Trending Assets

Top investors this month

Trending Assets

Top investors this month

Twitter Wasn't Built For Investors

On Fintwit, there's no concept of 'verified performance.'

Most people don't realize how pernicious this is.

There's a cognitive bias called 'Self-Serving Disposition' that we all have naturally— We believe our failures are situational but our successes are our responsibility.

"$ROKU is down because of supply chain issues and the #UkraineConflict— not because I made the wrong call" (— Me)

This bias is responsible for the blind spots that keep us making the same insane investing mistakes over and over again.

It often takes a friend holding up a mirror for us to realize that we're falling pray to self-serving bias.

But the kicker is that Twitter doesn't have any mirrors. There's no concept of verified portfolio performance.

Now you have two problems: your blind spot, and an absence of the tool you need to realize you have it.

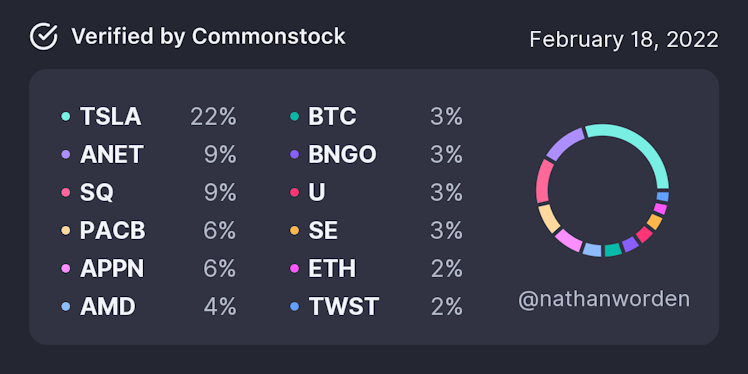

The solution (the mirror): Portfolio returns built-in to the platform. This allows you to see the world for how it really is, not how others spin it to be.

If you aren't proactive about fighting it, self-serving bias will turn you into an insular, defensive, cherry-picking investor.

That's bad for the community, and it's even worse for you.

Imagine a gym with no weights, where people just talk about how strong they are. That's Twitter.

If you want to get stronger, go to a gym where people track their progress. Where' there's actual weights. Where people get stronger on good days and bad.

Surround yourself with people capable of learning and outgrowing their biases. @joincommonstock

Inspiration for this post: some great tweets by @parrot and @youngmoneycapital

Already have an account?