Trending Assets

Top investors this month

Trending Assets

Top investors this month

Netflix: "We're Off To A Good Start"

This is an extended preview of today's write-up, exclusively for Commonstock readers. To read the remainder of the post, please subscribe to the TSOH Investment Research service.

From “This Is When It All Matters” (April 2022): “For me, a key part of any long-term investment is partnering with an honest and able management team; while this is a major bump in the road, I’m confident they’ll adjust and find a way to win in the years ahead. At the same time, I think legacy media companies will be forced to navigate these same challenges, with the kicker that they’ll be doing so from a much weaker position given a lack of global scale. (And as discussed earlier, that conclusion may sow the seeds for inorganic opportunities as well.) At ~$216 per share, Netflix has a market cap of ~$98 billion. With run rate revenues of ~$32 billion and ~20% operating margins, the stock trades at ~15x EBIT. When viewed in the context of (what I continue to believe is) a massive long-term global opportunity, in combination with my belief that management will effectively navigate through this environment, I’m personally of the opinion that the current valuation is very attractive. For that reason, I will be buying additional shares tomorrow.”

Everything about Netflix – the underlying business results, the narrative in the investment community about it’s future prospects, and the stock price – was a roller coaster ride over the past year. For long-term shareholders, this period has been instructive in terms of what it truly means to own a business.

Today, it feels like the storm clouds have started to dissipate. At the same time, it would be foolish to assume nothing but clear skies ahead (any long-term thesis that assumes so will inevitably face a rude awakening). The key question is whether this company and management team are positioned to survive, and thrive, through these inevitable periods of real pain (company specific headwinds, as well as more broadly in the economy or industry).

For Netflix, I think the company’s 2022 performance was revealing. In the midst of the most competitive environment that they’ve ever faced, Netflix maintained a substantial lead over their peers on key metrics like revenues and engagement. As others in the industry are forced to address the realities that have surfaced over the past year, Netflix stands alone in its ability to remain 100% committed to the long-term opportunity in streaming. (“It's easy to talk about streaming in one big, broad brush - but there is Netflix, and there is everyone else trying to figure out how to do what we’re doing.”)

Personally, I continue to believe the long-term opportunity for the leaders in this industry will be substantially larger than it appears today (in terms of revenues and profitability / free cash flow). Further bumps along the road are inevitable – but the long-term destination should prove well worth the ride.

2022 Review

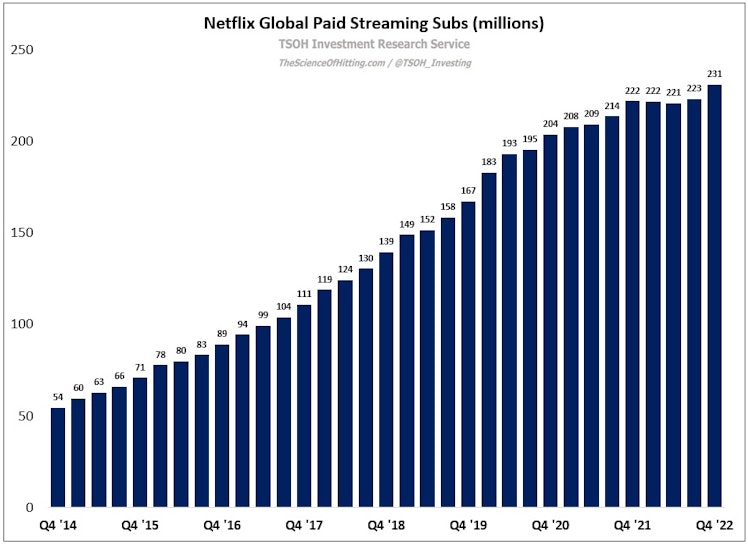

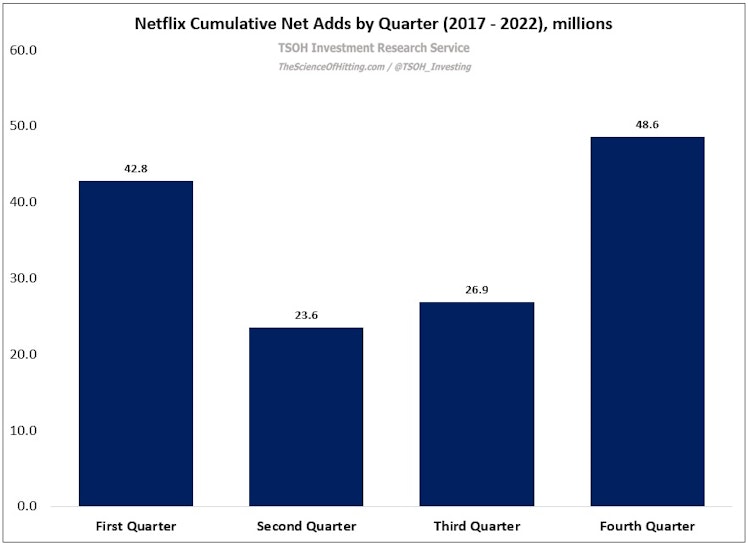

Netflix ended 2022 with ~231 million paid subs globally, an increase of 4% from the year ago period. As you can see below, the company experienced some tough sledding through the first nine months of the year, with a sub count at the end of Q3 FY22 that was roughly in-line with the total at the end of Q4 FY21. The vast majority of sub growth in FY22 was delivered during (the seasonally strong) Q4, helped by the launch of the ad-supported tier.

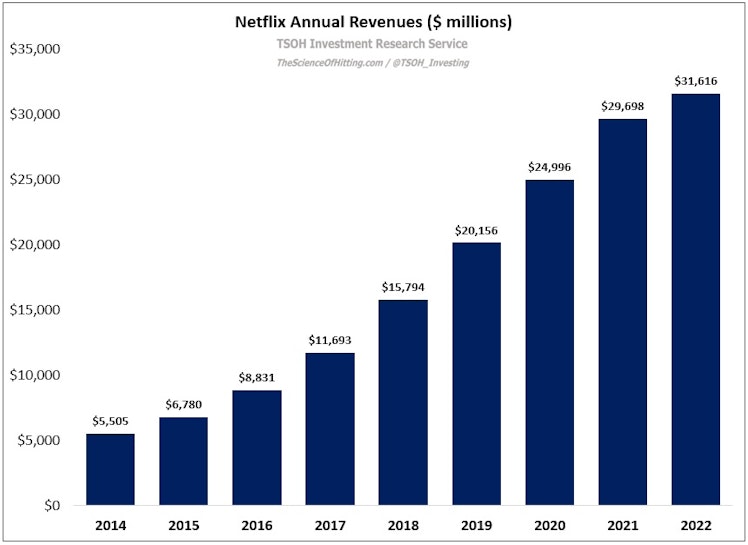

As I’ve written previously, subscriber growth is only one part of the equation. Netflix’s global monthly average revenue per membership (ARM) in FY22 was ~$11.4, up marginally compared to FY21. The net result, as shown below, was a 7% increase in FY22 revenues, to $31.6 billion. (Roughly equal to the combined run rate DTC revenues for Disney, WBD, and Paramount.)

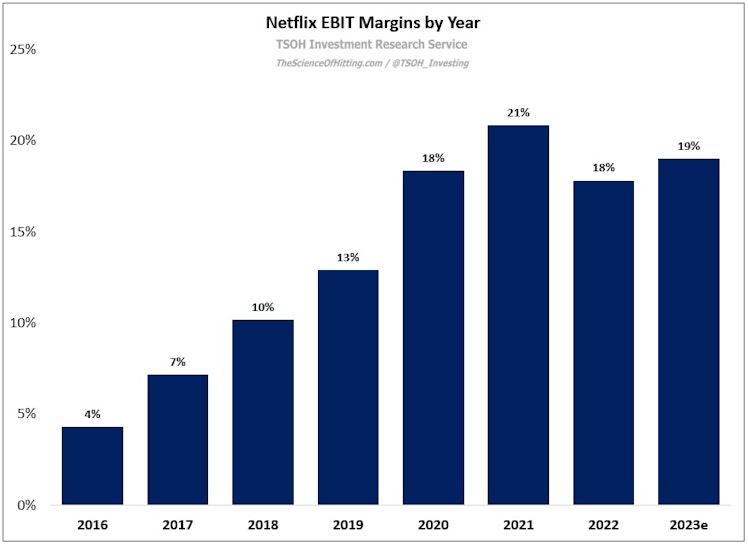

As we move down the income statement, the significant deceleration in revenue growth in FY22 (relative to historic trends) presented headwinds to profitability. The company course corrected to adjust to this new reality, and will continue to tweak its business model in the years ahead (most notably as it relates to the level of annual content spend required to satisfy its global audience). In the end, I’d argue that the FY22 results were reasonable: for the year, Netflix reported EBIT margins of 18%, down ~300 basis points versus FY21; after adjusting for FX impacts in both periods, the YoY change in Netflix’s operating margins was ~160 basis points. (As shown below, the FY23 guidance assumes a slight improvement over FY22 at the midpoint.)

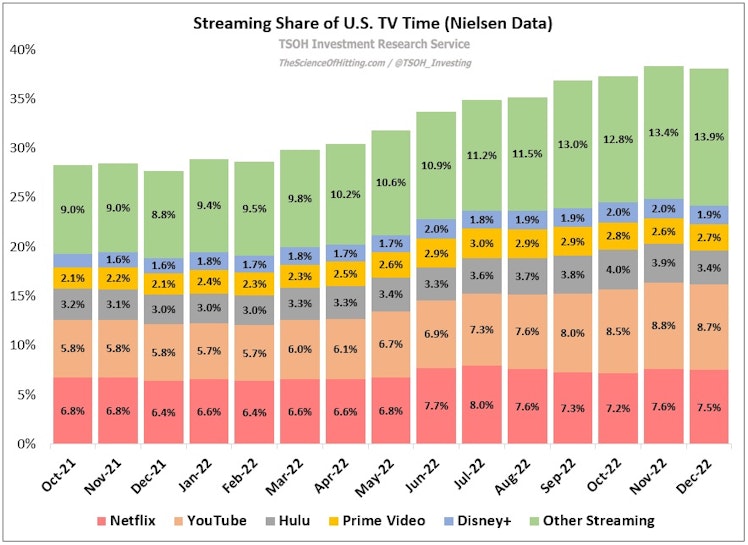

In summary, there’s no question that 2022 was a difficult year for Netflix. That said, in the face of unprecedented competitive activity - most notably from legacy U.S. media companies who have spent the past few months clearly signaling to investors that they plan on pushing higher prices after a period of significant discounting aimed at driving DTC sub growth – Netflix managed to hold their own. As you can see in the Nielsen data below, the company continues to hold a strong position in the U.S. (the most competitive market in the world); in addition, while we don’t have as reliable data in most other regions, everything I’ve seen to date leads me to believe Netflix’s competitive positioning is even stronger as we look beyond the United States.

(End of Preview)

thescienceofhitting.com

Netflix: "We're Off To A Good Start"

From “This Is When It All Matters” (April 2022): “For me, a key part of any long-term investment is partnering with an honest and able management team; while this is a major bump in the road, I’m confident they’ll adjust and find a way to win in the years ahead. At the same time, I think legacy media companies will be forced to navigate these same challenges, with the kicker that they’ll be doing so from a much weaker position given a lack of global scale. (And as discussed earlier, that conclusion may sow the seeds for inorganic opportunities as well.) At ~$216 per share, Netflix has a market cap of ~$98 billion. With run rate revenues of ~$32 billion and ~20% operating margins, the stock trades at ~15x EBIT. When viewed in the context of (what I continue to believe is) a massive long-term global opportunity, in combination with my belief that management will effectively navigate through this environment, I’m personally of the opinion that the current valuation is very attractive.

Already have an account?