Trending Assets

Top investors this month

Trending Assets

Top investors this month

A Pair Trade Concept

Disclaimer: This post might only appeal to investing nerds like myself. It's more of a philosophical rant with little practical value.

In Tech, winners take most or all in an emerging growth opportunity

So theoretically, it makes sense to go long the perceived winner, and short the losers for some purer, market uncorrelated, alpha. A similar idea has manifested in the famous "long disruptors, short disrupted" as a generalized hedged investing strategy.

The problem with the generalization is that it can occasionally crush you as styles of stocks deviate from long-term trends and go in and out of fashion. For example, long renewables, and short oil & gas. Or long any high-growth software, short boring old $IBM in the software space (that would have truly sucked this year). For the disruptor/disrupted trade, one has to often go long a traditionally expensive stock and short a traditionally cheaper stock - hoping that the valuation spread would widen as the disruptor further takes over the disrupted. The market is often efficient in this way of thinking in my opinion.

So here's a crazy idea:

Go Long #1 leader, and Go Short #2 leader in a narrow tech industry space - Instead of going long #1 and short #5 or something else for instance. After all, only one usually takes most or all.

Leader #1 and #2 in a closely related disruptive space often trade in a highly correlated manner, with multiples that are not that far apart. Often, the valuation is not working deeply against you, and thorough research might provide you with a trading opportunity that brings on lower risk, and purer alpha. I say purer because the closest competitors move very similarly in various macro paradigms. The soul-crushing deviations in value/growth we saw this year wouldn't be nearly as prominent.

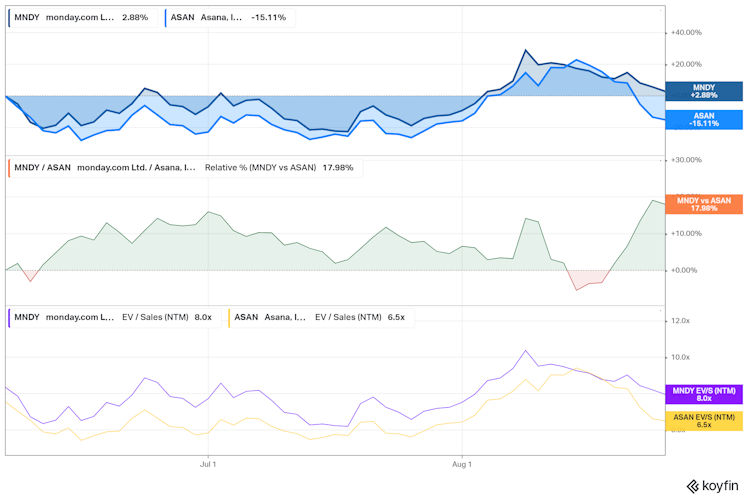

On June 8, I wrote a post here stating that I liked $MNDY in the workflow space where it was a winner for me against $ASAN and $SMAR. In my view, the three were #1, #2, and #3 leaders in the hotly contested Workflow Software space. ASAN was the closest competitor, and it was trading at a minor discount on sales multiples to MNDY at the time. I also mentioned that going short $ASAN would make a good hedge. I personally was only long $MNDY throughout this period.

Here's how that long-short trade would have evolved (about +18% so far):

Now, this is just one example, and it doesn't prove anything. Furthermore, Asana is yet to report on earnings while Monday already did with strong results. To add to the complexity of it, the discipline of entering and exiting positions is a whole different game of skill. But to me, good areas to double down on the trade are when the purple and yellow lines trade closely or surpass each other, such as June 10th, or mid-August. I say this with the comfort of hindsight bias, of course. At the current spread, I'd reduce the trade exposure.

I imagine firms like Citadel play such games and amp up the leverage on these spreads. Super hard to do, but for those that like the purest equity-based alpha available without macro pain, the strategy is really worth exploring. If you can push a 10% CAGR annually on such a strategy pre-leverage, you have my respect. For the kind of pension funds that invest in the Citadel types, this is incredible from a risk management standpoint. As it happens, Citadel's flagship fund was 20%+ YTD as of July end.

Unfortunately, my country's laws don't let me go short or use leverage on (foreign) US market stocks. For now, I'm long $MNDY and pretty happy with my cash long-only position.

Already have an account?