Trending Assets

Top investors this month

Trending Assets

Top investors this month

Volatility Composure & How It Leads to Long-Term Conditioning

Successful long-term investors don’t allow their emotions to coerce them into impulsive actions that can sabotage years of good work. Our natural fight or flight response doesn’t serve us well in the financial markets and this instinct can be difficult to neutralise. It causes us to double-down on losing positions that we really should’ve cut long before our losses started to mount. Denial, the need to be right, loss aversion, stubbornness, inflexibility … these all work against us. If we allow our emotions and instincts to govern our investor behaviour without restraint, we’ll end up impulsively buying high and selling low.

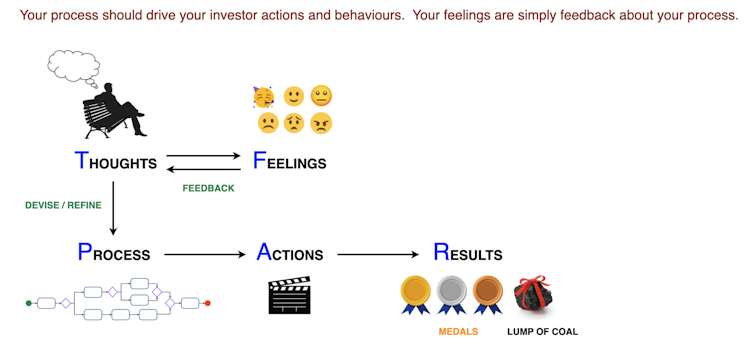

By learning to separate the immediacy of your emotions from your investment actions, you can enter a zen-like state about the markets. You’ll strengthen your "emotional detachment muscle", and this enables you to stay calm and composed during times of market turbulence (volatility composure). My previous post outlined how you can use a rule-based investment process to inject latency between your emotional self and your subsequent actions. You don’t deny your emotions, you just use them to tell you whether you need to refine your investment process that regulates your future actions. This is how you avoid knee-jerk reactions you might regret later when a cooler head prevails.

This might not be the only way, but it’s is the fastest and most effective way I know how to keep emotions in check and not let them sabotage your investment journey. Over time, the market will prune out investors who can’t control their skittish and impulsive tendencies. It will also prune out investors whose confidence surpasses their competence. You want to make sure that it’s not you who’s been cut from the game.

It’s fair to say without a rules-based process, your "emotional detachment muscle" will eventually become strengthened over a long period of time through sheer grit and tenure. But this only works if you can survive long enough and not cut and run when things get dicey. We discussed in my earlier post how the most common advice to avoid skittish behaviour is to stop looking at your portfolio too often. I’ve always been a fan of Charlie Munger’s philosophy of "invert, always invert". Hear me out on this mental exercise. What if we took that common advice of "check your portfolio infrequently" and did the exact opposite: "check your portfolio balance every day". If a beginner investor made this a habit, would it invite investor ruin?

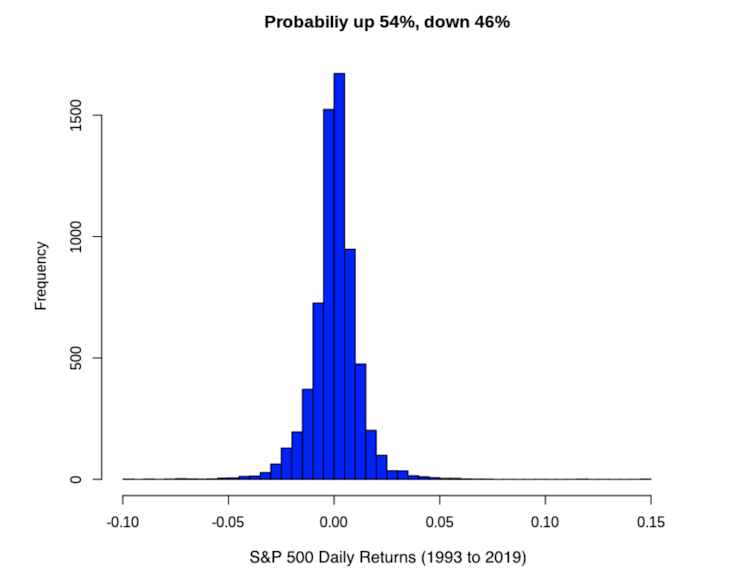

Every day the beginner investor would observe how the daily ebb and flow of the market causes an oscillating rise and fall of their portfolio balance. They would experience the pleasure of seeing their daily balance grow, and the pain of giving those gains back to the market on a regular basis. Assuming their portfolio moves in the same direction as the general market (and most will), there’s a 46% chance the beginner investor will experience a negative return for the day and a 54% chance of a positive return. This experience would be repeated each and every day. They’d quickly become conditioned to the daily ebbs and flows of the market and eventually treat it as just noise. This is exposure therapy at work and the investor would become immune to normal market volatility. It would only be the larger market moves like days when the market moves 1% or more that would capture their attention.

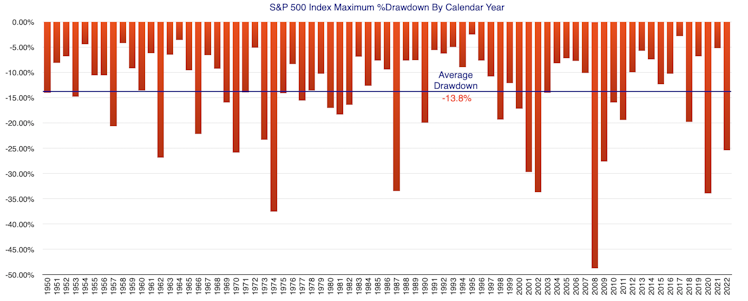

The longer we remain invested in the market, the more corrections and bear markets we experience. Even during the years when the market closes higher, there will always be an intra-year drawdown at some point and these can be non-trivial. The following chart uses the S&P 500 index as a proxy for the extent of the drawdowns that have to endured each and every year, regardless of whether the index closes up for the year or not:

Exposure therapy conditions us to become numb to the daily noise of the market, and over the longer-term, conditions us to become numb to any large intra-year drawdown. Price volatility will no longer trigger any hasty reactions on our part and that becomes important contributor to our long-term investing success. We’ll still be dismayed on the days our stocks flounder in a sea of red, but our default reaction would be one of benign inactivity.

For the beginner investor no rule-based process to back them up, exposure therapy is a longer road to building up an immunity to market volatility. There’s always a flight risk if the new investor walks right into a market crash after investing a non-trivial sum of money. An investor who doesn't have a written plan and doesn't know their base rates when it comes to drawdowns is at risk of abandoning the market. Long-term stock investing always demands grit and a survivor mindset. Sticking to a rules-based process, which can be as simple as dollar-cost averaging into a market index fund each and every month without fail, gives you the best odds of surviving the market long enough to develop an immunity to market turbulence. Once you’ve developed your "natural immunity", things can get really interesting when it comes to your investor preferences.

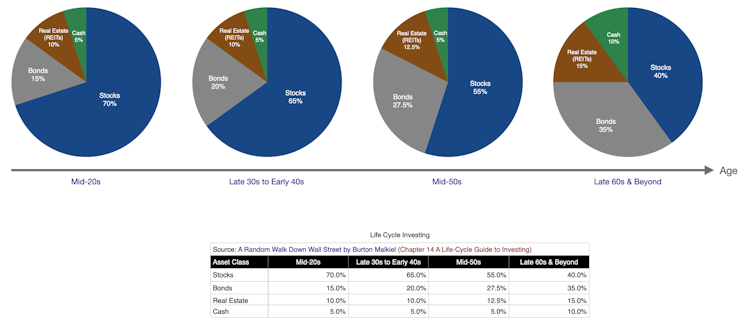

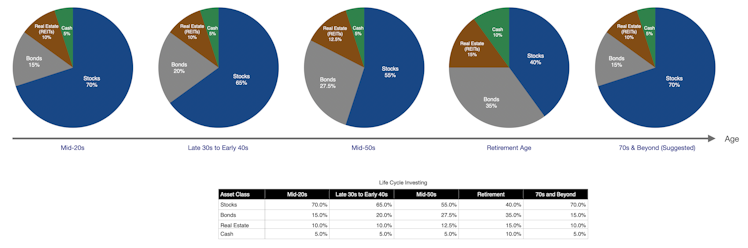

Financial planning teaches us about life stage investing. Your asset allocation devision divvies up your investment money into stocks, bonds, property and cash. This decision is one of the most influential factors determining your future long term returns. It also dictates the degree of volatility you'll experience. The general rule is "the greater the potential return, the higher the potential risk as measured by price volatility". Financial planners guide their clients into asset allocation decisions based on their life stage and risk appetite (how comfortable you believe you can ride out the variability of asset prices).

Burton Malkiel, Professor of Economics at Princeton University and author of investment classic "A Random Walk Down Wall Street", suggests the following asset allocation for each life stage:

You can see at a young age, the allocation to stocks is high. You have plenty of time to ride out a market crash. In fact, many young investors will be comfortable having a 100% allocation to stocks (as were we). This percentage allocation to stocks should fall as you get older and you funnel more money into bonds. The rational is when you get older, capital preservation and income becomes more important. Stocks provide the highest return over the long-term, but over the short-term, market volatility can threaten your retirement well-being. As you approach retirement, the sequence of returns risk comes into play. This is the risk that a market crash occurs just as you begin you retirement years. Companies can suspend dividend payments which can severely curtail retiree income. This risk will need to be mitigated because any forced selling of stocks at fire sale prices to meet a gap in living costs can seriously endanger your retirement future. The assumption here is that many retirees begin a slow and steady phase of asset decumulation.

"Sequence of return really is, in our view, the largest risk for the youngest retirees. When your balance is the largest, you've got the most time in front of you. If you have a material 20%, 30%, 40% reduction in your balance, which would mean a really large equity correction, you're risking your ability to generate income in the future if you sell"

Anne Lester

Head of Retirement Solutions

JP Morgan Asset Management

Of course this risk is easily mitigated by being so incredibly wealthy that money is never going to be an issue. But realistically, anyone reading this isn't likely to be in that position ... at least not yet.

Financial advisors suggest you implement a contingency strategy as you approach your retirement cliff-edge decision:

- Build up a sizeable cushion of cash to cover any income shortfall in the event of a market crash. This involves identifying all guaranteed income sources and non-guaranteed income sources like dividends. For your non-guaranteed source, factor in something like a 30% reduction in income (or better if you have the figures). Estimate your living costs and determine if you have a shortfall. You’ll want a cash cushion to cover that gap for at least 1, preferably 2 years.

- Rebalance your portfolio and increase your allocation to bonds while reducing your allocation to stocks as you approach retirement years. Bonds will help preserve the capital value of your portfolio while providing some income.

Bonds help mitigate the retirement sequence of return risk. However, a high allocation to bonds exposes the retiree to longevity risk. We're living longer thanks to medical advances and better healthcare. In 2020, the life expectancy of a person aged 60 years in the United States of America was 23 years. Back in 1975, a 60 year old was expected to live another 18 years. Of course this is only an average, many are expected to live much longer.

Some retirement researchers suggest we begin to gradually increase our allocation to stocks again a couple of years after retirement when sequence risk has eased to avoid outliving our money. Given that we can easily live 2 to 3 more decades after retirement, we still need reasonable exposure to growth assets. A systematic rule often suggested is to increase your stock exposure by 1% every year after retirement (systematic rebalancing) until you reach a 70% to 80% allocation to stocks. Bill Bengen, the financial adviser who developed the 4 percent withdrawal guide for retirement found an allocation to equities of 75% results in the potential for higher safe withdrawal rates to ensure you don’t outlive your money.

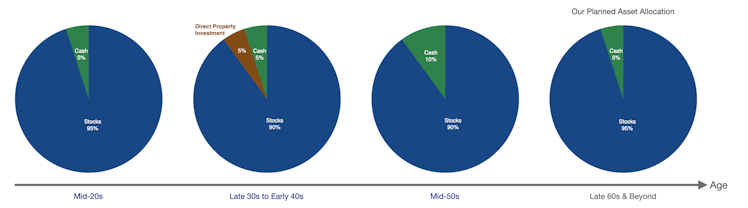

We came across this idea of increasing our allocation to stocks after retirement a full decade before we reached our financial freedom number. This really got us thinking. We were at the stage where we should be thinking about ramping up our allocation to bonds, or at least get started. But had gotten comfortable with a 95% allocation to stocks for several decades now. We carried this allocation into market crashes and came out the other end, frazzled but still standing. To mitigate sequence of returns risk at early retirement, we just has to ensure we had enough cash to protect our stock holdings in the event of a long and protracted bear market. Some colleagues suggested we could always go back to paid employment in our professions, but that was out of the question because my ego wouldn’t allow that. It would be perceived by friends and family as a clear and abject failure to manage our finances and I pride myself in my fiscal acumen. I allow myself to be crap at everything else, but not finance.

All we needed to do was to build up a 10% allocation of cash that would cover our living expenses and a reasonable amount of discretionary spending for 3 years, assuming a scenario where all our dividends were cut to zero. We wouldn’t need to sell down any stocks at fire sale prices and hand the opportunistic market player the bargain of the decade.

Applying Dr Stephen Covey’s "Begin With the End in Mind", we never wavered from our 90% - 95% allocation to stocks except for a brief and ill-fated dabble with direct residential property investment that I conveniently store in repressed memory. We've conditioned ourselves to endure market volatility and remain confident that our rule-based process will keep us from regressing into bad investor behaviour. When I use the royal "us", what I really mean is "me (Colin)".

This is the asset allocation by life stage we followed, breaking most of the conventional guidelines:

We were never interested in bonds. Even today with bond yields now at reasonable levels, we still can’t get interested in an asset with no potential for capital gain if held to maturity. Almost all of our long-tenured, retired stock investor colleagues feel the same way: it’s stocks all the way. We’re certainly not suggesting everyone follows this asset allocation plan because not too many people would be comfortable with this degree of stock exposure. But once you earn your stripes as a long-tenured stock market investor, don’t be surprised if you feel the same way at retirement and discard all the conventional rules around life stage asset allocation. Conditioning will do that to you.

Already have an account?