Trending Assets

Top investors this month

Trending Assets

Top investors this month

Economic Update - Lower Home and PMI Data

Stocks opened lower Tuesday morning, reversing the rally seen on yesterday.

As Fed officials have thrown their support behind 2 big rate hikes in future meetings, investors are worrying that FOMC action could spur a recession. It is believed that the next 2 FOMC meetings will both result in 50 basis point increases as Fed officials have already started discussing options for the September meeting.

Looking at economic data today, new home sales unexpectedly plunged 16.6% to an annual rate of 591,000 in April. It is the lowest level since April 2020 & well below forecasts of an increase to 750,000. The median sales price was $450,600, up from $435,500 in March and $376,600 a year ago.

Elsewhere, the May flash reading of S&P Global U.S. Manufacturing PMI fell less than expected to a reading of 57.5, down nearly two points from the previous reading. It was also the lowest reading in 3 months. The Services PMI fell over two points to a reading of 53.5, a bigger drop than expected.

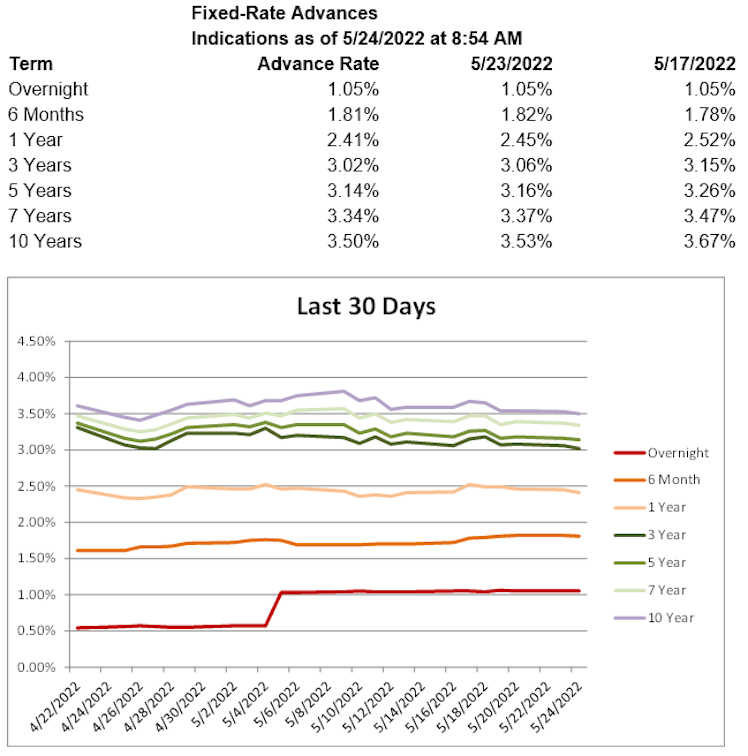

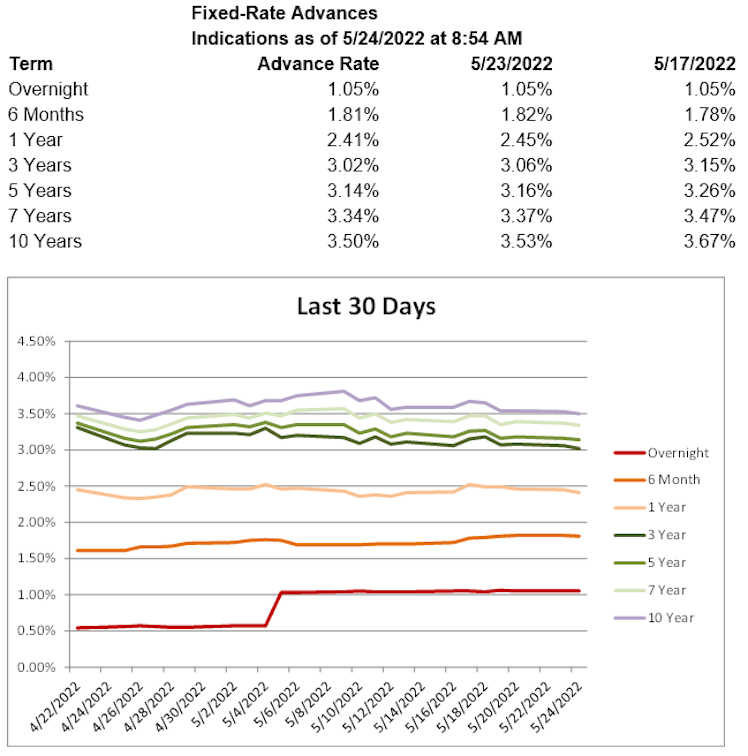

U.S. Treasury yields are lower, with the 2-year Treasury yield down 14.2 basis points to 2.48%, the 5-year Treasury yield down 14.5 basis points to 2.73%, and the 10-year Treasury yield down 12.6 basis points to 2.73%. Long-term advance rates are lower today.

Already have an account?