Trending Assets

Top investors this month

Trending Assets

Top investors this month

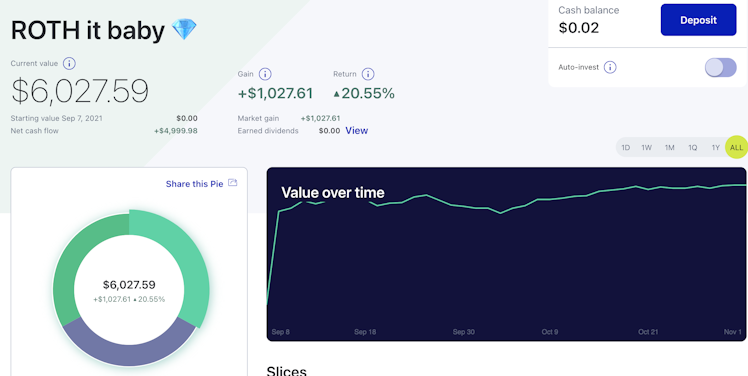

Multibagger ROTH IRA: update #2

I started my Multibagger ROTH IRA on September 8th, 2021. It consists of three stocks that I think will go 10x+. It consists of $U, $APP, and $IS.

Now it's been around two months and we have gotten decent returns from the stocks for 2 months with 20.55%.

While $SPY returned only 1.85% at the same time.

Beating the market is sexy, but we need to know if it is logical and makes sense or not. If it's not logical or doesn't make sense then I might have to reconsider selling it.

Why did the portfolio grow?

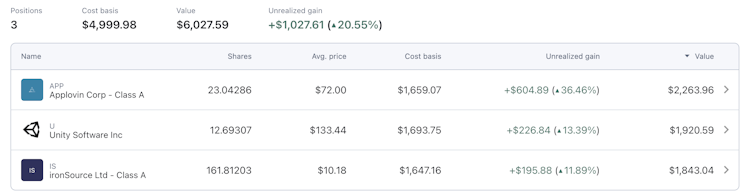

The growth of the portfolio is not driven by the good earning reports as Q3 reports are pending. I think both $IS and $U will lose money. While $APP will have positive EPS. Here is the portfolio breakdown.

- $APP (+36.46%): The growth of $AAPL stock is driven by the acquisition of MoPub from Twitter for $1.1B. MoPub gives Applovin to boost MAX's ads supply and first-party content creation. I believe $APP will be able to maximize the return from MoPub and generate more than $188M revenue that was generated with Twitter. I think the growth makes sense. I am expecting the EPS to grow.

- $U (+13.39%): As the great Bryan Murphy said, "Those Unity people don't stop." And, indeed they don't stop. $U first announced mediation (which already added to their quality ad) will be helpful in the advertising business. Later they announced a service to make multiplayer games that cross-platform 🤯 In my opinion $U at $150 is not a bargain but still has growth potential to $170 (my price target was $140 when analysts were having $170 - what do I know about valuation). The mediation of $U is not appreciated as much but I think it will be a great asset in the future.

- $IS (+11.89): I still think there is potential for 5%-10% gain in short term. As, I was targeting for $12 (so were many analysts - yayy I am an analyst now ). The acquisition of TapJoy helped. I think the release of Luna Elements (in love with this product and so are a lot of publishers) will be reflected in this quarter. I am not quite happy with the returns even though it's very short term and maybe acquisitions and new product releases might not have reflected in the stock.

So what's next?

Since all the growth is making sense as of now - I will be holding the stocks. I still have $1,000 of purchase left for the year in ROTH and will wait till the Q3 earnings report to make a judgment if I should be buying any. If I were to buy any among these three I would buy $APP (in the expectation that they can generate more revenue from MoPub than Twitter). I would, however, avoid buying $IS for now (as I see only 5%-10% movement as nothing significant has happened). $U if it keeps improving its services and releasing new products/services at this rate, I think will be the best stock to hold among these three.

EAT-SLEEP-GAME

Already have an account?