Trending Assets

Top investors this month

Trending Assets

Top investors this month

Portfolio Recap 2022

2022 was a challenging year. I've learned a lot, especially regarding my strategy and investment criteria I want to focus on in the future. I already outlined these criteria in my last substack.

I owned 38 different stocks this year. This is way too high for me. Especially in 2020 & 2021 I've bought many stocks that did not really fit into my strategy and that's why I used the current bear market to concentrate the portfolio more on my higher conviction ideas.

But let's take a closer look into what has happened in my portfolio during the year:

The 13 stocks below are the ones I already owned at the beginning of the year and also currently own. All my Top 5 holdings are included in this list ($EPSIL.AT, $EVVTY, $YSN.DE; $KSPI, $LEAT). As I consider myself a long-term shareholder, this list should be longer.

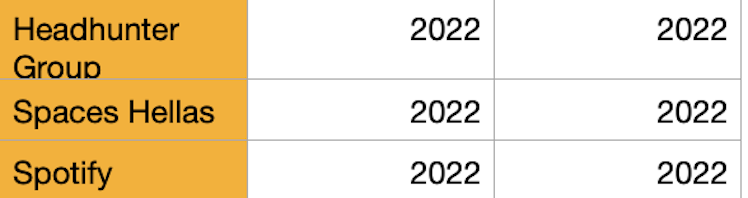

These 3 stocks were bought in 2022 and also directly sold after just a short time period. Regarding $SPOT I realized for example that the main reason why I bought it was, that I love their product. But just loving the product doesn't mean that it's also a great stock to invest in.

I bought 9 new stocks in 2022, that are still part of my portfolio. I hope that I can own these stocks for a long time. But my strategy is not just to Buy & Hold. You should not forget to Check your holdings from time to time. When I realize that my original investment thesis for the company is not intact anymore, I'll have to sell it. Part of my $VOW.OL thesis is for example, that they're able to secure a new big contract for their pyrolisis solution in the coming quarter. When I realize that they're not able to do so, I have to re-evaluate my thesis again.

I have sold the 13 stocks below this year. As already said, I've bought too many stocks where my conviction was not that high during 2020 & 2021. Stocks like $TCEHY, $BABA, $SE, $U don't really fit my strategy which focuses on underfollowed small caps. Others like $MYNA or $SEYE are unprofitable and I realized that my conviction in unprofitable companies is not that high in a bear market. So in the future, I want to focus on profitable companies and will not experiment with high-risk bets.

All in all the turnover in my portfolio was too high this year. But the number of stocks has been too high. I bought too many stocks, that didn't fit into my strategy during the hot phase of the bull market. I used this year to correct these mistakes and in the coming year, I will probably continue to do so. I want to further increase the hurdle rate for new companies and more rigorously sell shares that no longer meet my requirements. By improving this process I hope that the list of the "winners" (stocks I own for many years) will become longer over time.

underfollowedstocks.substack.com

Investment Criteria

What are the characteristics of a stock i like to invest in?

Already have an account?