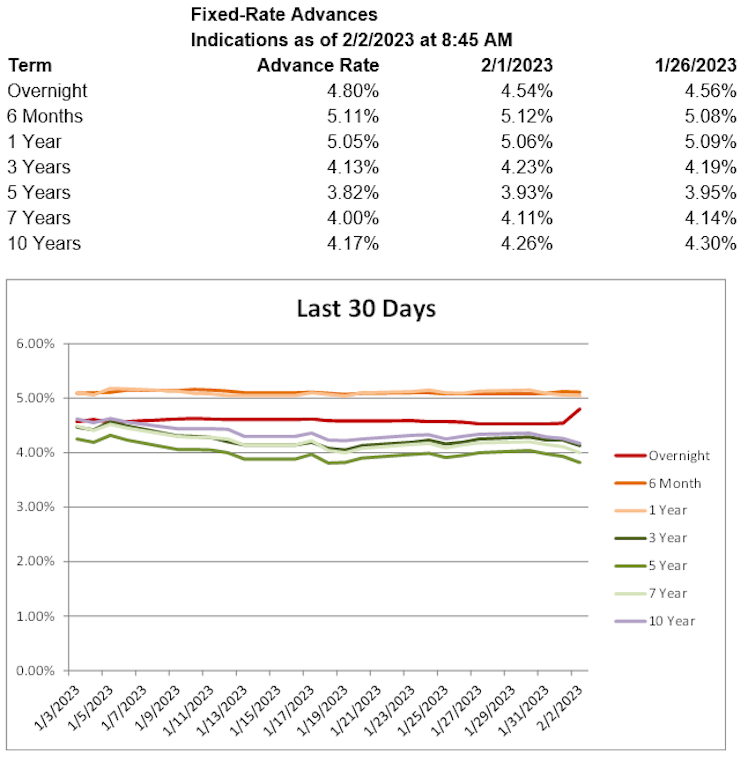

Treasury yields are lower, with the 2-year T yield down 2.0 basis points to 4.09%, the 5-year T yield down 1.9 basis points to 3.48%, and the 10-year T yield down 1.6 basis points to 3.38%. Shorter-term advance rates are mostly higher, while longer-term rates are lower today.

Already have an account?